Sales Transactions

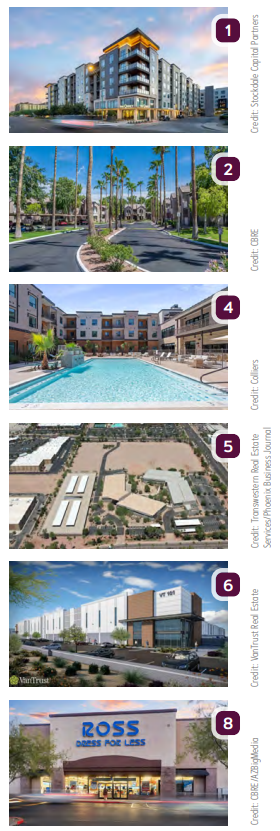

1. Stockdale Capital Partners acquired The Quincy at Kierland for $110.3M. The 266-unit Class A multifamily community at 15826 N. Scottsdale Road in Scottsdale was purchased in an all-cash transaction. The seller was EMBREY, which completed construction of the property in July 2024. Institutional Property Advisors marketed the property on behalf of the seller.

2. CBRE has arranged financing totaling $45.6M for the acquisition and renovation of Coral Point Apartments, a 377-unit multifamily community located at 2343 W. Main St. in Mesa. CBRE’s Shaun Moothart, Doug Birrell, Bruce Francis, Bob Ybarra, Nick Santangelo, Anna Britt and Amber Coleman secured the financing on behalf of InTrust Property Group. The lender was Brightspire Capital.

3. Next Wave Investors purchased The Avi, a 196-unit apartment community at 1235 W. Baseline Road in Tempe. The nine-acre property was sold by Tides Equities through an auction for $40M, marking a steep drop from the $66.5M the company paid in 2022. ACRES Capital provided $55M in financing for the acquisition.

4. 55 Resort Scottsdale, a recently completed adult apartment property in Scottsdale, recently sold to DEM, Inc. for $32.8M. Velocis Edison McCormick JV, LP sold the property. Colliers’ Matt Roach, Chris Roach, Brad Cooke and Cindy Cooke handled the transaction.

5. Widewaters sold a 189KSF office complex at 8530-8550 S. Priest Dr. in Tempe for $27M. Maricopa County Community College District purchased the two-building asset and will use it as its new headquarters. Widewaters was represented by Transwestern Real Estate Services’ Paul Borgesen, Dylan Sproul, Bill Zurek, Jim Achen Jr. and Royden Hudnall. MCCCD was represented by CBRE’s David Barrett.

6. An entity linked to William P. Churchill purchased a newly completed 155.8KSF industrial building at 6051 N. Ballpark Ave. in Glendale for $25.7M. The seller was VanTrust Real Estate. The transaction included $17M in financing from PlainsCapital Bank. CBRE represented the buyer.

7. The 103-key Home2 Suites by Hilton Phoenix Airport Southwas purchased by Gurbir Sandhu Company for $18.8M. Baywood Hotels sold the 60.4KSF hospitality asset at 4725 E. Broadway Road in Phoenix. The buyer was represented by Marquee Lodging Advisors’ Damian Gordillo and Bernard Vas. The seller was also represented by Gordillo, as well as Ryan Scarpulla.

8. CBRE arranged $18.9M in acquisition financing for Sterling Organization and Cohen & Steers Income Opportunities REIT Inc. for Deer Valley Towne Center, a 158.6KSF retail center at Loop 101 and 27th Avenue in Phoenix. The property is 98% leased and anchored by Target and AMC Theatres.

9. G & S Technologies purchased three industrial buildings totaling 47.5KSF at 2950 W. Catalina Dr. in Phoenix for $7.7M. The seller was American Aerospace Technical Castings, which was represented by Newmark.

10. Lyon & Lyon Inc. acquired a Filiberto’s Mexican Food location at 1987 W. River Road in Tucson for $2.6M. The single-tenant property was sold by Oneten REI and is leased to Filiberto’s under a long-term net lease. Echo West Capital Advisors arranged the sale.

11. The 215-unit Alta Biltmore apartment community in Phoenix’s Camelback Corridor was sold by a national multifamily developer to Millburn & Company for an undisclosed amount. CBRE arranged the sale.

Lease Transactions

12. Ballet Tucson leased 10KSF of industrial space at 3529 E. Gold Links Road in Tucson from Tin Cup Properties, LLC. Alex Demeroutis, Paul Hooker and Jesse Blum with Cushman & Wakefield | PICOR represented the landlord. Hank Amos with Tucson Realty & Trust Co. represented the tenant.