By Roland Murphy for Arizona Builder’s Exchange

Four commercial real estate and development leaders gave their predictions for what lies ahead in 2018 at Valley Partnership’s Friday Morning Breakfast program, Jan. 26.

Following a brief address by Republican U.S. Senate candidate, and current congressional representative, Martha McSally, moderator Mark Detmer, managing director of JLL, introduced the morning’s panel: Chris Anderson, managing director of Hines Development; Rick Butler, principal of Butler Design Group; and Paul Engler, senior VP of Alliance Bank.

Detmer started off by asking the group for their thoughts on the economy overall. Anderson went first, saying Arizona is maturing and getting more strategic with a targeted focus on sustained quality of jobs and growth. He predicts the “new normal” will be in the neighborhood of 2.5 percent growth. He estimates the current cycle will be stable, but the next one will show more vigor.

One issue facing the economy, Anderson said, has to do with demographics. “Baby Boomers aren’t willing to turn over the keys yet,” he said, adding, “Millennials aren’t ready to drive, and there just aren’t enough Gen Xers.”

Butler said 2017 was one of his company’s best years, and that that seems to be the case nearly everywhere. He believes 2018 will largely continue that trend.

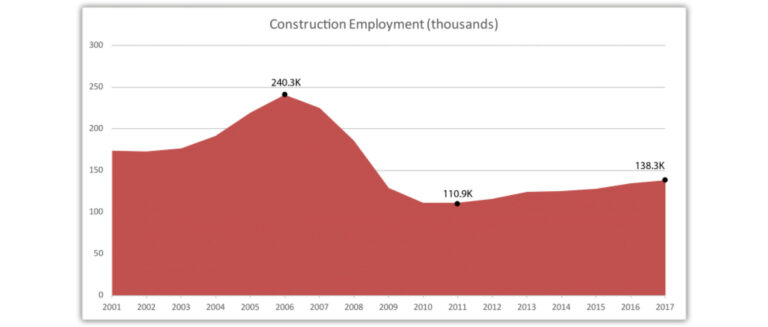

He noted that, even though 2017 was one of his firm’s most productive years ever, pre-Recession the company had 50 people. Now it has 25. In September, AZBEX reported similar trends across the industry, noting that construction employment in Ariz. peaked at 240,000 in 2006 and had only come back up to 134,500 at the end of 2016. (AZBEX; Sept. 15, 2007)

Engler said the currently low unemployment rate of 4.1 percent is problematic, and the lack of available labor across all lines in the development community will continue to be a challenge. “What’s interesting is having full employment feels good, and it is good, and everybody’s employed, but that’s something you have to watch out for,” he said. “There was a report that came out from Moody’s I saw this week, that talked about when you look at full employment and compare it to the long term unadjusted accelerated employment rate, when those two lines cross, historically there has always been a recession within three years. Those two lines crossed last year; that would indicate that three years from now we can expect another recession. Hopefully, because of the slow growth of this recovery, the downturn will be a lot softer.”

Detmer then asked the panelists to discuss the impacts of technology on the industry. Butler said, “Once upon a time, not that long ago, architects were artists. Everything we did was hand drawn. We hired architects based on their lettering skills, basically. Then CAD came along and computerized two-dimensional design, and recently with Revit, everything is being done in three dimensions now. Contractors can price projects now with very precise quantities and the drawings can be turned over to facilities people who can then manage their projects a lot better.”

The next item dealt with the impacts of ecommerce on the industrial sector, which is experiencing challenges meeting demand due to the quality of available labor. Despite that, however, “Industrial is flying,” Butler said, noting there are currently 36 projects under construction, 12 of which are build-to-suit. His fear, however, is the lack of rail-served industrial sites and West Valley infrastructure could become a problem for the sector.

Engler pointed out the continuing erosion of retail space due to ecommerce is significantly benefitting industrial, particularly in terms of fulfillment facilities. “For every square foot of retail space that closes, you need three square feet of industrial.”

Moving on to office, Anderson reported activity is, “Probably as good as I’ve seen it in the last five years,” but there is not a lot of new supply coming online. “To build a new 1MSF industrial building,” he said, “it’s a $50M project. To build a 200KSF office building it’s also $50M. The difference in cost is just so much greater.” He added later the construction cost and degrees of risk and return on office development will continue to preclude speculative construction well into the foreseeable future.

In his closing summary, Butler returned to the earlier point that the biggest challenge across the board continues to be finding skilled talent. “It’s really prohibiting us from growing. We love the size we’re at. We have great workload and phenomenal clients, but that’s one of our biggest challenges. On the construction side, we hear the same thing. It’s really tough out here, and with Florida and Houston a lot of framing crews and subs left Arizona. We need them here with all the growth we have going on. That’s what’s holding us back. The work is here. Growth is here. There are great projects, but how do you deal with that part of it and keep up with it?”