By Roland Murphy for AZBEX

From Founder and President Rebekah Morris down through the entire Research, Editorial and Support staff, the crew at BEX Companies proudly self-identifies as “Data Geeks”. The annual Construction Activity Forecast Event is our time to shine and show off the extreme (some might even say excessive) volume of data we’ve put together over the year and compare it to the previous year’s output and result.

For our 2023 event(s), 365 attendees registered to drink from the data firehose and soak up as much information as they could in a whirlwind two-hour presentation by Morris and DATABEX Manager Lya Parrish. For the first time, demand was so heavy the event had to be presented twice to accommodate everyone who wanted to come.

Following brief introductory remarks from Parrish explaining how data for the 11 covered markets is collected and analyzed, it was off to the races with Morris’ now-familiar overview of the state of the overall Arizona construction market, its impacts and what has changed over the last 12 months.

State of the Market

Morris started her annual summary noting the three major factors impacting construction in the state—Population Growth, Employment, and Inflation and Interest Rates—the last of which she noted had not been a major factor until 2022.

Population growth has been a primary factor in Arizona since the end of the Great Recession, trending generally upward over the past 10 years and hovering around 1.5% annually.

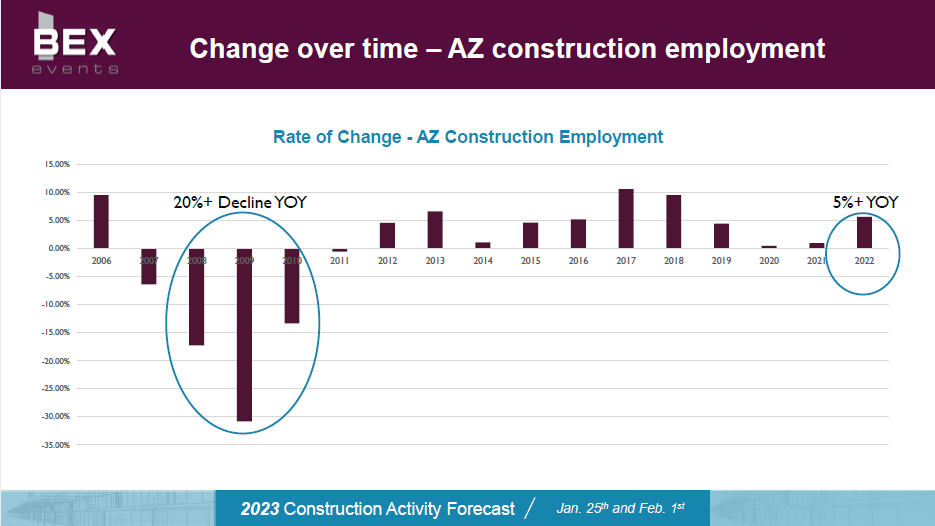

That has, of course, fueled demand across the range of construction markets. Ironically, what it has not done is return construction employment to its pre-Recession levels. At its peak in 2006, Arizona construction employment was 240,300 jobs. That plummeted in the recession down to 110,900. Even with the exceptional boom in project counts and valuations, however, by 2022 construction employment had only rebounded to 186,700.

Even with a workforce that’s 22.3% below its former peak, however, 2022 construction activity totaled $22.4B, a 24% year-over-year increase and a $730M increase over the 2006 past peak.

On the inflation side, a combination of supply issues and cost increases held market growth back in 2021, Morris said. “Construction was constrained in Arizona. We couldn’t get materials, couldn’t get labor. There were, and there are still, some significant permitting delays. We did not grow the industry, but we certainly grew our Producer Price Index, that inflation number,” which hit 10%. The PPI for 2022 came down to approximately 6.7%.

Construction activity, however, grew by 24%. “I don’t have a precise answer on, ‘How much did inflation grow versus how much did the market grow?’ What we know is that we grew jobs. We’ve got specific counts by market sector. We have very specific project-level detail. We can tell the overall market grew much more than inflation.”

After going over the general numbers, Morris put the data into context across construction markets. She reported that in 2019, the cost/SF for a small office renovation was between $50 and $100. In 2022, that had risen to $150-$250. For new mid-sized apartment complexes, the cost/SF was $150-$175/SF. In 2022 the average was between $220-$275.

