By Roland Murphy for AZBEX

A request to amend the zoning district map for a 5.78-gross-acre site at 13875 N. Northsight Blvd. in Scottsdale was submitted last week. The change is needed to develop a residential healthcare facility with an estimated 188 units/270 beds.

The property is owned by Northsight Partners LLC (KB DEVCO, LLC). KB DEVCO bought the site – currently home to a parking area and an 8.2KSF vacant former credit union building – for $4.3M in February, according to the company website and Maricopa County records.

The Northsight Residential Healthcare proposal would amend the current Central Business District, Planned Community District zoning, which that dates back to 1991, to permit changes in the building heights and floor area ratios. Residential healthcare facilities are already permitted under the existing zoning. Building heights would be increased to 51 feet (including mechanical apparatuses) from the current 36-foot limit, and the floor area ratio would go from 0.8 to 1.15.

Proposal Considerations

The facility would wrap around an interior parking structure and feature a primary entrance point on the east-southeast of the property. Amenities noted on the site plan include a pool, a lobby/lounge area, a theater/bistro space, a primary courtyard and secondary open spaces, a salon, a clubroom, a fitness center and multiple spaces dedicated to different types of therapy services.

The gross residential area is planned for 225.8KSF. The garage area will be 104.4KSF, and open space is planned for 65.3KSF, which is a 29% increase from the required amount.

The project site lies within Scottsdale’s Greater Airpark Character Area Plan, and the project narrative submitted by representative law firm Berry Riddell, LLC says the design will draw upon desert-related elements in keeping with surrounding uses, including several two- and three-story office buildings.

The narrative says the mix of other uses in the area will create a mutually beneficial situation for the new care facility. “The mixed-use character and proximity to both the Loop 101 freeway and Raintree Drive establish an ideal context for active adults to ‘age in place.’ Notably, this underutilized vacant infill site is situated on the southern edge of the Greater Airpark Character Area Plan with proximity to services, retail, and medical support land uses.”

While ‘aging in place’ is usually used in the context of a development having a mix of independent and assisted living units – allowing residents to remain on the property as their needs change – this proposal takes an expanded view and touts the benefits of residents remaining in the overall Scottsdale community.

The narrative also claims the facility would strengthen the overall vitality of the Airpark area by converting a vacant site to new uses and supporting area businesses and services while contributing to overall walkability with enhanced pedestrian connections.

Part of that walkability and pedestrian enhancement includes proximity to both Valley Metro bus service and the Scottsdale Trolley’s Mustang Route. With 62.9KSF of planned open space, the developer also intends to create shaded pathways for improved pedestrian connectivity both in and around the site.

The exact setup for the facility has not been finalized. There are three different configurations noted as possibilities in the narrative. The document states:

Residential Healthcare: A maximum of 270 beds on 5.78+/- acres

- 106 specialized care beds (assisted living & memory care) or 106 one-bed minimal care units (independent)*

- 82 two-bed minimal care units or 164 specialized beds*

- Current proposal for 188 units with a total of 270 beds*

* Mix of minimal and/or specialized breakdown is conceptual only and will be determined with the Development Review Board application.

In addressing the land use element for the proposed facility, the narrative says, “Integrating a residential healthcare community on the southern edge of the Greater Airpark brings physical and economic synergy, that will continue to enliven and enhance the city consistent with the goals and policies of the General Plan and GACAP by offering new housing options for seniors. This residential healthcare use is an ideal fit given the type of surrounding land uses and nearby residential communities and open space amenities. The proposed three- and four-story building massing is designed to respectfully integrate with the surrounding building heights.”

The Senior Market

All types of senior housing as a market sector took a major hit during the pandemic, with the national occupancy rate falling to a low of 77.9% in Q2 2021, according to tracking data firm NIC MAP Vision. As of Q3 2022, it had rebounded to a healthier 82.2% and reported five consecutive quarters of gains. NIC MAP reports the total number of occupied units nationwide is just 2,400 fewer than the all-time pre-pandemic high.

