By Roland Murphy for AZBEX

If you’ll look to the top right corner of this page (for the magazine subscribers; web viewers will have to use their imaginations) you’ll see AZBEX is starting a new publishing year.

There are always good things about rounding another annual corner. The most obvious has to be we’re thriving and still sharing our findings and insights with a loyal audience that appreciates our work. There’s no doubt that feels good. Another good thing is it gives me that chance to go through the give or take 150 original articles from the last 100 issues and pause for a moment to scope what turned out to be important and what was merely interesting at the time.

Over the last year, we’ve hit upon nearly every topic concerning Arizona construction. Before I jump into the review with both feet, let me make one note for clarity: These are the Top 10 stories of the year, not the Top 10 articles. While many of these are, in fact, standalones, you’ll also see several stories on this list that have multiple articles included. There’s a method to my madness here, and I’m not being cheeky or sentimental when I list one story but include half a dozen articles in the write up. It’s legit. Trust me.

So, without further ado, let’s take a look at what popped out, to me, as the Top 10 stories of the last year.

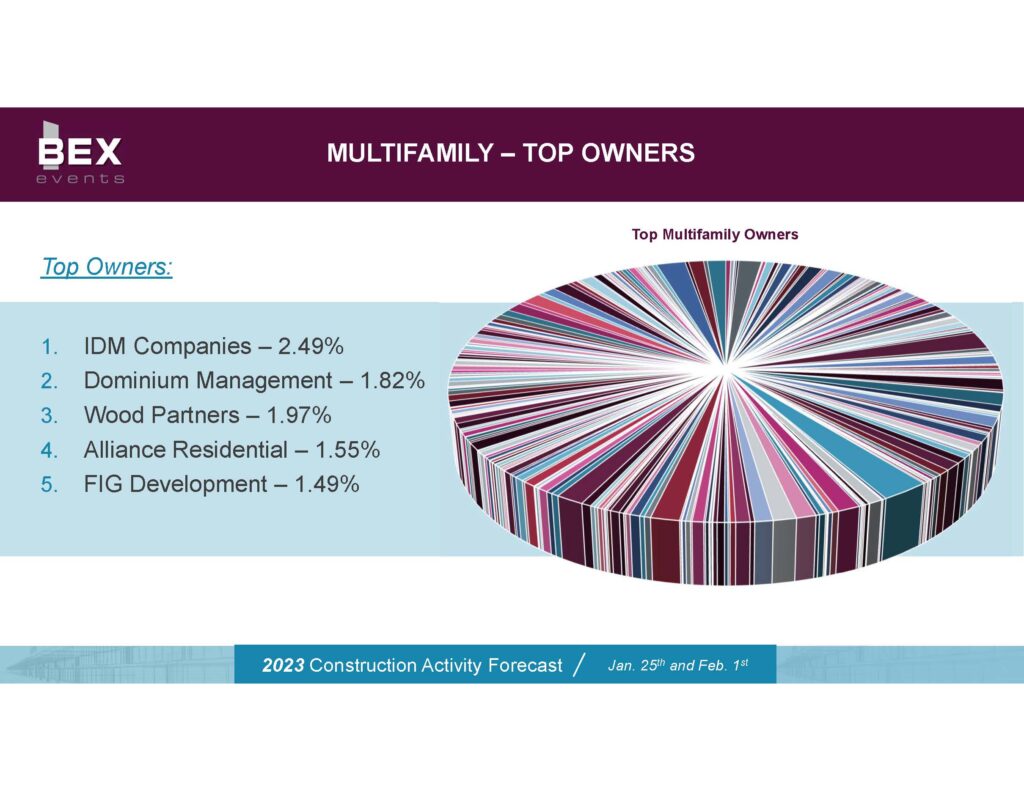

10: BEX Events

Much like this Top 10 column, the BEX Private Development Summit, Public Works Conference, and Construction Activity Forecast Event give us the chance to step back, focus our attention and bring into clear view a year’s worth of activity in the public, private and aggregate total Arizona A/E/C industry.

