Source: Colliers International

The Greater Phoenix industrial market has surged during the COVID-19 pandemic, driven largely by the country’s increased use of e-commerce and elevated grocery shopping while restaurants were closed. Completion of new industrial projects in 2020 has been the strongest year in more than a decade.

Arizona’s business-minded approach led to more companies remaining open during the pandemic. The Trade, Transportation and Utility Super industries actually increased jobs year-over-year in the months of June through August. Additionally, demand for warehouse and distribution buildings surged because of online purchasing of goods and groceries.

Net absorption of industrial space exceeded 2.5MSF during third quarter. This marked the sixth consecutive quarter of net absorption exceeding 1MSF. Manufacturing and distribution space dominated the quarter, particularly in the Northwest and Southwest submarkets.

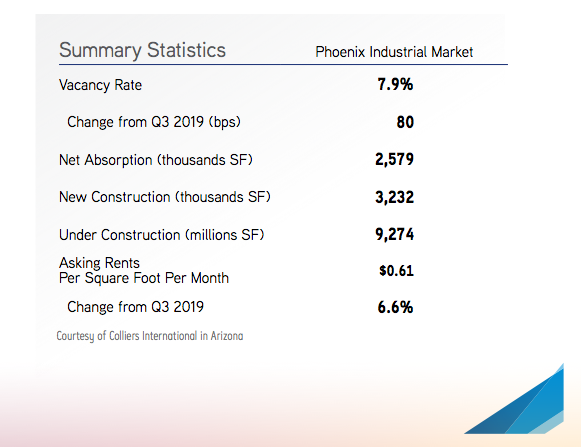

The vacancy rate during third quarter remained low at 7.9 percent, having increased 10 basis points during the quarter and 80 basis points year-over-year. This marked continuation of sub-10 percent vacancy that began in third quarter 2015. Vacancy remained low despite delivery of 3.2MSF of new space during the quarter. Vacancy is expected to stay low as new tenants are migrating here at an increased rate. Space is being absorbed at a faster pace than previous years. Currently, the top 10 largest buildings under construction have a vacancy rate of just 58 percent.

Construction of new properties declined 2.4MSF from the second quarter to a total of 9.2MSF. The Phoenix industrial market delivered more product in the first three quarters of 2020 than it has in more than a decade. West Valley submarket contains more than 85 percent of the current construction activity. However, the Southeast Valley delivered its first sizable big box project this past quarter. The 486KSF speculative building has been leased to Dexcom and has set up that submarket for more big box projects in the future.

Infill development resulting from the South Mountain Freeway 202 expansion has captured a lot of attention from the Southeast Valley. This transportation connection to the historically lower-priced Southwest Valley is driving up rents along that freeway expansion.

Rental rates increased 6.6 percent year-over-year and 0.15 percent over-the-quarter to an average of $0.61/SF. Distribution buildings posted the largest gain in rental rates, increasing 11.5 percent year-over-year to $0.51/SF. The Airport Area submarket cluster led rental rate increases with year-over-year improvement of 12.3 percent. The Southwest submarket follows with an increase of 8.6 percent year-over-year. Rental rates are expected to continue rising because of strong demand for space and limitations of space availability. A high volume of product under construction will push rates up because of the expense of this new, quality space.

The USMCA officially became effective on July 1st, which will benefit manufacturing and distribution in Phoenix. This is especially true at Phoenix-Mesa Airport, which is developing the nation’s first international air cargo hub to house both Mexican and United States customs designed to streamline transportation of goods between countries.

Investment sales volume of industrial properties outpaced second quarter by 77 percent. However, 2020 has not been able to keep pace with immense bulk sale transactions experienced in the market during 2019. Third quarter brought $512M in volume, but the price per square foot decreased 3.2 percent over-the-quarter. Price per square foot has increased 6.81 percent year-over-year to $114.

The Greater Phoenix industrial market is experiencing tremendous activity and is forecast to continue this trend. Construction will continue moving forward and new speculative development is expected to increase in the fourth quarter. This city has attracted national attention from investors and tenants alike. The enthusiasm for Greater Phoenix will help our economy, and, specifically, the industrial market, thrive moving through 2021.

NEWS TICKER

- [October 8, 2025] - Peoria Eyeing Billion-Dollar Advanced Water Purification Facility

- [October 7, 2025] - UA Continue Work on CAMI Alongside $70M in Planned FY 2027 Projects

- [October 7, 2025] - Early voting for Coconino Community College bond begins this week

- [October 7, 2025] - Halo Vista Master Plan to Receive Two Hotels and a Costco

- [October 7, 2025] - Industry Professionals 10-07-25

- [October 7, 2025] - Commercial Real Estate 10-07-25

- [October 3, 2025] - NAU Capital Improvement Plan Approved, $138M of Projects Planned

- [October 3, 2025] - First Street and Brown Avenue Parking Garage in Scottsdale Discussed at Community Meeting