By Roland Murphy for AZBEX

LGE Design Build released its Construction Delivery Outlook for Q3 this week, and the data shows signs that a continued positive attitude may be justified, although challenges for the Phoenix and national construction industry still remain.

To be clear, AZBEX receives quarterly market reports from nearly every outlet that covers Phoenix and Arizona. With no disrespect intended, those reports are usually from commercial real estate brokerages, most of which draw from the same data sources. As a result, our coverage is usually on a first-come, first-served basis.

We like to examine the LGE reports from time to time because, as a leading design and construction firm, LGE provides a different, more ground-level view of the active development space and includes information specifically relevant to the building community, as well as CRE.

In his introduction to the Q3 report, LGE VP of Preconstruction Blake Wells says Phoenix is seeing “robust growth” in the custom-built and general Industrial sectors, as well as in Student Housing. He adds the Office sector remains positive and that Phoenix is seeing increased investor activity in Medical spaces.

The report’s core market demand summary says, “The current sectors thriving in the Phoenix market consist of custom-built industrial projects, student housing and retail in 2024, due to steady demand and careful planning. The construction industry in Phoenix anticipates continued growth and innovation, focusing on tailored solutions for specific client needs and longterm sustainability.”

Industrial

The Industrial sector has been Phoenix’s shining star for the last several years, with strong activity in warehouse and logistics, manufacturing and data center development maintaining a healthy diversity of project types.

LGE’s data shows more than 10MSF of industrial space delivered last quarter. Even with that heavy pace of output, net absorption in Q1 was 4.5MSF. The report adds that rental rates are still rising and have reached a new high of $1.15/SF.

LGE does not report its methodology in determining project statuses. BEX’s DATABEX project database does not track items like delivery dates in a searchable manner. LGE also does not identify all the municipalities included in its definition of “Metro Phoenix.” As a result, apples-to-apples comparisons are impossible. Still, there is some interesting information to be discovered by looking at multiple sources.

LGE reports 37MSF of Industrial space under construction in the Phoenix market, making it the U.S. leader for the sector.

Factoring out master-planned projects and focusing solely on individual developments, DATABEX shows 49.5MSF under construction across 89 projects across the state as of July 25. It should be noted that four of those 89 developments do not have square footages available.

If we narrow the search to Maricopa County as a rough equivalent for Metro Phoenix, that count drops to 82, with an under construction area of 46.1MSF, noting that four of the projects do not have square footage information available.

DATABEX does not regularly update project construction cost valuations, as any attempt to do so given the current state of the market would keep our Research team too busy to do much else. Cost estimates are, typically, entered at the time the project is input into the database and updated if and when the developer or the municipality provides new information.

With that said, the estimated construction valuation for Industrial projects in Arizona is $33.07B. Limiting that to Maricopa County puts the number at $32.58B.

Office

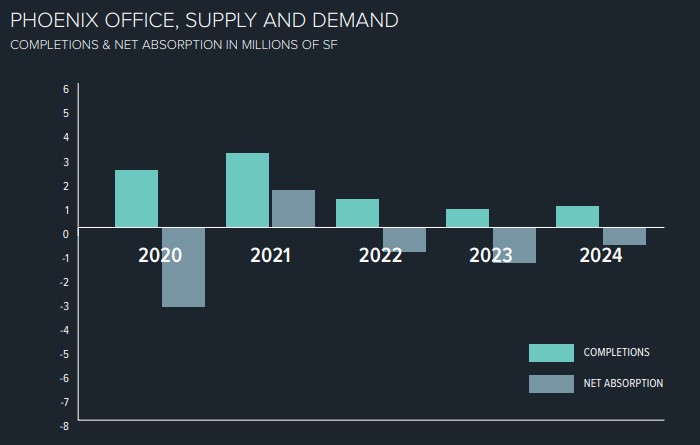

On the Office side, LGE reports construction is seeing something of an increase, even though property performance is declining and all the financing challenges that construction in general and Office construction, in particular, have experienced in the last few years remain in place.

According to LGE, January through May 2024 construction volume reached nearly 70% of the total for last year. The report chalks the increase up to the increasing need for support services to bolster job growth. Major advanced manufacturing developments, particularly in north Phoenix and the East Valley will boost the need for services like healthcare and insurance, for example, which will in turn continue to sustain Office space needs.

LGE also notes vacancy rates are declining in Medical Office space, particularly in north Scottsdale, which has a wealthier than average population and therefore generates high healthcare demand.

The report does not detail construction volumes or statuses for the quarter or year to date. Many, if not most, of the Office-related projects in DATABEX are part of larger mixed-use developments, and the Office-specific portions are often not available for individual reporting.

DATABEX shows 25 projects with significant Office components currently under construction around the state, for a total valuation of $2.15B and a total area of 3.5MSF, with square footages unavailable for four projects.

Narrowing the review to Maricopa County, DATABEX lists 20 projects under construction, with a total valuation of $1.1B and a total area of 3.08MSF. Of those, square footages are unavailable for three projects.

Market Factors

Looking at factors influencing construction, LGE reports that the supply chain has shown impressive resiliency and stability, but that primary areas still face significant challenges.

“Rising ocean freight rates, driven by strong U.S. import demand and shipping issues through the Red Sea and Suez Canal, are a concern,” the report said. “Core commodity prices, especially copper, continue to climb due to high demand and mining disruptions. The recent increase in tariffs on steel and aluminum imports from China, announced by the White House, will further pressure raw material and freight prices, potentially affecting finished goods prices through 2024.”

Electronic components and distribution boards remain significant pain points, with lead times for electrical gear reaching 10-15 months and distribution board waits averaging anywhere from eight to 20 weeks. On a positive note, the previous pain points of HVAC and drywells have shown significant improvement since Q1.

Material costs are also seeing a general improvement, although some challenges remain in place there as well.

“While overall prices are stabilizing, materials like drywall have shown consistent price declines over the past six months, a notable change from the high prices since the pandemic,” according to LGE. “Experts point out that materials such as structural steel, framing lumber, copper electric wire, and concrete block each have unique price trends and challenges. We expect continued stability but emphasize the need for resilience and preparedness in project planning, as localized cost increases could still occur due to large projects, labor shortages, and geopolitical events.”

The complete LGE report is available here.