NEWSFLASH: Construction costs keep going up.

BREAKING NEWS: They’re going up more quickly and at higher rates in already hot markets like Phoenix.

Add one more data point into the complex morass of economic data swirling around the good news/bad news currently making up Arizona construction and economic reporting. Rider Levett Bucknall has just issued its “North America Quarterly Construction Cost Report” for Q1 2022.

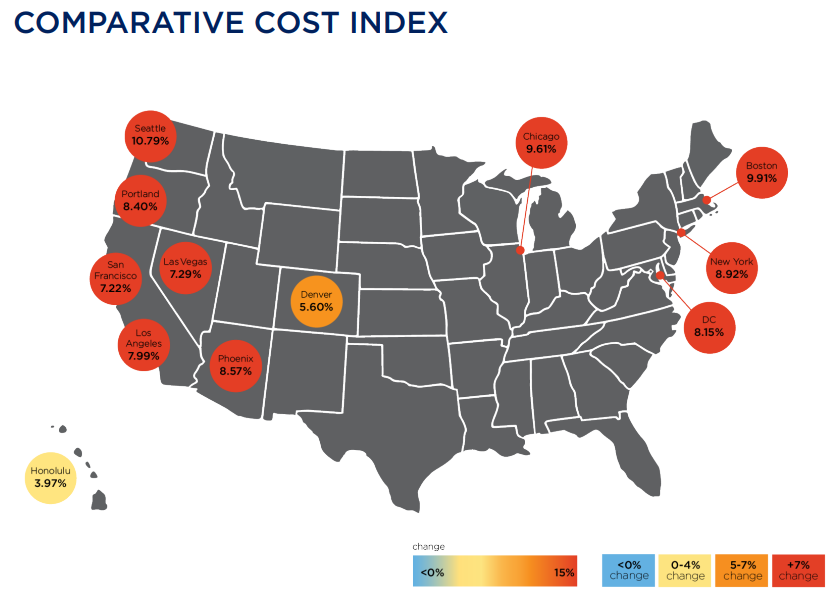

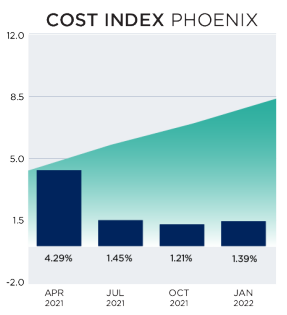

Nationally, construction costs rose 8.04% over the course of 2021. Phoenix’s costs increased 8.57%, the fifth largest major-market increase in the country. This appears to be indicative of an overall trend for Phoenix and Arizona versus the nation as a whole.

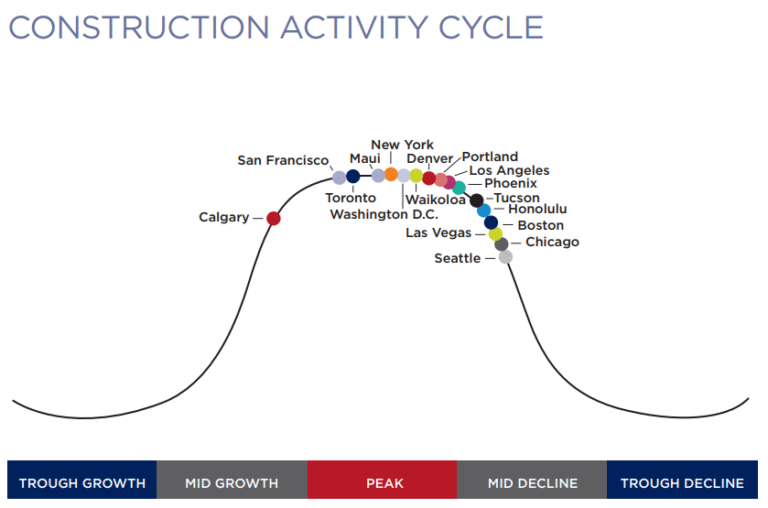

One particular point of concern in the RLB report shows the Phoenix Construction Activity Cycle passing out of the Peak stage and entering Mid -Decline.

As RLB North America President Julian Anderson said in the report’s overview, “The severity and duration of the economic and market fluctuations on the US economy are difficult to predict.”

The Overall State of Economic Affairs

After more than a decade of the Federal Reserve tending the fires of the national economic engine by tossing handfuls of thermite into the liquidity and money supply furnace, policymakers have noticed things have gotten a little too hot and embarked on an aggressive program of interest rate increases to cool things down.

