Source: ABI Multifamily

ABI Multifamily has published its Q1 2020 Phoenix Multifamily Quarterly Report. And while the start of 2020 was strong, with rent growth, healthy occupancy rates, lower cost of living, and high renter demand all pointing to another extraordinary year, the future has yet to tell how the multifamily industry will be impacted by the COVID-19 global pandemic. With a development pipeline full of planned and under-construction properties, the timeline for the completion of these projects is unclear.

The real effects will be highlighted in Q2 2020 data. However, it is expected the Coronavirus Recession will be shaped more like a “V” or a small “U” rather than an “L,” with a path to normality optimistically expected to return around the start of 2021.

Phoenix Market Metrics

- Q1 2020 witnessed a healthy start in the first two months with a poor finish in the month of March as a result of the initial effects of COVID-19.

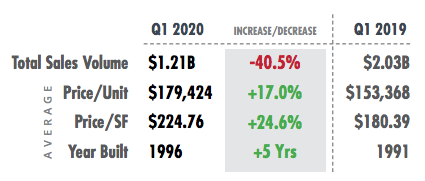

- For 10-99-unit properties, Q1 saw a transaction volume of approximately $186M, which represented a 54.3 percent year-over-year increase from Q1 2019. In the 100+ unit category, Q1 brought in $1.21B, down 40.5 percent year-over-year.

- Average price-per-unit amounts were up in the 10-99 segment, rising 30.1 percent year over year to $144,296, and up 17.0 percent to $179,424 for 100+. These translated to an average price/SF of $167.64 in 10-99 (up 23.6 percent) and $224.76 (up 24.6 percent) in 100+.

- Inventory age saw an increase year-over-year, with average year built for 10-99 units being 1974, versus 1972. Average year built in the 100+ unit segment was 1996, compared to 1991 in Q1 2019.

- The market’s occupancy rate took a hit. Q1 occupancy for 10+ units was 95.1 percent — a decrease of 0.4 percent year-over-year. Average rent was $1,235, up $94 (8.2 percent) from last year.

- Phoenix MSA demographics continued their solid trends. The Census estimate of total population was 4,857,962. The unemployment rate finished the quarter at 4.7 percent, according to Bureau of Labor Statistics numbers.

- Median household income was $64,427, and per capita income came in at $32,482.

- In the realm of new construction for 50+ unit properties, 1,399 units were delivered across six projects to start the year – a disappointing number, considering 2,587 units were delivered by this time last year.

- Currently, an estimated 23,347 units are in the planning stages across 93 properties. A total of 19,730 units were listed as under construction in 79 properties.

- Pre-lease absorption rates are lower this quarter at a rate of 11 units/property/month.

- Total unit inventory for 50+ unit properties came in at 310,983.

- Across the MSA, 50+ unit inventories by city were:

- Phoenix: 139,317

- Mesa: 38,658

- Tempe: 34,726

- Scottsdale: 28,657

- Glendale: 24,528

The full report is available for download here.