By Roland Murphy for AZBEX

A new report from Northmarq shows the current slate of difficulties in the U.S. economy and government’s blunt but aggressive responses to address them have the potential to continue fueling growth in the Build-to-Rent housing market.

The Federal Reserve’s continued rapid-fire interest rate hikes have had the intended effect of cooling demand in the overheated and under-supplied single-family owner-occupied market. Northmarq reports residential mortgage rates went from all-time lows to 20-year highs in less than a year, which has led to restrictions on potential buyers’ ability to purchase homes.

The report predicts high mortgage rates will continue to fuel renter demand as the pool of potential qualified buyers continues to shrink and that those already in the rental space will stay there. As such, both overall demand and appetites for diverse format options will likely continue.

This bodes well for the already popular Build-to-Rent multifamily subsector. The report says, “Developers are increasing activity levels to meet this accelerating demand for an alternative form of rental housing to traditional apartments. Deliveries of single-family build-to-rent units are forecast to rise 20% in 2022, and construction starts are on pace to spike by 25%.”

BTR is not immune from risk, however, Northmarq notes that persistent inflation could ultimately impact demand, as could over-contraction in the labor market. High interest rates could also negate some developers’ and investors’ ability to produce.

Still, BTR is exceptionally well-positioned to ride out the waves of uncertainty and continue its expansion. “While uncertainty persists,” Northmarq says, “single-family Build-to-Rent housing units – particularly those in high-growth parts of the country – are likely more insulated than most other sectors of the economy. Demand for these projects is rising, renters tend to remain in place for longer periods, and transitioning to home ownership is likely to remain challenging.”

Market Headwinds and Opportunities

The report notes that after a comparatively strong start to the year, inflation has become an ongoing problem in 2022 for consumers and developers alike, with the primary impacts being felt in fuel, food and housing costs. The Federal Reserve’s dual mandate of maintaining price stability and maximum employment has faced challenges. With inflation rising at an annualized rate of 5.5% – and topping 9% in the month of June – the Fed’s aggressive interest rate increases to combat it have added uncertainty and increased capital costs into the overall economy.

Employment, meanwhile, has surpassed its pre-pandemic peak. Jobs are perceived as easy to get and wages are generally increasing.

“The Fed is trying to walk the fine line of causing the economy to slow without stalling,” the report says. “Nearly every economic indicator is showing signs of cooling. The concern is that the Fed’s measures take time to carry over into the larger economy, and the cumulative impact of several consecutive rate increases may result in companies reducing employee headcounts as the economy slows and operating costs remain elevated.”

Rising costs, significantly higher mortgage rates and general economic uncertainty have led to an expected slowdown in both the affordability and perceived ability of many renters to transition to homeownership. The average 30-year fixed mortgage rate at the start of 2022 was in the area of 3.1%. By October, it had exceeded 7%. The report uses a $300K mortgage as an example and says, “On a $300,000 loan, an increase in mortgage rates from 3.5 percent to 7.0 percent results in a higher interest payment of $875 per month.” The increase in mortgage rates has offset – and in many cases exceeded – the rate of price decrease caused by the slowing of demand for owner-occupied homes.

The report concludes its affordability assessment by saying, “The continued rising cost of home ownership is expected to keep would-be buyers in the renter pool for longer periods, supporting demand for single-family rental housing. On the supply side, the slowing pace of new-home sales could create some opportunities for single-family rental operators to purchase blocks of completed homes that were originally intended to be sold to individual buyers when mortgage rates were lower. Additionally, SF BTR developers may be able to acquire lots from homebuilders scaling back operations.”

The BTR market, where occupants tend to be older and more affluent than traditional apartment renters, has experienced an initial uptick in its already strong level of appeal and demand. Across the nation, BTR construction starts totaled roughly 36,000 units in the first half of 2022, which is more than double the starts in the first half of 2021. Northmarq expects that pace to continue at least through the end of 2022.

Deliveries have also accelerated, even with the challenges presented by supply chain and skilled labor constraints. In the first half of 2022, deliveries hit 31,000 units, compared to 21,000 units in the first half of 2021. BTR deliveries are currently averaging 16,000 units per quarter.

“Looking ahead for the remainder of this year,” Northmarq says, “construction starts are expected to remain elevated, fueled by ongoing renter demand for units, even with the economy showing signs of volatility and capital costs increasing. Developers are forecast to start 74,000 units in 2022, up from 59,000 units in 2021.”

The Arizona BTR Market

We reached out by email to Northmarq President-Investment Sales Trevor Koskovich for his help and insights regarding the Arizona and Phoenix local markets, specifically. He began by pointing out Phoenix was among the first major markets where BTR made its initial inroads in 2015.

Koskovich said Phoenix and Arizona are experiencing the same demand drivers as the rest of the country, only more so in some instances. “Even after accounting for some recent declines in prices, the median single-family home in the Phoenix metro area is up 10% year-over-year and is 65% higher than the median price in 2019,” he said. “This price appreciation, coupled with a doubling of the average 30-year fixed mortgage rate thus far in 2022, is making it much tougher to transition from renting to owning.”

Looking at market performance, Phoenix continues to be highly desirable, both for existing and planned communities. “BTR communities are also performing well, which will prompt continued development. Vacancy rates in Phoenix for single-family rentals were below 4% throughout much of last year and into the beginning of 2022. The rate has trended higher in recent quarters, but at about 6% is consistent with the market’s long-term average vacancy rate for rental units,” Koskovich explained.

