By CBRE

Investment in U.S. net-lease properties was close to pre-pandemic levels in Q1 2021, driven by robust sentiment, 1031 exchange requirements, increased interest in office assets as return-to-the-workplace plans gained momentum and, despite COVID-19-related international travel restrictions, resilient foreign investment, according to the latest research from CBRE.

Net-lease properties are characterized by a lease structure in which the tenant agrees to pay the building operating expenses such as taxes, insurance fees and maintenance costs in addition to the base rent. While US net-lease investment activity (comprising office, industrial and retail properties) decreased by 2.6 percent year-over-year in Q1 2021 to $14.3B, volume was up by 10 percent from pre-pandemic Q1 2019. The decline for total U.S. commercial real estate volume in Q1 2021 was deeper at 18.3 percent year-over-year.

Phoenix ranked in 11th place for total net-lease investment volume rising 43.8 percent to $388M. Q1 office net-lease investments in the market soared nearly five-fold to $161M from $33M. In the net-lease retail space, Phoenix placed in spot No. 4, with total investments rising 161 percent to $81M.

The U.S. office sector’s share of total net-lease investment volume increased by 5.2 percentage points from the year-earlier Q1 to 41.5 percent, with its largest first quarter volume on record at nearly $6B. The industrial sector continued to attract the most net-lease capital with its share remaining relatively unchanged at 43.4 percent, while the retail sector’s share fell by 5.4 percentage points to 15.1 percent.

Institutional and equity funds, the largest net-lease buyers this quarter, increased their acquisition activity by 40 percent year-over-year in Q1 2021 to $6.7B. Private investment in net-lease properties grew by 6.7 percent over the same period to $6.3B. REIT net-lease investment volume was down by 44 percent year-over-year in Q1 2021 to $1.4B.

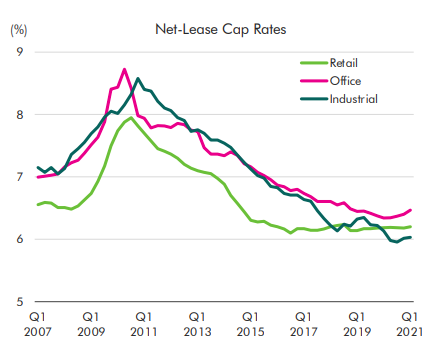

The net-lease sector is attractive to investors because the long-term leases and creditworthy tenants are considered safe attributes during an economic downturn. During the pandemic, the net-lease share of total commercial real estate volume increased to 14.7 percent in 2020 from 13.5 percent for full year 2019. The sector exhibited a similar trend during the GFC when its share increased to 15.1 percent for full year 2009 from 8.7 percent for full year 2007. For the year ending in Q1 2021, while total net-lease investment volume declined by 25.9 percent compared with the same period last year as the COVID-19 economic downturn stalled transaction activity, it comprised 15.4 percent of total commercial real estate investment volume. (Source)