By Roland Murphy for AZBEX

The sky is not falling. The End of Days is not at hand. Still, the raucous party that has been the U.S. multifamily investment market for the past few years is running into serious threats of a shutdown.

The surge in inflation – and the Federal Reserve’s blunt tools to manage it – have dramatically increased debt and equity costs across the economy. Having soared to among the greatest heights of any sector, multifamily has been hit especially hard and particularly rapidly.

While national multifamily sales are still up 25% year-to-date over 2021 volumes, they dropped 17% in Q3, according to data from the National Multifamily Housing Council, and investor optimism continues to wane.

Earlier this week, the Fed raised short-term borrowing rates another 0.75%, the fourth consecutive time it has done so. While some watchers are taking comfort in the accompanying statements that a shift in approach may be on the horizon, that horizon is far off, and Chair Jerome Powell has been careful to use vague and couched terms, saying there may be a discussion in the next meeting or two about slowing the rates of increase.

The statement that the Fed “will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments,” has analysts hopeful this is the much talked about “step down” that could see rate hikes start to decrease in scale, but the language has left the door wide open.

The newly announced target interest rate of 3.75%-4% is the highest since 2008, a date that carries with it an exceptional degree of emotional baggage in financial markets.

Q3 Apartment Sales, Vacancy Rates a Rude Awakening

NMHC Chief Economist Mark Obrinsky blamed debt and equity costs and the pervasive state of uncertainty across the boarder economy for Q3s decreases in sales volumes. The quarter also saw slower rent growth and more increase in the vacancy rate than the multifamily market is used to.

NMHC surveys senior executive apartment specialists and produces four quarterly sentiment indices. Each index is scored 0-100, with any score below 50 indicating a lower level of transactions than the previous period. The results were not encouraging:

- Sales Volume Index: 6,

- Equity Financing Index: 12,

- Debt Financing Index: 5,

- Market Tightness Index: 20.

While the Bisnow headline “Apartment Investment Sales Grind To A Halt As Capital Costs And Vacancies Rise,” is hysterical in the extreme, hardly anyone is taking comfort from the fact that national apartment transaction numbers fell 17% in Q3, particularly when that surprising drop in total sales is combined with declines in rent growth and occupancy rates.

In a review of the current state of affairs from last month, Marcus & Millichap reported, “The average effective apartment rent in the U.S. was up by a double-digit percentage year-over-year in the third quarter, but the pace is easing as availability increases and units take longer to fill. In September, rentals in the U.S. remained vacant for 27 days on average, up from 23 days in the same month of 2021. This is producing smaller rate adjustments for new tenants. Rent increases for units leased out to new occupiers dropped from a 2022 peak of 19.1% in May to 11.3% in September. Meanwhile, rates for tenants renewing their leases have climbed throughout this year, as rents are realigned to the market, following significant upward movement over the past 18 months.”

Most predictions fall largely in line with estimates that came out of a recent Investors Management Group panel in Portland. Historical data show rents grew 10% between Aug. 2021 and Aug. 2022, then hit zero growth from July to Aug. 2022. Between March 2020 and Oct. 31, rents have increased 22% nationally.

The expectation is that rent growth will moderate and stabilize at a rate of around 1% more than inflation and that long-term inflation will eventually average 3%-4%.

While that is certainly a cool down over the performance of the last couple of years, it is hardly panic inducing.

The Arizona Q3 Data

Having been among the highest-flying multifamily markets for rent growth and sales volume in the recent surge, it stands to reason Phoenix data would track the national at an exaggerated level. Preliminary Q3 data from ABI Multifamily reports Q3 transaction volumes for assets of more than 100 units fell more than 31.8% year-over-year, going from $4.11B in Q3 2021 down to $2.8B in Q3 2022.

For properties of fewer than 100 units, the performance was slightly worse, dropping 34.4% year-over-year. The Q3 2021 volume was $490M, versus $321M for Q3 2022.

Rent rates rose at a more modest rate than most previous quarters, and occupancy rates dipped 1.8%, settling at a still robust 94.5%.

Colliers’ data gives slightly different, but highly similar, numbers for Phoenix. For Q3 2022, Colliers’ research for sales in 100-unit-plus properties shows 33 transactions totaling $2.39B. That reflects a commensurate drop compared to earlier studied periods, particularly after the explosive upside that began in the second half of 2020 when volumes, transactions, and units all more than doubled compared to the first half of the year.

Tucson’s numbers from ABI partially bucked the trend in an interesting anomaly. Volumes for assets of more than 50 units actually increased a healthy 27.2% in Q3, hitting $435M this year compared to $342M last year for the same period. Smaller properties, however, were right on track, plummeting 37.4% with a total of $25M in Q3 2022, while Q3 2021 was $39M.

Cap Rates are the Culprit

The Fed’s aggressive pace of rate increases has led to marked shifts in the fundamental math behind CRE investment in general and multifamily in particular.

Many multifamily developers and institutional investors are taking a step back, waiting for a clearer view to emerge as they try to estimate returns on investment and costs of development and ownership.

Despite the Fed’s rate increases, inflation may have slowed or even stopped but it has not receded. While investors wanted to believe the optimistic rhetoric that inflation would be “transitory,” the pace of that transition is appearing more and more glacial than merely cyclic.