There’s a fair bit of pride involved with this selection. Our staff—proudly self-referenced as BEXperts—put in massive amounts of time and effort every week finding and tracking projects and trends. The events are where they get to take all these thousands of individual nuggets, assess the value of the overall lode and share it with the entire prospecting community (AZBEX: May 13, 2022; Oct. 21, 2022; Feb. 3).

9: Peoria Place Redevelopment

We could do an entire dissertation on why some areas flourish and others flounder. Some areas seem to succeed effortlessly; some succeed in spite of themselves. Some grow because of one set of advantages but don’t reach their full potential because of other interconnected constraints, and some seem to perpetually struggle no matter what good things may be going on in the aggregate.

The revitalization of several core areas in Peoria has been one of those project sets that has faced repeated challenges from a number of different directions. Development partners have walked away from some efforts. Council has held out for what it thought was a better vision after developers changed proposals, only to have the developer withdraw. Little has happened in the way of actual execution, and the area remained in limbo.

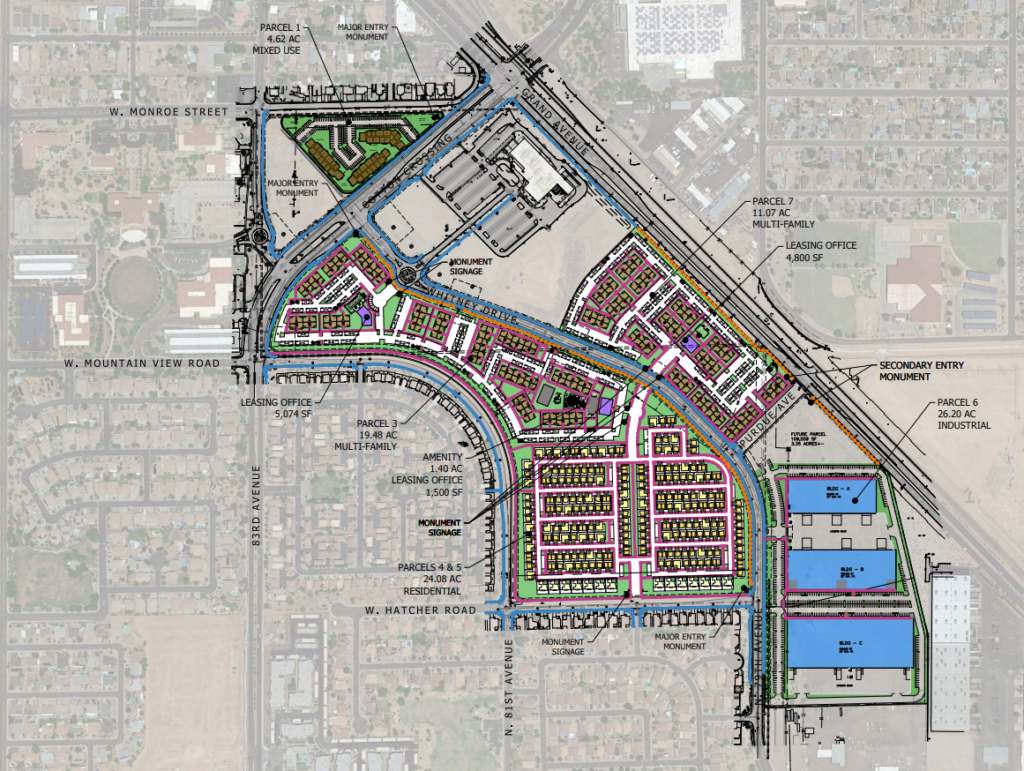

That got shaken up last year. We broke the story about a pre-application from Greystar—ranked as the country’s largest developer by the National Multifamily Housing Council—for a master plan that would redevelop Peoria Place as a new master-planned mixed-use development consisting of traditional multifamily, Build-to-Rent and industrial uses on 105-acres. The company announced it intended to invest up to $500M in the redevelopment.

The new proposal breathed life into an old redevelopment plan that had languished for years but only produced one project.