The Bureau of Labor Statistics’ Consumer Price Summary for Urban Consumers for all items in Q1 showed an unadjusted increase of 8.5% year-over-year, the largest inflation leap since December of 1981. Energy prices were up 32% for the same period.

Of course, tossing water on a raging fire will drop the temperature, but the steam it generates brings its own sets of complications.

On top of the Economics 101 matters, the construction industry, like every other, faces additional, co-related concerns. The supply chain shortages that preceded and were amplified by the pandemic remain unresolved. There had been some modest optimism on that front, but then Russia invaded Ukraine and worries, particularly in terms of global energy supply stability and deliveries, reaccelerated.

On an apparent bright note, federal spending on infrastructure, most notably via the Infrastructure Investment and Jobs Act, has dramatically increased funding for highways/roads/bridges, water projects, passenger and freight rail, and public transit improvements.

While this will undoubtedly lead to new employment opportunities, that could well exacerbate the already existing labor shortage. According to a February report from Associated Builders and Contractors, the U.S. construction industry had a deficit of 650,000 skilled construction workers.

IIJA does have provisions to invest in workforce education, including, among others, an apprenticeship program to train 18-21-year-olds as truck drivers, which, if implemented and executed as planned, could benefit both the skilled labor and supply chain issues. However, it stands to reason that adding more jobs in the near-term, while potentially adding to the workforce in the mid- and long-term, may create more near-term pain than it alleviates.

Since the late 1970s, national policy has pushed toward sending all kids to college, resulting in a stigma associated with work in the skilled trades and a student debt crisis totaling $1.75T and directly impacting more than 43 million Americans. It has only been in the last few years that the construction industry and a plurality of national leaders have begun orchestrated efforts to counter those impacts, and half a decade of even the most focused effort cannot made much impact on an issue going into its second generation.

The Growth-Stagnation Paradox

As all these issues come to a head, even the fuels that have powered the last several years of economic growth in Phoenix and similar markets threaten to burn beyond containment. Largely driven by its historically better affordability and generally business-friendly policies, companies and individuals from high-dollar, high-regulation states like California have moved to Arizona in droves, adding jobs and new capital to the overall economy. Arizona has led or been among the leaders in in-migration for the last several years, adding nearly 89,000 new residents between July 2019 and July 2020, according to the U.S. Census Bureau.

That influx has had its share of negatives, however. First, Arizona’s housing supplies were woefully lacking even before the influx, due in large part to an understandable slowdown in deliveries during the Great Recession. The expanded and still expanding population has increased demand levels to the point that multifamily occupancy rates now routinely exceed a once considered impossible 97%.

Second, the new arrivals are used to markedly higher residential costs than the existing population. If someone is used to paying more than $4K/month for an 850SF apartment, the Phoenix average rent of $1,550 seems like a steal. That, however, has gutted the area’s affordability as a practical matter, particularly for existing residents. Arizona is now rated the fourth-worst state in the country for affordable housing.

Colliers reports Phoenix-area rents increased 80% between 2016 and 2021. Federal Reserve data show the area’s median household income only increased 22% during the same period. BLS data show March’s Phoenix inflation rate was 10.9%, the highest in the nation.

Conversely, San Francisco, which leads the nation in out-migration, also had the lowest inflation rate at 5.9%.

Adding a final note of caution to the good and impacts of Arizona in-migration is the concern that the pace of skilled job growth may outstrip the supply of skilled workers. While relocations often bring a retinue of existing workers along with them, rarely does the full staff follow the company. In addition, the host of brand-new developments and employers will need to staff from the ground up, and there are some initial rumblings that economic development officials may have done too good a job bringing new opportunities without a sufficiently skilled workforce to fill them.

Some companies and economic development staffs are working to address the worker issue. When AZBEX broke the news about LG Energy Solution’s plans to build a massive new battery plant in Queen Creek, we reported that part of the development agreement between the company, Pinal County and the Town included employee education incentive payments of up to $3K/employee and the creation of a workforce training facility with construction and operation costs of up to $6.5M. (AZBEX, March 18th).

Many employers, however, are not undertaking this kind of planning, and they may encounter difficulties in finding sufficient talent to fill their jobs, which could lead to a slowdown in new development and yet another supply-versus-demand conundrum.

Prophesy is a complex and cumbersome art, and only hindsight will say whether predictions were insightful or foolish. However, as more and more investors, analysts and policymakers adopt cautious tones, both nationally and regionally, it does not take Nostradamus to understand the factors influencing the newfound sobriety of many expectations.