Sales Transactions

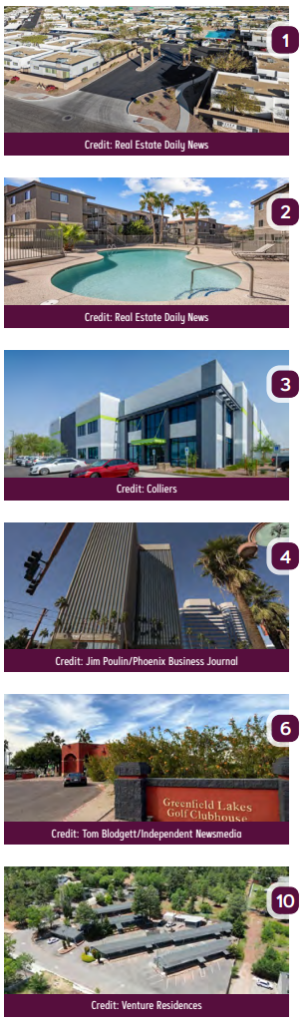

1. The 194-unit Bella Grace Build-to-Rent community in Chandler recently sold for $69M. Golden Horizon Enterprises purchased the asset. Berkadia’s Mark Forrester, Ric Holway, Dan Cheyne and Andrew Curtis represented the seller, an affiliate of The Inland Real Estate Group of Companies, Inc.

2. A 312-unit multifamily community called Ventura Villas at 6200 S. Campbell Ave. in Tucson recently sold for $31.7M. RDM Tucson, LLC sold the multifamily complex to Pacific Transwest – Nevada, Inc. Northmarq’s Trevor Koskovich, Jesse Hudson, Ryan Boyle and Logan Baca represented the seller.

3. ATLAS Capital Partners sold a 60.5KSF industrial building at 3797 S. Silverado Ct. in Gilbert for $26.8M. The property sits on 8.2 acres and is fully leased to Frito-Lay, a division of PepsiCo. Will Strong and his team at Cushman & Wakefield represented the seller, and Colliers’ Brian Ackerman represented the buyer, Simone Charitable Foundation. The transaction closed at a 5.28% CAP, achieving the lowest CAP rate and highest price/SF this year for a Phoenix industrial building sale.

4. Cotterkey Investments purchased a 20-story office building at 2600 N. Central Ave. in Phoenix for $15M. The 317KSF property, built in 1994 and renovated in 2022, was sold by Townline Ventures. Berkadia represented the buyer, and Colliers represented the seller.

5. Thomas Title & Escrow announced the successful closing of a $13.23M commercial land sale at 2215 W. Union St. in Phoenix, located in the Union Park at Norterra corridor. The closing was managed by Justin Wine, Joel Montemayor, Vickie Montemayor and Teri Guevara. Trammell Crow Company purchased the site from US RELP Norterra East I, LLC for $13.23M, along with a construction loan from Comerica Bank.

6. Greenfield Lakes Entertainment LLC acquired Greenfield Lakes Golf Course and Club at 2484 E. Warner Road in Gilbert for $7.1M. The 97.7-acre, 18-hole course includes a 2.2KSF clubhouse and 5.5KSF of maintenance facilities. The seller was Anderson Property Management LLC.

7. Arise Investments purchased the 26KSF Mountain View Plaza shopping center near Mountain View Blvd. and 7th Street in Phoenix for $6M. The shopping center features several buildings laid out across 2.5 acres of land. Velocity Retail Group will be handling leasing activity.

8. Power 12 GB LLC purchased 40 acres of land at the NEC of Arizona Farms and Felix roads in Florence for $5M. San Tan Center LLC sold the land. Willis Land Company’s Ryan Willis handled the transaction.

9. SBA Management, LLC purchased a 47.5KSF industrial building at 1401 & 1501 S. Pantano Road in Tucson from East Coast Tucson Development, LLC for $3.8M. Airtronics will occupy the building. Robert C. Glaser and Stephen D. Cohen with Cushman & Wakefield | PICOR, represented the seller.

10. Neighborhood Ventures acquired Venture at Route 66, a 24-unit renovated multifamily property at 1914 E. Mountain View Ave. in Flagstaff. The sale was completed through a Section 721 UPREIT exchange valued at $5.5M.