Since we were lucky enough to have four of the state’s leading experts on the Build-to-Rent market address our BEX Leading Market Series event this week, we decided to take a closer look at the state of the market as it stands today.

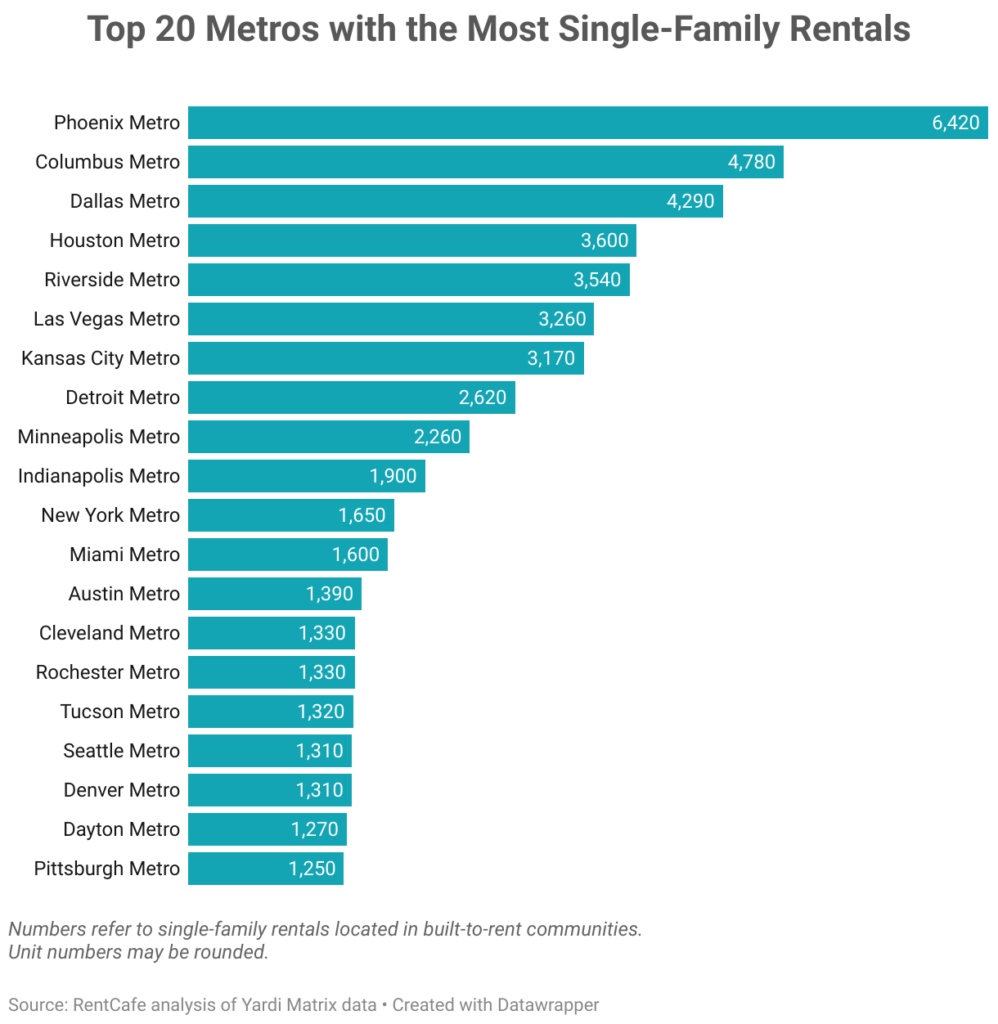

Arizona is generally considered the origin point for the modern Build-to-Rent multifamily sector. Even though the sector has gained traction in every U.S. market, Arizona – particularly metro Phoenix – continues to dominate. A January 2020 market review by RentCaféshowed Phoenix with 6,420 units in inventory. Metro Columbus was a distant second with 4,780.

That same report identified 6,740 units delivered across the country in 2021 and set the 2022 delivery estimate at nearly 14,000.