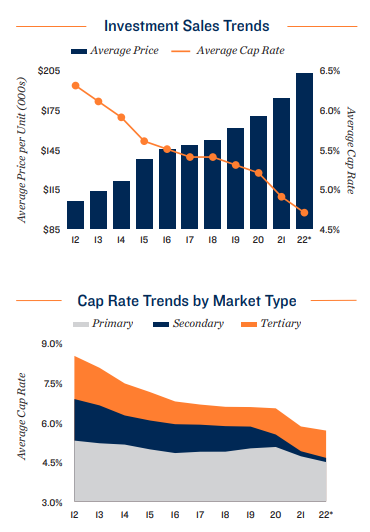

Inflation and the interest rate increases deployed to fight it are creating wild impacts on capitalization rates, which are the predicted rates of return on CRE investments. Cap rates are still below their pre-pandemic levels at the moment, but CBRE reports they have increased 0.72% over the last six months.

Because of the shifting cap rates, investors are taking a much more cautious approach to purchases. At the same time, lenders are eyeing capital projections and rent growth estimates with much greater scrutiny.

Those investors who bought assets at the exceptionally low cap rates the market was experiencing before the inflationary surge and the Fed’s attempts to manage it will have to hold onto their assets longer. Traditional real estate private equity firms generally target holding an asset for five years. That timeline is becoming less and less plausible as rates continue to shift, and it may cross over into the realm of the functionally prohibitive depending on how much cap rates change and for how long.

This could lead to a change in the profile of who invests in multifamily going forward. As hold times become too long for private equity investors, insurance companies and retirement funds – which normally target investments with longer hold times – may take their place. That shift, however, could also add additional brakes to the pace and volumes of transactions.

There are as many predictions as to how long the cap rate shifts and interest rate increases will continue as there are investors. Some optimistically predict a rapid pace of interest cuts if and when inflation finally starts moving downward. Others are taking a years-long view.

The generally agreed best case timeline for cap rate stabilization, according to many experts, is mid-to-late 2023, assuming there are no other major negative events to hit the economy. While many say they want to be ready to act when that stabilization starts to take effect, few, if any, are eager to be among the first to move given the stakes attached in a market of this magnitude.

Marcus & Millichap’s Q3 prediction was fairly optimistic, saying, “Many are providing competitive rates and terms, but are still playing it safe. It is possible that deal flow retreats in the near term amid these obstacles, which could lessen the downward pressure on cap rates as the market retreats from historic trading levels. Nonetheless, the asset classes’ very strong fundamentals and ability to turn over leases on a typical basis of 12 months, which is favorable during periods of high inflation, should bolster buyer interest.”

Closing Thoughts and Takeaways

One quarter’s data does not make a trend. Panic is rarely called for, and prognostication is, at best, an inexact art. The turmoil in the economy, in CRE in general, and in multifamily in particular leaves us not knowing exactly where we stand at the moment, which makes it hard to guess where we’re going to end up.

Some things are certain, however. No matter how the mid-term elections come out next week, there will be economic and market repercussions – some good and some bad.

There is a fine line between playing things safe and letting an overabundance of caution turn fears into self-fulfilling prophecies. At the same time, the opposite is also true. Every economic downturn in recent memory has been made worse by major players who ignored detailed warnings and operated under the false certainty that “It’s going to be different this time because…” How many times did we hear, “Home prices always go up,” between 2006 and 2008 when that myth got definitively shattered?

As much as we want to believe in institutions and collective wisdom, institutions – and markets and companies and investment divisions and banks and every other mechanism that make them up – are made up of people when all is said and done, and people are fueled by emotion at least as much as they are tempered by facts. Unfortunately, the two leading emotions at the moment are fear and uncertainty.

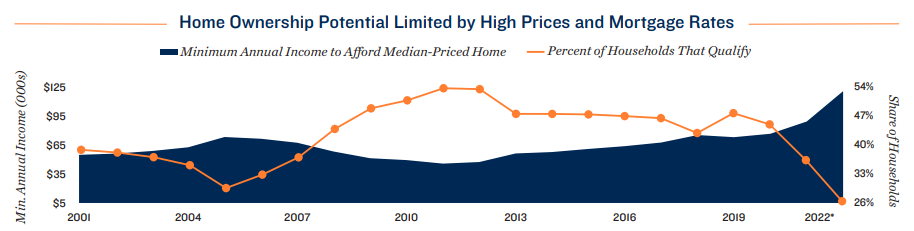

Despite the fear and uncertainty, there are plenty of positives to draw comfort from. Even though vacancy rates are up slightly and the construction pipeline is setting records with an estimated 2022 delivery of 420,000 units nationwide, the pent up demand that has been fueling that construction remains voracious, in large part due to years of under-building. Given the increases in mortgage rates and the resulting impacts on people’s ability to buy houses, that demand is not going away anytime soon.

Of course, capital costs, labor, and materials shortages, approval process delays fueled by NIMBYism and a range of other atypical forces are causing havoc, but the overall momentum could still be enough to carry the day once the dust settles. Citing those factors for slower than expected deliveries, Marcus & Millichap shows a completion rate of 370,000 units so far.

It remains to be seen if the market will swerve too far and overreact to the change in vacancies, rippling out to a return to under-development. This would be particularly problematic for Phoenix and Arizona, as the area’s undersupply and population growth both exceed national averages.

In the end, watchers would do well to remember that the market was healthy before the pandemic. While average rent increases of between 2.5% and 3% are not exciting, excitement is often a net negative in commercial real estate. Markets are more like ore freighters than racecars: They do not respond predictably or, usually, with desired results when drivers try to turn them too quickly.

The fundamental positives of the multifamily market remain in place, even in the face of all the ongoing challenges. Investment is always a gamble, and gamblers who take a long view tend to fare far better than the dabblers who expect to make their fortune in one frantic weekend at the tables.

Looking at the various reports and predictions, one sees words like ‘normalization’ and ‘correction’ far more frequently than ‘crash’ and its synonyms. Since markets generate the best overall benefits when predictability and consistency are major factors in determining the odds when making a bet, we have to ask ourselves: Is a return to normalcy such a bad thing?