The researchers and the audience were fortunate enough to have an apples-to-apples comparison for high-end multifamily. In 2020, the Optima Kierland luxury apartment development was announced with a per-unit cost estimate of $632K. For the Optima McDowell Mountain Village project announced in 2022, the per-unit development cost had risen to $751K.

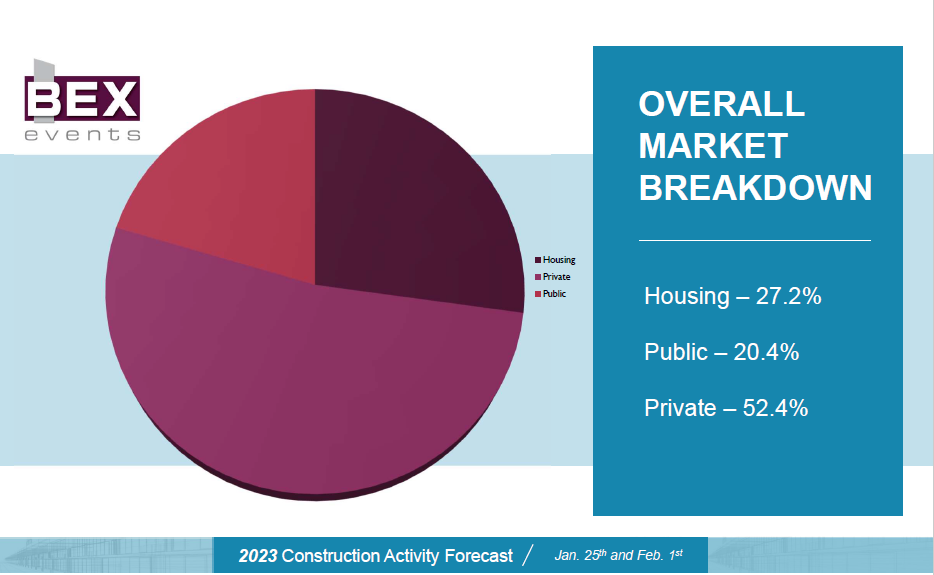

Nearing the end of her introductory segment, Morris talked about how, not very many years ago, the market share breakdown between Housing, Public and Private projects was generally one-third to one-third to one-third. Showing a seismic shift in demand volumes, Housing currently stands at 27.2%, Public at 20.4% and Private at a whopping 52.4%.

Capital Improvement Programs

Morris next launched into coverage of projects and trends in Capital Improvement Programs and the Public sector, which for research purposes consist of Education, Public Spaces, Utilities and Transportation.

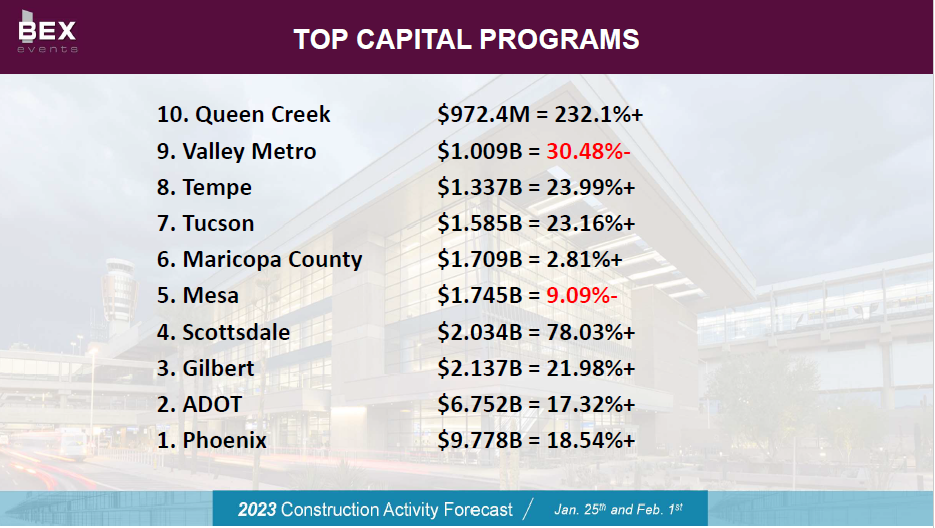

Of the Top 10 Capital Improvement Programs analyzed this year, only two—Valley Metro and Mesa—showed decreases. Phoenix led with $9.778B, followed by the Arizona Department of Transportation at $6.752B.