While no new movement has been reported on the plan since August, at that time four of the five individual projects had been submitted for site plan review and/or minor PAD amendments, according to the DATABEX project database. (AZBEX: April 15, 2022)

8. Annual Capital Improvement Plans

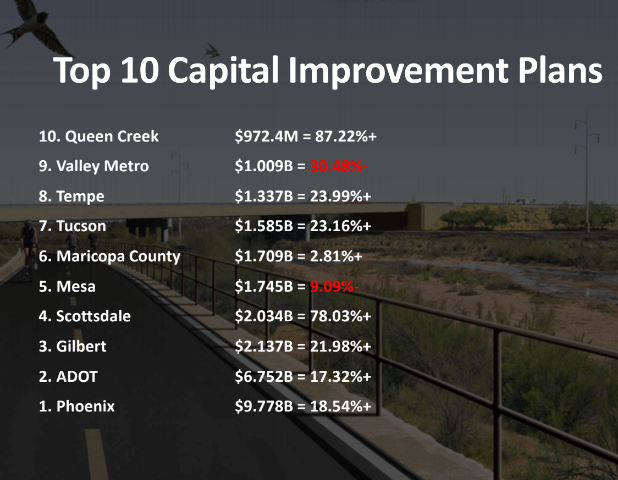

Every year, we take a look at the Capital Improvement Project documents from around the state. One of two major standouts this year was the City of Phoenix setting a record with $9.77B in planned expenditures and funding.

From our Sept. 27 article: “Before 2018, the Arizona Department of Transportation had been the single largest public agency in the state for capital programs and expenditures. Since then, however, Phoenix has absolutely dominated the space, growing from a variety of new funding sources, significant tax revenue growth, as well as federal funds… This most recent CIP shows an astounding 18.54% YoY increase in the total program.”

Not to be outdone, ADOT also posted significant increases in its planned expenditures, rising 17.32% over the previous year. Much of that funding was due to increases in federal infrastructure spending, most notably under the Infrastructure Investment and Jobs Act (AZBEX: Sept. 27, 2022; Sept. 30, 2022).

7. Inflation, Project Costs and Tax Receipts, Oh My…

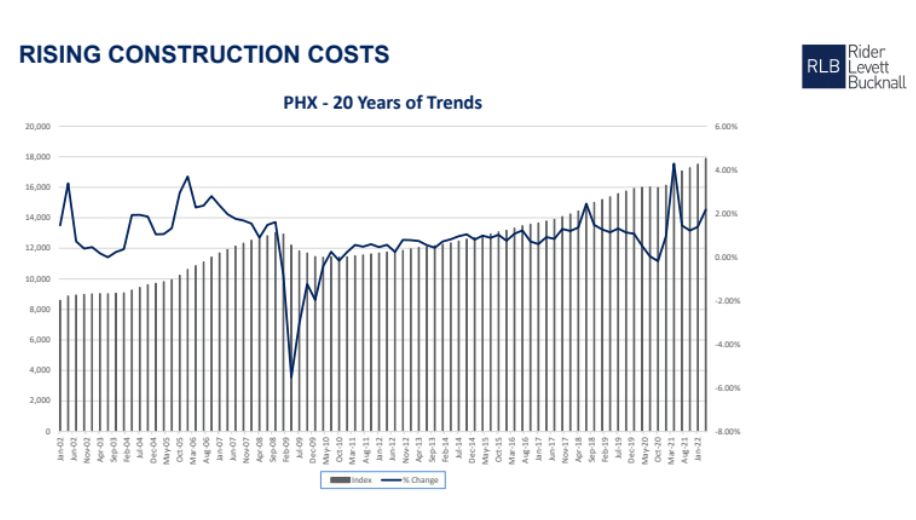

2022 was the first time in many years developers, project estimators and other stakeholders really had to worry about inflation as a factor in project deliveries.

Experts at our June Leading Market Series event on construction costs weighed in both with anecdotes and hard numbers showing just how badly construction was being impacted by both the ongoing supply chain issues and also by rapidly rising prices due to inflation.

In July, Rebekah and I teamed up on a column taking a look at how inflation was impacting CIP projects. We culled information from a variety of news sources, looked at apples-to-apples comparisons of project costs over time and generally put together a clear and comprehensive overview of the state of the industry as of mid-2022.

