By Tasha Anderson for AZBEX

The estimated financial impacts of COVID-19 on the State Transportation Improvement Program over the next five years may be as much as $540.4M, according to Kristine Ward, Chief Financial Officer for the Arizona Department of Transportation.

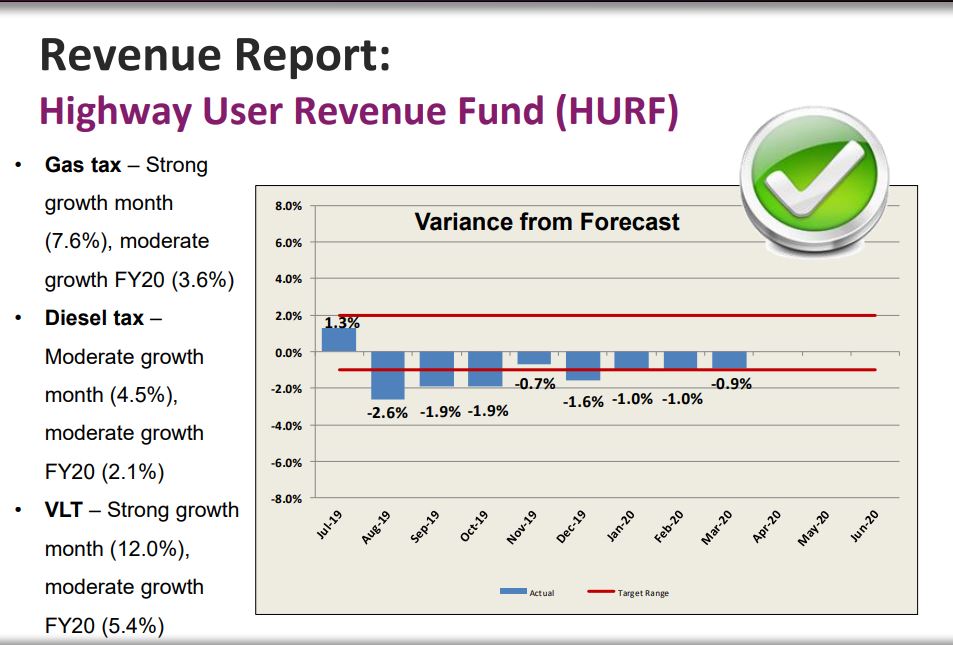

Ward presented the current revenue reports for the Highway User Revenue Fund (HURF) and Regional Area Road Fund (RARF), as well as the estimated impact to the Arizona State Transportation Board at its April 17th meeting.

So far, approximately $1.2B in revenue has been received for HURF, which was about 0.9 percent below forecast, and approximately $333M has been received for RARF, which was about 2.2 percent above forecast. “Gas tax is about 3.6 percent above last year and about 2.7 percent above what our forecast was,” according to Ward.

However, these numbers only report through March for HURF and February for RARF and does not capture the impacts of COVID-19 and the stay-at-home order Governor Doug Ducey announced back in March.

“The bottom line is we don’t know what the COVID revenue impacts will be,” Ward said as she discussed developing upcoming revenue estimates. She went on to note that the Great Recession cannot be a comparative model because, unlike the pandemic, the Recession was more gradual and not an, “immediate shock to the system.”

The estimated $540.4M came from the preliminary recasting of the State Transportation Improvement Program for fiscal years 2020 through 2022 due to impacts on the State Highway Fund and the municipal bond market.

By significantly reducing the forecast for gas tax/VLT revenues early on and then slowly raising them around October/November, a 9 percent decline in HURF revenue is estimated for FY ’20, with a 22 percent decline for FY ’21 and a 12 percent decline for FY ’22. This will drop the available revenue for the State Highway Fund by $385M. “When you are in a situation in which you have no way of forecasting what is to come, the approach is to preserve your most liquid and flexible fund source. So, we are looking to preserve cash so we can not only respond to the situations that are dealt to us but deal with matching our federal funds and so forth,” Ward said.

The municipal bond market is also volatile, with limited bond demand and investors looking to cash out. Ward noted there was $2.3B flowing out of the bond market and that, mixed with declining revenue and a higher cost of capital results in an estimated $155M in deferred planned bond issues.

The next steps, according to Ward, are to recast the tentative program with the new revenue figures given and rebalance it to bring it back into the “fiscal constraint” knowing that the forecasts are very speculative and are subject to change.

NEWS TICKER

- [October 8, 2025] - Peoria Eyeing Billion-Dollar Advanced Water Purification Facility

- [October 7, 2025] - UA Continue Work on CAMI Alongside $70M in Planned FY 2027 Projects

- [October 7, 2025] - Early voting for Coconino Community College bond begins this week

- [October 7, 2025] - Halo Vista Master Plan to Receive Two Hotels and a Costco

- [October 7, 2025] - Industry Professionals 10-07-25

- [October 7, 2025] - Commercial Real Estate 10-07-25

- [October 3, 2025] - NAU Capital Improvement Plan Approved, $138M of Projects Planned

- [October 3, 2025] - First Street and Brown Avenue Parking Garage in Scottsdale Discussed at Community Meeting