By Roland Murphy for AZBEX – BEXclusive

Metro Phoenix remains at the forefront of trends in the multifamily/apartment market, according to a news report from RealPage.

The metro Phoenix market is second in the country in terms of apartment absorption with 6,635 units absorbed in the first half of 2023. Houston led with 6,877.

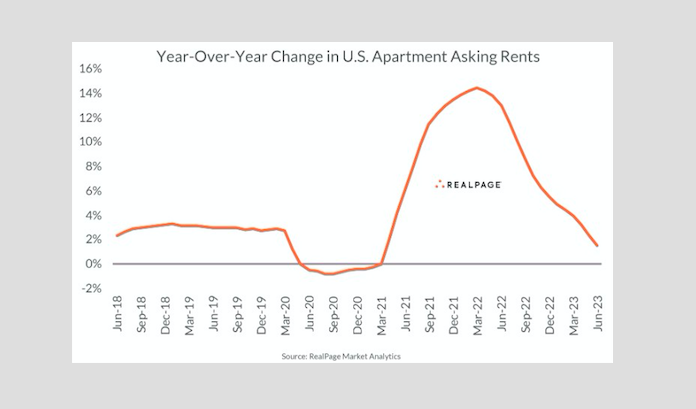

Phoenix was also at the forefront for decreasing asking rents, dropping 4.7% year-over- year. Boise had the sharpest decline at 6.2%, following a rapid spike during the pandemic.

RealPage reports national demand at 83,449 in Q2, a five-quarter high. More than 75% of new demand remains centered in the Sun Belt.

Demand levels are not expected to sustain, however, as the recent peak in apartment construction levels is now yielding a peak in expected unit deliveries nationwide. RealPage reports Q2 deliveries of more than 107,000 units across the country, and more than 1 million units are currently under construction. Dallas/Fort Worth and Phoenix both have more than 25,000 units under construction, as do 15 other US markets.

The currently high demand is helping to maintain high occupancy rates. The national occupancy rate at the end of June was a still robust 94.7%, down just 0.1% since the first month of the year. Nationally, only two markets (Memphis and San Antonio) have occupancy rates below 93%, a percentage that was once considered a functional maximum by many analysts before the pandemic.

The RealPage report summary does not provide occupancy rates for every market it tracks, but the June data from Yardi Matrix lists Phoenix occupancy at 94.0%, where it has remained since November 2022.

Despite the normalization currently taking place in boom markets like Phoenix, rent growth is continuing nationwide, although at a much slower pace than in previous periods. RealPage reports nationwide year-over-year effective rent growth at 1.5%, which is the lowest degree of growth since 2021.