Sales Transactions

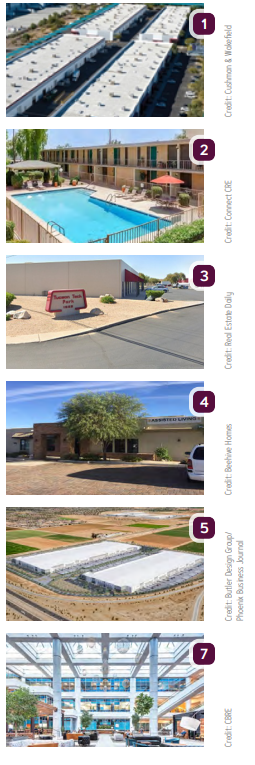

1. Cushman & Wakefield announced the firm advised the sale of Seventy5 Business Park, a four-building industrial infill park totaling 222.4KSF at 7150 W. Roosevelt St. in Phoenix. The property sold for $46.8M and is currently 95% leased to 33 tenants. MIG Real Estate acquired the property from Baron Properties. C&W’s Will Strong, Phil Haenel, Foster Bundy, Molly Hunt, Michael Matchett, Jack Stamets and Madeline Warren represented the seller. C&W’s Gary Anderson and Nik Vallens provided market leasing advisory.

2. Neighborhood Ventures announced the acquisition of a 78-unit multifamily property in central Phoenix, which will rebrand as Venture on Maryland. The online real estate investment company launched the property into its Arizona Multifamily Opportunistic Fund under a pre-foreclosure forced sale transaction of $10.7M.

3. Tucson Tech Park at 1622 E. 17th St., 1665 and 1700 E. 18th St., and 160 and 1662 E. Winsett St. sold for $8.7M. The industrial campus totals 87.7KSF across multiple buildings. FJM Investments and its affiliate, SBC Investors, purchased the property. DeBell Investments, LLC sold the property. Cushman & Wakefield’s Paul Boyle represented the buyer, while Martin Property Advisors’ Gordon Rasmussen represented the seller. Cushman & Wakefield | PICOR’s Andrew Keim and Alex Demeroutis will handle leasing.

4. A 20-bed assisted living facility at 6180 W. Mamie Kai Dr. in Marana sold for $2.4M. The transaction included the real estate, which sold for $2.3M, and the business, which was valued at $75K. The property was developed and operated by MM&P Healthcare Properties LLC under the Beehive Homes franchise. The buyer, owner of a senior housing portfolio, will operate the facility locally and rebrand it. The 40KSF parcel allows for construction of a second building to double capacity.

Lease Transactions

5. Lawncare manufacturer Scotts Miracle-Gro recently leased a 733.9KSF industrial building at the 303 Crossroads industrial park at 8700 N. Sarival Avenue in Glendale. The landlord, a joint venture between Peakline Real Estate Funds and Clarius Partners, was represented by CBRE’s Pat Feeney, Dan Calihan and Tyler Vowels. The same brokers, as well as CBRE’s Phillip Pelok, represented the tenant.

6. Hadrian announced it is leasing Building A at The Cubes Mesa Gateway. JLL’s Greg Matter, Kyle Westfall, Eric Turner, Meredith O’Connor and Ada Wong represented the advanced manufacturing company. This is part of the company’s $200M investment in establishing its 270KSF Factory 3.

7. CBRE facilitated four new leases at Galleria, a two-building office complex at 4301-4343 N. Scottsdale Road in Scottsdale. The new leases totaled approximately 120KSF. CBRE represented owner Stockdale Capital Partners. The transactions included:

- Illuminarium Experiences, 43KSF;

- Mark-Taylor Residential, 31KSF;

- Independence Home Loans, 23KSF, and

- AmTrust North America, 20KSF.

8. EōS Fitness signed a lease for a 40KSF gym near N. Verrado Way and I-10 in Buckeye. The new location is set to open in 2027. The transaction was brokered by Echelon Realty Advisors, while the landlord, Eisenberg Company, self-represented.