Unfortunately, all that digging harkened back to a story we ran in February detailing how inflation, project delays and cost increases were impacting local tax revenues across the state. With materials hard to come by, timelines getting pushed out, materials purchases getting delayed and the pace of construction slowing for many projects, some agencies that depended in part on construction sales taxes were seeing revenues drop at the same time prices were rising.

(AZBEX: Feb. 15, 2022; June 10, 2022; July 19, 2022)

6. NIMBYism

It was the rare week that passed without NIMBYs (Not In My Back Yard), BANANAs (Build Absolutely Nothing Anywhere Near Anyone) and CAVEs (Citizens Against Virtually Everything) garnering far more coverage than we would have liked to have to give them.

We ran several pieces on NIMBYism over the year, but my two favorites had to be the Dec. 12 report on the Bisnow multifamily event where Scottsdale Mayor David Ortega gave a keynote that left-handedly excoriated developers as disengaged opportunists and also stressed “balance” as a driving goal of his administration. In the second half of the event, Councilwoman Tammy Caputi and other panelists dismantled the keynote elements point-by-point.

After all the time spent covering obstructionism, it was a delight to write our April Fools Day piece. Phoenix has taken a good amount of heat from Scottsdale for allowing high-density development literally across the street from the Scottsdale side of the border between the two. The April First column carried that out to a far-fetched conclusion.

(AZBEX: Feb. 8, 2022; Feb. 11, 2022; Feb. 22, 2022; April 1, 2022; Dec. 6, 2022)

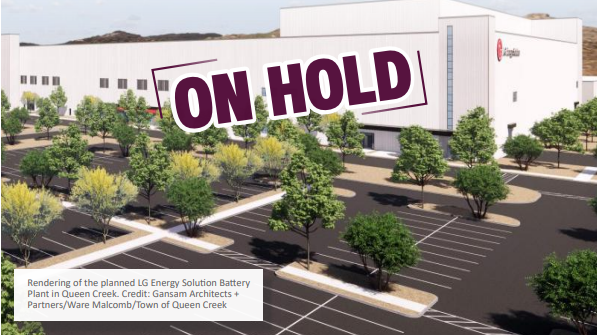

5. LGES

Every reporter loves to get an exclusive. I particularly love to get the exclusive when it’s good news. On our March 18 front page, I was able to report that LG Energy Solution, the Town of Queen Creek and Pinal County were entering into a development agreement to put what we (correctly) speculated at the time would be a battery plant on 300 acres in Queen Creek.

The agreement listed the overall investment at $2.8B. Infrastructure and a job training facility were part of the terms, and our story was picked up in multiple outlets, which was then picked up by other outlets until it rippled enough to become global news (The general story, not our specific article, unfortunately.)

I also got the scoop a few months later that the project had been put on hold, which was not nearly as fun to report. (AZBEX: March 18, 2022; June 24, 2022; July 8; 2022; )

4. The TSMC Expansion

The Taiwan Semiconductor Manufacturing Company plant in north Phoenix was already one of the biggest investments in the history of Arizona when we got the word it was about to become much, much bigger. Everyone who reads AZBEX or had checked the project in DATABEX already knew it was multi-phase and work beyond Phase I was already in development.

Then a TSMC official disclosed plans for several more fabs the same approximate size as the original during a presentation at a BEX event. Obviously, that was going to be my splash headline in the next issue. Unfortunately, because of some complications with TSMC, the next issue was a straightforward write-up of the event and we had to, “Get the story some other way,” for the issue after that.

After a full weekend of research and deep diving into domestic and international sources, we had one of the more detailed pieces on TSMC’s plans, advanced tech manufacturing and the state of U.S. politics and the semiconductor industry to have run anywhere last year.