Bringing up the rear at Number 10 was the Town of Queen Creek, which saw its CIP explode with a 232.1% increase to reach $972.3M.

The Market Sectors

While regular AZBEX readers know we have no aversion to running long showcase articles as our original features, to detail the findings for each sector would run to at least half-a-dozen more pages. It also wouldn’t be fair to the nearly 400 people who took the time and effort to register and attend.

Attendees are entitled to a copy of the complete presentation as part of their registration, and we do not want to undercut the value of their investment.

We also, however, don’t want to leave our readers who were unable to attend in the dark about what is going on where. As a compromise measure, we have decided to include the spotlight project; the top owner, design firm and general contractor by market share, and list each of the sectors’ projected 2023 volumes.

K-12

- Top Project: Madison Park Middle School Partial Campus Replacement ($37M);

- Top Owner: Madison School District #38;

- Top Design Firm: Orcutt | Winslow;

- Top GC: Chasse Building Team;

- Projected 2023 Construction Volume: $398M.

Higher Education

- Top Project: ASU Poly School of Manufacturing Systems & Networking ($175M);

- Top Owner: University of Arizona (UA);

- Top Design Firm: SmithGroup;

- Top GC: McCarthy Building Company;

- Projected 2023 Construction Volume: $324.7M.

Public Spaces

- Top Project: 100 W. Washington Renovations ($150M);

- Top Owner: City of Phoenix;

- Top Design Firm: Arrington Watkins Architects;

- Top GC: Okland Construction;

- Projected 2023 Construction Volume: $1.06B.

Transportation & Parks

- Top Project: South Central Light Rail Extension ($1.35B);

- Top Owner: ADOT;

- Top Design Firm: ADOT (in-house);

- Top GC: Kiewit Corporation;

- Projected 2023 Construction Volume: $2.95B.

Utilities

- Top Project: SunZia SW Transmission Project Phase I ($600M);

- Top Owner: City of Phoenix;

- Top Design Firm: Burns & McDonnell;

- Top GC: Kiewit Corporation | MMR Constructors, Inc.;

- Projected 2023 Construction Volume: $1.28B.

Housing

- Top Project: Optima McDowell Mountain Village Phase I ($333M);

- Top Owner: IDM Companies;

- Top Design Firm: Todd & Associates;

- Top GC: MT Builders;

- Projected 2023 Construction Volume: $6.953B.

Healthcare

- Top Project: Banner Verrado Hospital (Possibly on hold, $200M);

- Top Owner: Banner Health;

- Top Design Firm: SmithGroup;

- Top GC: McCarthy Building Company;

- Projected 2023 Construction Volume: $1.03B.

Hospitality

- Top Project: VAI Resort ($350M);

- Top Owner: Mosaic Quarter Development;

- Top Design Firm: Gensler;

- Top GC: Okland Construction;

- Projected 2023 Construction Volume: $1.03B.

Industrial & Data Centers

Industrial

- Top Project: TSMC – ($13B—Adjusted downward from publicized total to account for equipment and machinery);

- Top Owner: TSMC;

- Top Design Firm: CTCI;

- Top GC: Austin Commercial;

Data Centers

- Top Owner: STACK Infrastructure;

- Top Design Firm: Corgan;

- Top GC: DPR Construction;

- Combined Projected 2023 Construction Volume: $14.8B.

Office & Retail

- Top Project: Verrado Marketplace ($125M)

- Top Owner: SimonCRE;

- Top Design Firm: Nelsen Partners;

- Top GC: Okland Construction;

- Projected 2023 Construction Volume: $482.9M.

Conclusions

With so much data dissected and scrutinized in so many different ways, it might appear difficult to come up with concise takeaways. Luckily the BEX Companies staff lives with this as a daily reality. Here are the Top Three Takeaways from this year’s Forecast Event:

- Industrial & Multifamily continue to dominate the market.

- High tax revenue bodes well for public sectors.

- As individual projects get canceled, capacity will flow to the next project in line.

With a raucous and sometimes bewildering 2022 in the books, we’re looking forward to seeing what 2023 will hold, how our projections will measure up to reality at the end of the year, and what major new trends and announcements we will see in the next 12 months.