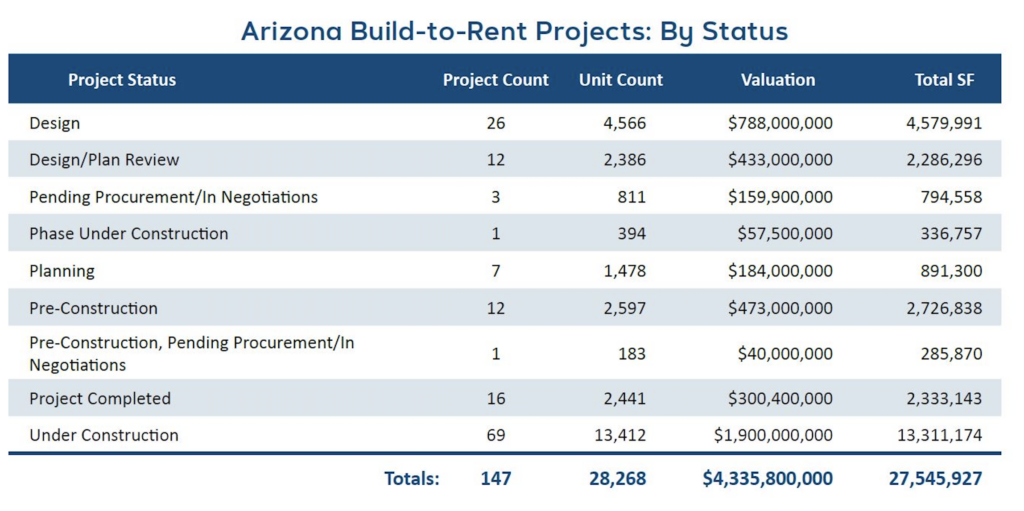

A look at the DATABEX project database gives an interesting history of BTR’s development in the state. Since its launch in 2016, the number of entries has grown to 148 exclusively BTR projects. Inserting the usual caveats, 147 of those projects have unit counts available, and we eliminated master plans and mixed-use projects with BTR components where the BTR aspect was not identified in submissions as a separate aspect of the overall development.

In this review, we will be taking a quick look at the 147 projects for which unit data exists. A very small percentage of these projects lack project valuation estimates or planned project square footages, but they are few enough to not significantly affect averages.

DATABEX reports that of the 147 exclusively BTR projects, 16 have fully delivered and been marked Completed, for a total of 2,441 units and a construction valuation estimate of $300.4M. Keep in mind these numbers a) do not include projects where BTR is one component of a mixed project inventory and b) DATABEX tracks total projects completed, rather than individual unit deliveries. Many of the projects listed as Under Construction have already delivered some portion of their unit counts, which are included in sources like RentCafé but omitted here.

Speaking of projects Under Construction, DATABEX shows a whopping total of 69 projects in Arizona, totaling more than 13,400 units and a project valuation of $1.9B. Another 26 (4,566 units) are in Design, seven (1,478 units) in Planning and 12 (2,386) in Design/Plan review, for a total of 45 projects, 8,430 units and more than $1.4B.

Splitting the project list down the middle in chronological terms as to the order in which they were listed in DATABEX also yields some interesting insights – most of all that projects are, on average, getting bigger. Looking at the first half of projects, we note an average unit count of slightly less than 186, with an average valuation of nearly $25.7M and project square footage of 185.5KSF.

For the 74 most recently added projects, the unit counts swell to an average of 199, with an average project valuation of $34.1M and built area of 209.5KSF.

If we narrow that list down to projects added since the start of Q4 2021, we see an even more interesting potential growth pattern. Between October 1, 2021, and April 6, 2022, the DATABEX team added 28 BTR projects, totaling 6,196 units, $1.1B and nearly 5.8MSF. The averages reinforce the project growth pattern, showing 221 units, nearly $41.4M and 222KSF per project, on average.

Giving readers a little peek behind the process curtain, no part of the DATABEX project input and management process is automated. To ensure accuracy, uniformity and completion, every project is individually reviewed and input by a member of the BEX Research Team. Consequently, there are always projects in queue waiting to be entered.

Looking at the project leads list, there are currently five projects on the list to be input, for a total of 1,066 units, which brings the average count for pending projects up to 213, slightly less than the two-quarter average of 221, but significantly higher than the average 186 for the first half the entry list and the 199 for the second.

Given project volumes like these it is easy to see why investors and developers are clamoring to enter or expand in the market, and it puts paid to any lingering doubts as to whether or not BTR has completed its transition from a trend into an established, dedicated and ongoing field in commercial and residential development.