I’m still rather proud of that one. (AZBEX: May 17, 2022; Dec. 12, 2022)

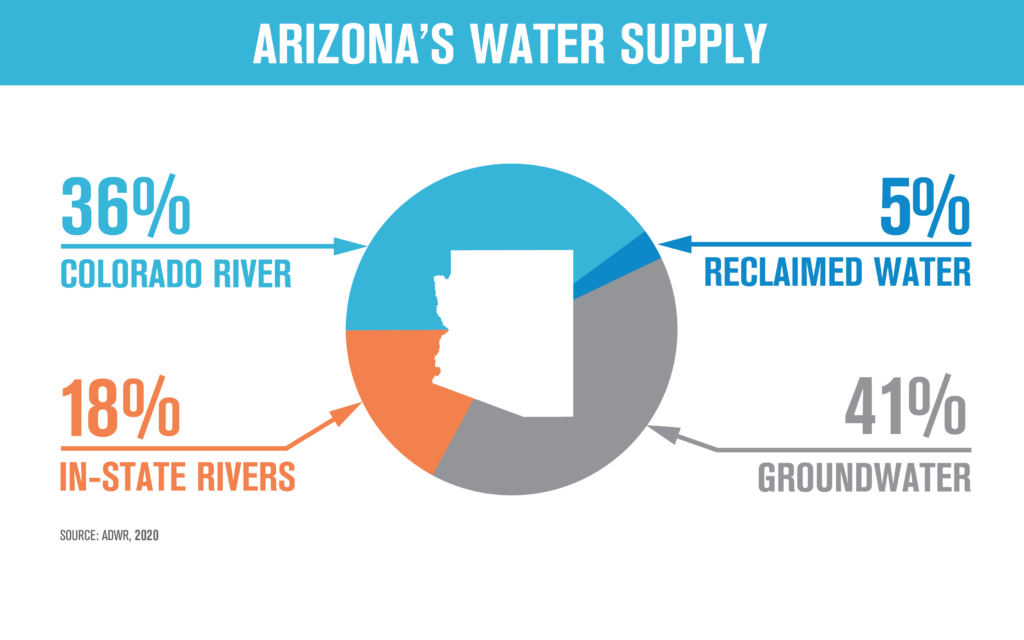

3. Water

With cuts to Arizona’s allocation of Colorado River water last year and a suddenly spiked sense that the multi-year drought was suddenly a real, honest-to-goodness life and economy-affecting issue, there was a plethora of reporting pretty much everywhere on the topic.

Unfortunately, most of it was maddeningly incomplete. Some of it was so bad it looked in several articles that the Colorado River was the only source of water in the state and that we were all going to dry up and blow away by Christmas.

We only did one original water piece in 2022, but I started it by wanting to examine the overall state of water, water supply, development and related issues in Arizona. I don’t know if I hit all those goals, but I think we came closer than most. (AZBEX Oct. 7, 2022)

2. Multifamily Market Shifts

Multifamily, at least in the national industry press, seemed to get more coverage on a volume basis than water issues did locally, and with good reason. Years of underbuilding triggered rampant demand (particularly around and after the pandemic), which triggered record price and rent increases, which contributed to inflation, which contributed to a slowing in the market, which contributed to falling rental prices, which contributed to investor worry that those double-digit rent increases were not, in fact, the new normal.

Or something.

Here’s the takeaway: Arizona still has a massive housing shortage across all property types and income levels. The market delivered record unit counts but is probably going to slow down when it really should be maintaining. Rents are still nowhere near normalized, but they are finally calming down. The sector is going to continue to be profitable, and everyone should just calm down a little. (AZBEX: Nov. 4, 2022; Aug. 23, 2022; Dec. 2, 2022; Jan. 17; Feb 10)

1. Proposition 400

We devoted a lot of time and thousands upon thousands of words to our coverage of the Proposition 400 renewal plan (Prop 400E) and Gov. Doug Ducey’s unfathomable veto. We also looked at the half-cent transportation tax’s history, economic and cultural development impact and the path to getting it back on the ballot in our first Special Coverage issue.

Unfortunately, the measure has become grist for the mill of some opponents to public transit in general, and the way forward, while hopeful, is still a long way off.

All the items we covered in this review carry forward into the new publication year, but this is one you can expect to see still more thousands and thousands of words about. (AZBEX: Oct. 11, 2022; Oct. 14, 2022; Dec. 16, 2022; Feb. 7)