Looking at the investment climate, Koskovich is bullish despite the headwinds in the general economy. “As these projects are delivered, leased-up, and then sold, prices have been soaring,” he said. “The median price for single-family rental communities in the Phoenix metro area has topped $455K/per unit thus far in 2022, up about 25% to 30% from 2021 levels. These returns to developers and investors should continue to support future projects.”

The DATABEX Data

Regular readers know BEX Companies staff take pride in the fact that we’re a bunch of data geeks. One reason I chose the Northmarq report for today’s column was because doing so would allow me to take a deep dive into our DATABEX project database and crunch the numbers into a market snapshot. It’s especially appealing because DATABEX launched in 2016, just slightly after BTR began to take off as a major market subsector in Arizona.

Before splashing into the tables and summaries, we need to manage some expectations. As with any data set this extensive, there are a few caveats to keep in mind before taking the deep dive:

- Some projects have been submitted for review but not yet added to the DATABEX project database,

- Construction cost/valuation estimates are unavailable for three developments,

- Build area square footage estimates are unavailable for 18 developments,

- Unit counts are not available for two developments,

- For purposes of analysis, we have eliminated master plans but kept the individual projects within them.

Keeping these asterisks in mind, the available data show an exceptionally robust and maturing market across the state.

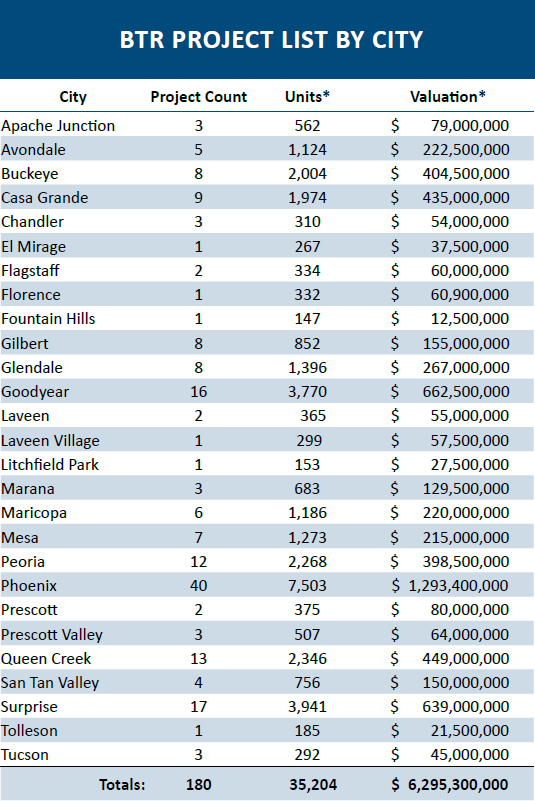

Statewide, DATABEX has listed 180 individual Build-to-Rent projects in Arizona since 2016. These total 35,204 units and 33.5MSF of build space. Most significantly, Construction valuations for these 180 projects come out to almost $6.3B.

As the major municipality in the state, it’s no surprise Phoenix leads in overall project count. The city is home to 40 of the listed developments, laying claim to 7,503 units covering the spectrum from initial proposal to completed project, with estimated construction values of more than $1.29B.

West Valley cities, with their comparatively strong volume of affordable and available land – as well as the skyrocketing popularity of employment growth and industrial development – have also fared well. Surprise has 17 projects in its planning area, equal to 3,941 units and $639M. Goodyear is close behind with 16 projects, 3,770 units and $662.5M. Peoria is third in the West Valley with 12 projects, 2,268 units, and $398.5M. Other West Valley cities have also made strong showings, and the product type even reaches as far out as Tolleson.

The BTR market explosion also closely coincided with Pinal County’s emergence as an advanced manufacturing and industrial/logistics center. Consequently, that area has also fared quite well in BTR development.

Queen Creek leads with 13 developments totaling 2,346 units and $449M in construction costs. Casa Grande is second with nine projects, 1,974 units and $435M. Maricopa is next with six projects, 1,186 units and $220M.

While development has, to date, been primarily concentrated in Maricopa, Pinal, Pima and Yavapai counties, it is safe to speculate other, more outlying regions across Arizona will start incorporating the model into their residential inventories sooner than later.

Looking at the 14 different project statuses under BTR’s DATABEX listings, we see the subsector has been strong since the beginning. Of 180 projects listed since 2016, only two (114 units) have been canceled. Impressively, given the current tumult in the overall economy, only five (1,418 units) have even been put on hold.

Arizona embraced its early adopter status as a BTR innovator and has, consequently, seen a strong volume. Since 2016, 21 projects totaling 2,944 units worth $372.4M in construction costs have been fully delivered.

Most impressive is the near parity between projects in various stages of the design/planning/pre-construction cycle and those currently under construction.

Across all stages leading up to breaking ground, Arizona has a total of 77 projects totaling 15,815 units and estimated construction costs of $3.343B.

That’s a robust pipeline by any measure, and almost a mirror image of the developments currently shown as under construction. BTRs under construction statewide total 75 projects and 14,913 units, with construction costs estimated at $2.273B.

The fate of the market cannot be taken for granted, and speculators are wise to keep an eye on the overall challenges and circumstances that could lead to a major worsening in the overall economy. That said, given the breadth, depth and comparatively long history of Arizona BTR, those gambling on the market to maintain and, potentially, expand have a treasure trove of solid numbers to back their bets.