By Roland Murphy for AZBEX

In a rare win for private multifamily development, two multifamily projects advanced in the March 21 Flagstaff City Council meeting.

Based on recommendations from the Planning and Zoning Commission, Council approved a preliminary plat for the 39-unit Miramonte at Presidio in the Pines VI Condominiums development (aka Presidio in the Pines Multifamily) on 2.77 acres on West Presidio Drive. It also held an initial hearing and gave a first reading for a proposed rezoning that would let Miramonte Homes build a 172-unit multifamily development known as Lofts on Butler on approximately 17 acres on East Butler Avenue in a “future urban activity zone.”

Presidio in the Pines Multifamily

Council initially approved zoning for the 91-acre Presidio in the Pines master planned community in 2004. The currently planned multifamily development is on one small tract in the overall master area. The development agreement for the community was amended in 2007, 2008 and 2012.

In 2020, a fourth amendment was approved that permitted the current tract to be developed as multifamily according to an updated site plan. Under that amendment, at least 10% of the multifamily units were required to be sold as “Market Attainable,” with a maximum price less than or equal to the Area Medium Income. A Conditional Use Permit was granted in September 2021.

Updates in the DATABEX project database show site permits were issued in July and August 2022 and that the construction has been underway since at least September.

Lofts on Butler

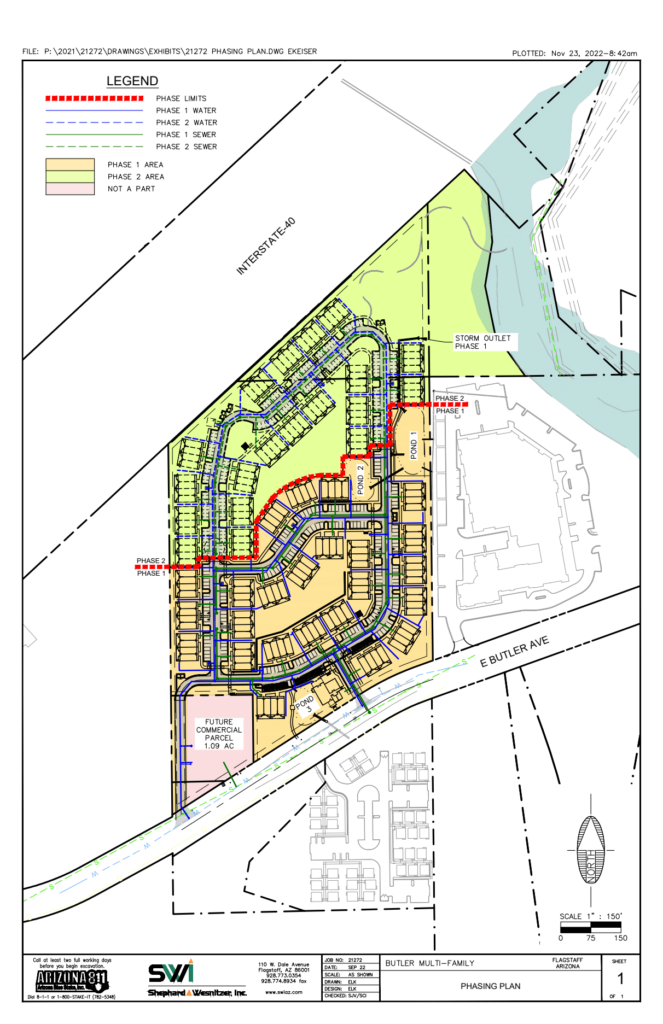

In the new proposal, Lofts on Butler, Miramonte Homes is requesting a rezoning that will combine four parcels, two of which are currently zoned Rural Residential, with the other two being Highway Commercial and Medium Residential. If approved, the site, situated between I-40 to the north and Butler Avenue to the south, will be rezoned to Highway Commercial. In addition to the 172 residential units, one acre in the southwest corner will be split off to create a new commercial parcel, for which there are no current development plans.

In the updated project narrative from March 2, Miramonte cites the goals under the Flagstaff Regional Plan to justify the need for and appropriateness of the development. The Plan says, “Activity Centers are mixed-use areas where there is a concentration of commercial and other land uses typically defined by a pedestrian shed. Activity centers are appropriate locations for higher-density residential development, such as mid-rise and apartment buildings. They include a high degree of pedestrian and bicycle connectivity.”

The justification continues with, “Regional activity centers focus on mainly loft and apartment-style living in a commercial core that is bike, pedestrian and transit oriented. The Flagstaff Regional Plan sets forth the community’s vision of how land use in the region should occur for the next 20 years. ‘Future growth is to be concentrated in reinvestment areas and include a balance of infill and redevelopment.’”

The core, nearly 16-acre site will feature 43 two-story residential buildings with four units each and a single 4.96KSF building divided between a 2.8KSF clubhouse area and 2.15KSF of commercial office space. The residential unit mix consists of 26 one-bedroom, 120 two-bedroom and 26 three-bedroom units.

According to the project narrative and supporting documents, the developer is Miramonte Homes, through its entity MICM Butler Lofts Project LP. Landscape planning is through Acuña Coffeen Landscape Architects. Engineering consulting is through Mogollon Engineering & Surveying, Inc., and the civil engineer is Shephard-Wesnitzer, Inc.

