By Roland Murphy for AZBEX – BEXCLUSIVE

Cushman & Wakefield’s “America’s Data Center Update” for the second half of 2023 shows the Phoenix metro area continues to maintain its national leadership position in the industry sector.

Having absorbed 411MW of capacity in 2022, the Phoenix area ramped up considerably last year and absorbed nearly 600MW. Most of the 2023 absorption took place in the first half of the year, with the second half reporting 269MW in a slight leveling off.

“This is likely a result of limitations on the delivery of supply as opposed to any slowing of demand. Phoenix has joined the rarified air of gigawatt-plus markets, and it has shown no sign of slowing, as hyperscalers and colocation providers alike have evaluated land sites across Mesa, Chandler, Goodyear, Glendale and Avondale,” the report says.

It also notes that all major hyperscale data center providers either have a foothold in Phoenix or plan to grow in the area. “With tight vacancy and many options when it comes to providers, Phoenix has quickly become the central data center hub along the West Coast.”

The Cushman & Wakefield market recap shows 12 major operators have 17 total projects in the works in metro Phoenix for a total build area of slightly more than 16.3MSF. Six of the developments are listed as Under Construction (2.8MSF), with the remaining 11 shown as In Planning (13.4MSF).

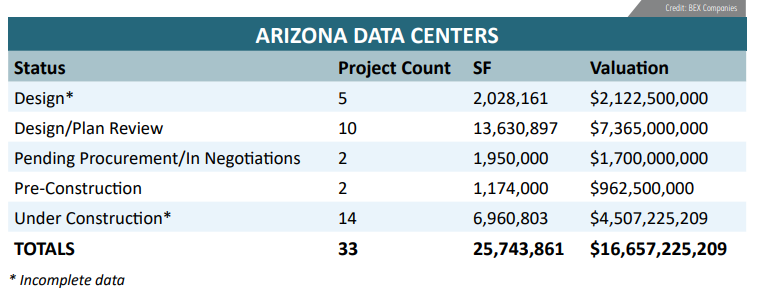

The DATABEX project database shows an even more expansive picture. According to our research, the current market state shows 19 data center projects in various stages of design/planning/preconstruction for a total of nearly 18.8MSF and a construction valuation of $12.15B.

In terms of projects actively under construction, DATABEX lists 14 developments totaling slightly less than 7MSF and valued at $4.5B in construction costs.

Since DATABEX was launched in 2016, nine data centers have completed construction and come online with construction costs estimated at $1.93B and space totaling 3.78MSF. In that time, only two data center projects have been proposed and subsequently canceled.

Of course, data center development does not happen in a vacuum. Nearly every project will require its own power substation, and utility providers have been struggling to meet demand, as has been discussed in several BEX events over the last two years.

Water needs have been a major efficiency driver, as well as a point of contention, in data center development. Old designs required massive amounts of water per day for cooling, making their viability in Phoenix’s desert environment a difficult prospect. Modern “closed loop” water and cooling systems, however, have made data centers a leading innovation source in terms of water management, although opponents still frequently reference old-style water needs as a reason for resistance.

Cushman & Wakefield address the power and water issues in the conclusion of their Phoenix overview, saying, “The established power grid in the market remains predominantly natural gas (52%) and nuclear (45%), however, more private solar developers continue to begin construction on new solar farms around the state.

“Despite growing solar developments in surrounding areas, power—as with many markets—is becoming more constricted as competition grows for larger data center deals in the Phoenix area. Water usage has also become a critical issue for the market, as high ambient temperatures and demand for more intensive AI/HPC workloads have generally increased the requirements for more intensive water-cooling technologies. State and local governments have begun to ask data center operators to limit their water usage and have incentivized the deployment of air-cooling technologies. The confluence of these factors will likely lead to fewer high rack density deployments in the Phoenix market as compared to others, though this will likely do little to dampen the overall positive momentum of the market.”