By National Association of Home Builders

Confidence in the market for new multifamily housing declined year-over-year in the first quarter, according to the Multifamily Market Survey released by the National Association of Home Builders.

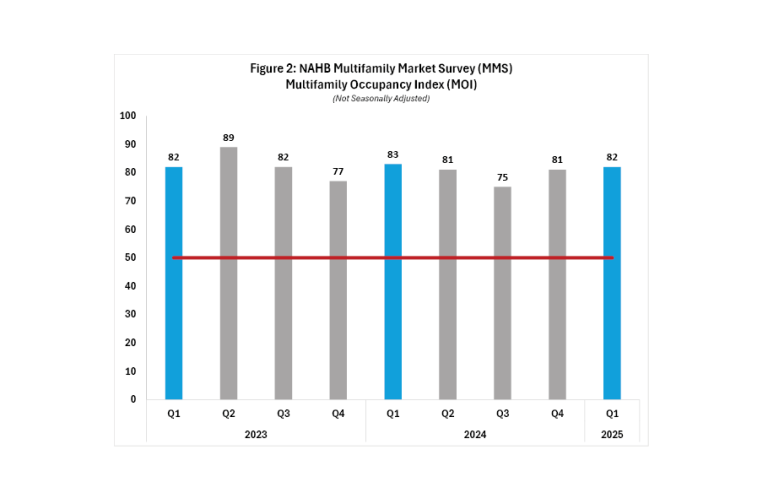

The MMS produces two separate indices. The Multifamily Production Index had a reading of 44, down three points year-over-year, while the Multifamily Occupancy Index had a reading of 82, down one point year-over-year.

The MPI measures builder and developer sentiment about current production conditions in the apartment and condo market on a scale of 0 to 100. The index and all its components are scaled so that a number below 50 indicates more respondents report conditions are poor than report conditions are good.

The MPI is a weighted average of four key market segments: three in the built-for-rent market (garden/low-rise, mid/high-rise and subsidized) and one in the built-for-sale (or condominium) market. The component measuring garden/low-rise dipped one point to 54, the component measuring mid/high-rise units fell eight points to 28, the component measuring subsidized units held even at 50 and the component measuring built-for-sale units posted a one-point decline to 38.

The MOI measures the multifamily housing industry’s perception of occupancies in existing apartments on a scale of 0 to 100. The index and all its components are scaled so that a number above 50 indicates more respondents report that occupancy is good than report it is poor. The reading of 82 indicates existing apartment owners are positive about occupancy.

The MOI is a weighted average of three built-for-rent market segments (garden/low-rise, mid/high-rise and subsidized). All three components remain solidly in positive territory above 50: the component measuring garden/low-rise units fell two points to 82, the component measuring mid/high-rise units increased two points to 76 and the component measuring subsidized units dropped five points to 89.

“While occupancy in existing buildings remains strong, multifamily developers are remaining cautious about starting new projects, especially mid/high-rise and condominium projects,” said Debra Guerrero, senior VP of strategic partnerships and government affairs at The NRP Group and chairman of NAHB’s Multifamily Council. “Construction costs, regulatory barriers and financing are the main headwinds right now, with some developers also citing uncertainty about tariffs as a reason to be cautious.”

“The MPI of 44 is consistent with NAHB’s forecast for a modest decline in the rate of multifamily production for the remainder of 2025, followed by a modest recovery in 2026,” said NAHB Chief Economist Robert Dietz. “Like remodelers and single-family builders, multifamily developers are being affected by rising costs and economic policy uncertainty. In NAHB’s first quarter multifamily survey, more than half of the developers reported that their suppliers have increased prices due to announced, enacted or anticipated tariffs.”

For additional information on the MMS, visit nahb.org/mms. (Source)