In this week’s meeting, Council held an initial hearing on the rezoning request and gave it a first reading. A second hearing, followed by a vote to approve or deny, is scheduled for April 4.

Slow Development Despite Declared Emergency

In its project narrative for Lofts on Butler, Miramonte notes its objective is “to respond to the City’s December 2020 ‘Housing Crisis Emergency Declaration’ (Resolution No. 2020-66) by providing additional rental units to Flagstaff.”

Despite that declaration and the February 2022 adoption of Flagstaff’s 10-year Housing Plan, there have been few new proposals or developments generated.

The most recent project entered in the DATABEX project database—the 40-unit Plaza Way Apartments, also from Miramonte Homes—received a Conditional Use Permit approval in December 2021. Miramonte representatives told BEX Research staff last June that construction would not start for at least a few more months. In an update from January of this year, construction was expected to begin this month. The project is currently listed as being in Pre-construction.

Flagstaff has proven to be a particularly challenging market for private, market-rate housing development. In addition to the standard neighborhood opposition concerns about height, density, traffic impacts and harm to neighborhood character, the area has a more vocal environmental and natural preservationist contingent than most cities, which adds another layer of resistance. There is also a perceived bias against privately developed and operated multifamily communities.

Despite the challenges faced by private development, Flagstaff’s expressed commitment to publicly owned and subsidized housing is legitimate.

In the 10-year Housing Plan, the overarching goal is to “impact at least 6,000 low-to-moderate income Flagstaff residents through a combination of unit creation or subsidy provision,” and, “Create or preserve 7,976 housing units by 2031 with a minimum of 10% of them being affordable. This will increase the overall supply of market rate, workforce, and affordable housing occupied by local residents.”

One policy initiative under the plan, “Create a dedicated funding source for affordable housing in Flagstaff,” was at least partially addressed last November, when voters approved Proposition 442, a ballot initiative allowing the City to sell $20M in property tax-backed general obligation bonds to modernize existing City-owned housing. Toward that goal, programs would be implemented to increase heights and densities for existing units – such as replacing single-story housing with two-story—and procuring underutilized spaces like abandoned hotels and commercial space for conversion to new rental units.

In the weeks leading up to the vote, City officials said they hoped Prop 442 could help deliver 500 more affordable units to the market, along with as many as 75 through converting existing properties, according to an Oct. 28, 2022 article in AZMirror.

While the 10-year housing plan is ambitious, every possible method of increasing supply will have to be considered and executed with high degrees of success if Flagstaff is going to get the affordability and inventory to a point sufficient to prevent a population exodus. In a Sept. 21, 2022 article, the Arizona Daily Sun reported findings in the plan that said 58% of residents were considering leaving the area because of the shortage.

Flagstaff Multifamily by the Numbers

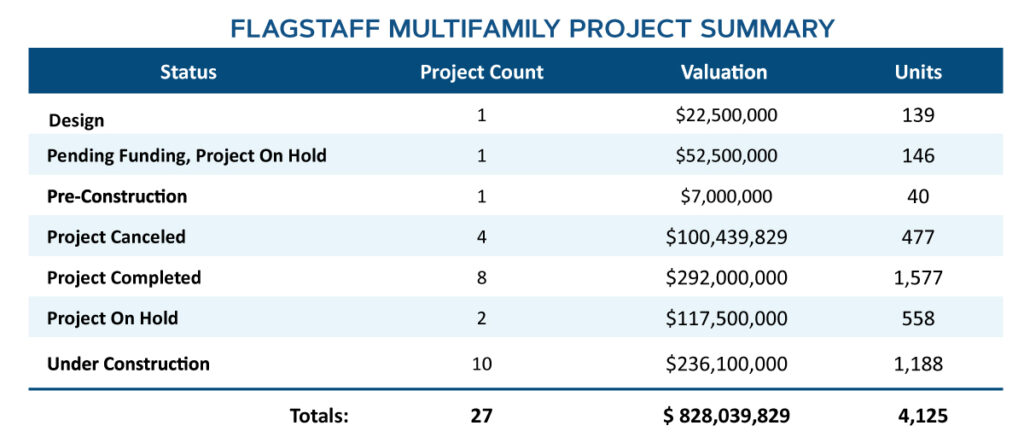

A look at the 27 Multifamily projects included in the DATABEX project database since 2016 gives insights into the complicated nature of development in Flagstaff.

Since DATABEX launched in 2016, 1,577 units have been delivered across eight projects with valuations greater than $5M. Another 1,188 units in 10 developments are shown to be actively under construction.

It is worth noting that seven of the 27 projects, totaling 1,688 units, are at least partially student housing. While student-specific housing certainly has an impact on the overall availability of supply, it is often excluded from market unit counts. We have chosen to include them a) because of that overall supply impact and b) because of the comparatively small overall volume of projects and units in development.

Unfortunately for housing supply and affordability, four projects with 477 units valued at slightly more than $100M have been canceled, and another three developments totaling $170M and 704 units are on hold for various reasons.

Most concerning is the planning and development pipeline. If we include Lofts on Butler, there are still only two projects in the pre-planning, planning or design phases with a total combined unit count of only 311 units.

Stated another way, in the entire universe of Flagstaff Multifamily development, the “visionary pipeline” portion (Pre-planning through Design phases) of the process is smaller than either of the two largest individual developments delivered since 2016—The NAU Honors Hall at 318 units and Elara at Sawmill with 317 units.