By Roland Murphy for AZBEX

LGE Design Build has released its Construction Delivery Outlook for Q2.

While the data is well-sourced, the overall tone is slightly more optimistic than we’ve seen from other outlets, including Associated Builders and Contractors, but it’s worth keeping in mind that LGE is first and foremost a highly regarded design and construction firm, not a market analysis think tank. When leading design and construction firms start to publicly express doubts, the time to start worrying will have already passed.

In introducing the report, LGE’s VP of Preconstruction Blake Wells says, “We are particularly encouraged by the leveled market conditions and the forward momentum observed across various sectors. With capital being deployed and debt placed on significant developments, there is a sense of optimism prevailing in the industry, underpinning our confidence in the future outlook.

“Anticipated rate cuts, coupled with the easing of supply chain pressures, further bolster the prospects of construction activities in the upcoming quarters. These developments pave the way for a more conducive environment, fostering growth and innovation within the construction landscape.”

That second paragraph, which was likely written well in advance of the report’s release last week, is, perhaps, the most optimistic. The latest inflation data shows interest rates will not be getting cut anytime soon. The three expected rate cuts for 2024 have already been revised down to two in most analyses, and a minority of analysts have even floated the possibility of one more rate increase before any cuts begin if inflation continues its current stubborn streak.

As to supply chain pressures, while nearly all sectors have shown vast improvement over their pandemic and early post-pandemic numbers, materials prices were up 0.4% for the month of March and 1.7% year-over-year. In its latest report, ABC said, “Were it not for declines in energy prices, the headline figure for construction input price dynamics would have been meaningfully higher. A new set of supply chain issues is emerging, including the cost of insuring ships and bottlenecks in the Red Sea, the Panama Canal and Baltimore.”

Phoenix Construction Performance by Sector – Industrial

Those quibbles aside, LGE’s data for Q2 gives plenty of reasons for hope, particularly in its breakdown of activity in various construction subsectors in metro Phoenix.

As has been the case for the past few years, Industrial remains Phoenix’s shining star. LGE cites data from Yardi Matrix’s February 2024 National Industrial report showing Phoenix has 41.6MSF under construction. The DATABEX project database, which is locally researched and regularly updated, shows Maricopa County has 51.3MSF under construction. While the two reports are not apples-to-apples—we assume there are differences in geographic/municipal inclusions and, perhaps, some product types—both show Industrial remains a leading construction sector, and that Phoenix remains a leader within it.

Because of two years of activity and deliveries that Colliers described as “red hot” in its 2023 year-end Industrial report, combined with inflated construction costs and high interest rates, Phoenix Industrial construction is slowing. Slowing, however, in no way means slow. The market has seen a dramatic spike in advanced manufacturing locations and data center activity, which is helping to offset a degree of overbuilding in warehouse/logistics properties. Recent infusions of federal funding for semiconductor- and battery-related projects will only continue to fuel the Phoenix area’s draw in that niche.

BEX Companies/DATABEX research shows Arizona Industrial construction activity—the majority of which took place in metro Phoenix—totaled $12.03B in 2023, and we project 2024’s volume will be $11.3B. (AZBEX, Feb. 2)

Phoenix Construction Performance by Sector – Office

With Office being LGE’s other primary sector of focus, the company reports that while construction encountered a slowdown toward the end of 2023, investment experienced a surge.

LGE’s data shows Phoenix had 1MSF of office space under construction across 19 properties. DATABEX, meanwhile, reports 2.94MSF at 20 projects. The DATABEX information, however, includes Office portions of mixed-use developments where that space is not broken out separately.

On the investment side of the equation, LGE reports, “…Investments in the Phoenix area increased notably since the start of the fourth quarter, with $587M worth of office space changing hands, making it one of the top 20 U.S. metros by active office loan volumes, with over $14.9B as of October 2023.”

Construction Data Trends and Points to Watch

LGE’s report also takes a look at current construction-related trends and gives concise overviews of the various data points.

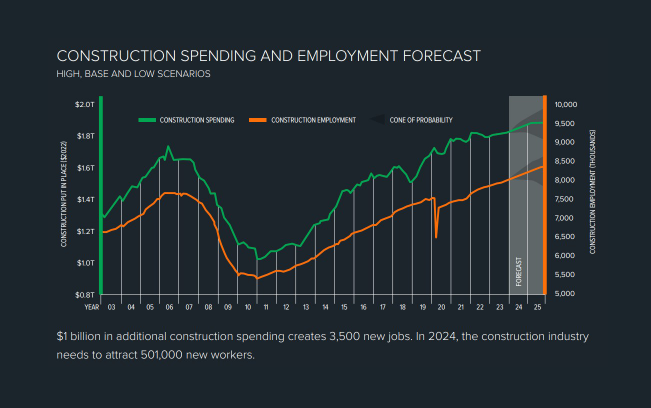

The demand for construction labor remains high, and many contractors plan to expand hiring in the coming months. LGE’s data estimates the industry needs to attract 501,000 new workers nationally in 2024.

Regarding supply chain concerns, LGE reports a mixed bag. While companies are noticing some improvements, which LGE says may be due in part to decreased disruptions or finding creative workarounds, the firm cites the Federal Reserve Bank of New York in reporting that “issues might persist.” It also acknowledges, “Supply chain disruptions have contributed significantly to inflation by limiting product availability and driving up material prices. The recent easing of these pressures has helped mitigate price increases, although many products haven’t returned to pre-pandemic prices,” and notes that if a hoped for “soft landing” takes place, potential Federal Reserve rate decreases could potentially increase construction activities.

Three particular procurement pain points listed in the report are HVAC units, electrical components and drywall materials.

The report takes a particularly optimistic view on the direction of materials costs. While costs have, generally, continued to rise, according to ABC’s Producer Price Index analyses, those increases have moderated significantly, which LGE refers to as a positive shift toward stability.

“Despite ongoing challenges in specific product categories, such as drywall, which has experienced consistent price declines, there is diversity in material dynamics,” the report says. “Various commodities like structural steel, framing lumber, copper electric wire, and concrete block are facing unique challenges and influences. Looking ahead, industry experts anticipate continued stability but stress the importance of resilience and preparedness in project planning, considering potential localized cost increases driven by factors like mega projects, labor shortages, and geopolitical events. Adaptability and foresight are crucial for navigating the dynamic landscape of construction material pricing trends.”

Design Expectations and Challenges

As both a design and construction leader, LGE’s report contains first-hand intelligence on the planning and design portion of project development that many other reports and analyses do not have. “Our architectural team is tasked with conceptual design, preliminary pricing, entitlements, construction documents, and construction administration through completion. Many of these steps are seeing long lead times because of heavily booked due diligence consultants, ever-changing design expectations from municipalities, as well as increasing entitlement and permit review durations.”

The report lists several ongoing challenges on the planning, entitlement and design side, including:

- Enhanced design expectations from municipalities, including the desire for Industrial developments to resemble Class-A Office and leading to façade enhancements, increased glazing, varied textures and increased landscaping requirements;

- Longer and more expansive entitlement and review durations, up to 50% in some municipalities,

- An increase in the number of reviews required for approval.

Overall, the report maintains a highly positive outlook for the near-term construction industry in Greater Phoenix. The closing thought from VP of Construction Grant Blunt says, “…The current landscape of the construction sector paints a promising picture. With evident improvements in cost management and project schedules, coupled with reassuring stability in crucial materials, we stand on solid ground for our endeavors. This positive trajectory not only fosters efficiency but also holds the promise of enhanced project outcomes.”