Sales Transactions

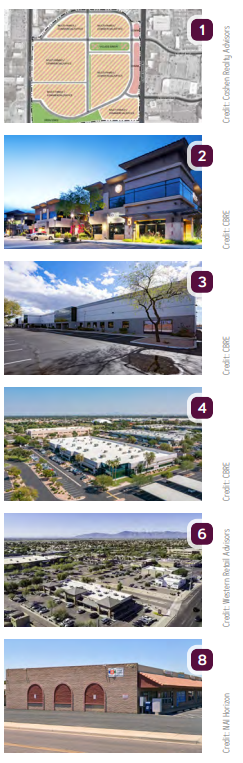

1. On Feb. 28, Verde Fiesta LLC acquired the former Fiesta Mall site between Southern Avenue and the U.S. 60 near Alma School Road. MMCP, LLC sold the space for $24M. Cashen Realty Advisors brokered the deal, and Ray Cashen represented the seller. The buyer intends to repurpose the area into a mixed-use development featuring multifamily housing, commercial and office spaces, and a central village green.

2. CBRE has negotiated the $23.48M sale of The Forum at Gilbert Ranch, a 97KSF, Class A office campus on 6.56 acres in Gilbert, to a private high-net-worth 1031 investor. CBRE’s Geoff Turbow, Anthony DeLorenzo, Matt Pourcho and Charlie Von Arentschildt represented the private seller. The buyer was self-represented. Located near East Williams Field Road and South Val Vista Drive, the property includes one single-story building and four two-story buildings, with an average suite size of 4.5KSF.

3. A Tempe industrial property at 1415 W. Third St. recently sold for $16.8M. CBRE Group, Inc. represented seller Diversified Healthcare Trust. The property is 82.3KSF and sits on 5.3 acres along Priest Drive and Loop 202. Three acres of excess land are also included on the property. Notable features of the space include a floorplate divided to 23KSF, 18-to-20-foot clear heights, a double truck well, four grade-level doors, property-wide air conditioning and 265 parking stalls.

4. SIN 360 Dental recently bought a 75.3KSF flex industrial property at 8312 S. Hardy Dr. in Tempe for $14.4M. The property lies on 7.5 acres near I-10 and Warner Road. The seller was Tempus Realty, represented by CBRE Group, Inc. The space originally held 40.9KSF of office space. However, its original heavy industrial zoning enabled the conversion into its current state containing 20KSF of office space and 20.9KSF of air-conditioned warehouse space. The 1.4-acre parking area on the property may be converted into a storage yard or a 20-to-25KSF warehouse building.

5. Alturas Capital Partners, in partnership with its lending partner Bank of Utah, purchased Montesa Plaza in Tucson. The 75.6KSF space is a multi-tenant retail center that was 95% occupied at closing. Kidder Mathews facilitated the $14.2M sale. Montesa Plaza is located at 50-190 S. Houghton Road and spans 7.2 acres.

6. Shops at Kohl’s, located on 1.1 acres at 4645 E. Chandler Blvd. in Ahwatukee, was sold for $4.5M. Western Retail Advisors represented the property seller, a California private investment group, in the sale to a California trust in a 1031 exchange. The 11.4KSF multi-tenant retail center is 100% occupied.

7. K E & G Real Property LLC purchased 47.8 acres of industrial land at Sunbelt Industrial Center from Sun Growth 1 LLC for $2.9M. The property is located at 8301 S.E. Old Vail Road in Tucson. Stephen D. Cohen of Cushman & Wakefield | PICOR represented both parties.

8. 9501 W. Peoria Ave., a retail center in Peoria, recently sold for $2.8M. The seller, Fen Investments, Inc., was represented by RE/MAX Solutions, and the buyer, Old Man Cactus, LLC, was represented by NAI Horizon. The retail center, named Sun Aire Plaza II, is 64KSF and sits on 1.5 acres.

9. Wane Investments, LLC purchased a 21.5KSF industrial building at 990 S. Cherry Ave. in Tucson from Gould Family Properties, VIII, LLC for $2.1M. Cushman & Wakefield | PICOR’s Paul Hooker represented the seller. Lee & Associates’ Christopher McClurg and Michael Giuliano represented the buyer.

Lease Transactions

10. Barrett Financial Group signed a 52.6KSF lease at Insight Enterprises’ headquarters on a 76-acre site at 2701 E. Insight Way in Chandler. The two-story building includes a cafeteria, coffee shop, health clinic, fitness facility, library and mothers’ rooms.