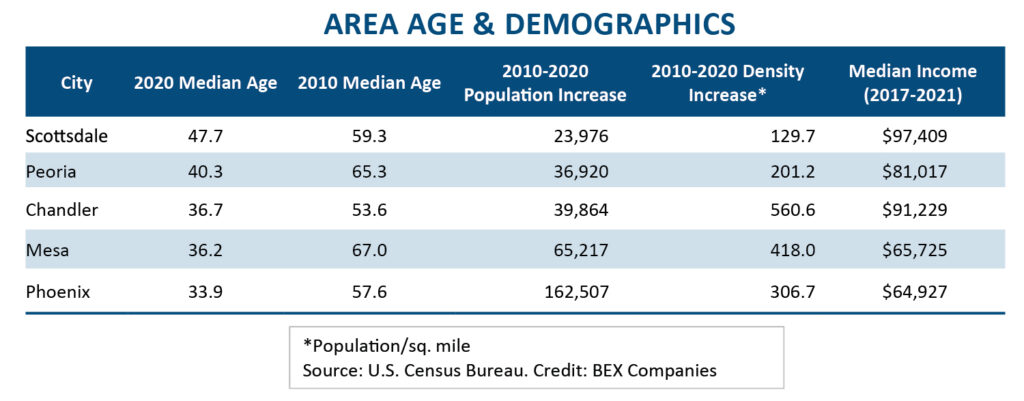

Both before and after the pandemic, it is, perhaps, surprising to see so little senior-focused development in the city, given Scottsdale’s aging population. At 47.7 years, Scottsdale has the oldest median age, by far, for Valley cities that are not foundationally age-restricted (the ‘Sun Cities,’ etc.) or primarily zoned for luxury residential and affiliated amenities (Paradise Valley).

Even with its long-standing reputation as a senior destination, Mesa’s current median age is only 36.2. Unlike Scottsdale, however, Mesa has seen significant growth in its employment base over the last decade. While Mesa’s 2020 population was roughly double Scottsdale’s, according to U.S. Census Bureau data, its population growth since 2010 was nearly 2.75 times as high.

All major cities in the Valley have gotten younger over the last decade – primarily due to in-migration by new working-age residents – but Scottsdale’s change in median age is markedly less than Phoenix or the four cities closest in age. Scottsdale has dropped from 59.3 years in 2010 to 47.7 in 2020. By comparison, at 40.3 years in 2020, Peoria has dropped from 65.3 years. Mesa has positively plummeted from 67.0 down to 36.2.

Without launching into a detailed academic study of the issue, recent history suggests it is probably safe to initially deduce Scottsdale’s greater age and lower population growth are due, at least in part, to its higher costs of living and lower rates of development in both employment centers and housing options than other cities.

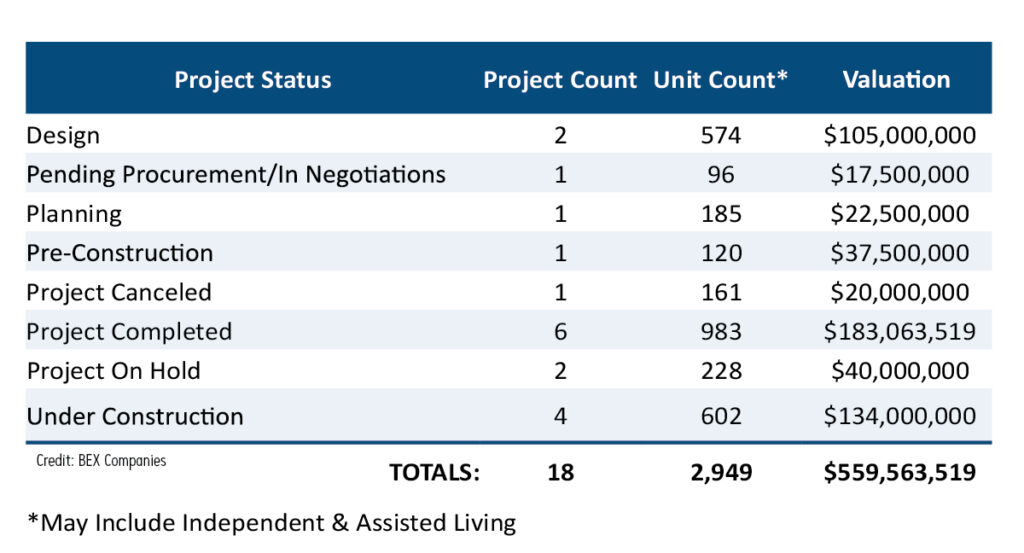

Looking at both Senior Housing and Assisted Living/Nursing Home projects in the DATABEX project database since 2016, there is little new activity across the state. To clarify, the two categories are difficult to separate, as many – if not most – Senior Housing developments have at least some portions of the overall project dedicated to assisted living, allowing residents to “age in place.”

Of the 18 individual projects in the database, six have already been completed and four are currently under construction. One project was canceled and two are listed as on hold.

The one canceled project was withdrawn from the Scottsdale City Council agenda by the developer in Jan. 2022, following a recommendation of denial by the Planning Commission in Dec. 2021. Of the two projects on hold, one was noted between late Aug. and late Oct. of this year, while the other was shifted in May 2021.

That leaves two projects in the Design phase and one each in pending procurements/in negotiations, planning or pre-construction.

While assisted living facilities fall under Residential Health Care and are not subject to the density restrictions and considerations that affect multifamily development, building heights, setbacks and other design concerns have encountered resistance from opposition groups and members of the Council. The most recent case in point was The Osborn – a 247-unit assisted living/nursing home planned at 7194 E. Osborn Road – which was approved by Council in September.

No discussion or meeting dates have been scheduled for the Northsight Residential Healthcare proposal as of press time.