By Rebekah Morris for AZBEX

On Thursday, more than 100 attendees at the latest Leading Market Series event listened to a lively roundtable discussion regarding the rising cost of construction and what they predict will continue to happen in the next six to 12 months.

Moderator and BEX President and Founder, Rebekah Morris guided the discussion between three types of firms: General Contractors: Mike Bontrager, President of Adolfson & Peterson Construction, Roger Rowley, Pre-Construction Manager for Hunter Contracting; Subcontractors: Mike Greenawalt, Senior Vice President of Rosendin Electric; Brian Scherer, Director of Business Development, Bell Steel; Andy Clarke, General Manager for Roofing Southwest; Materials Suppliers: Lloyd Hannon, Phoenix Ready Mix Sales Manager for CEMEX, and Ben Rathke, General Manager for Ferguson.

To start the discussion, Morris requested each participant gauge where the market is in terms of supply and demand. All participants agreed the market is demanding construction services, while supply has not increased.

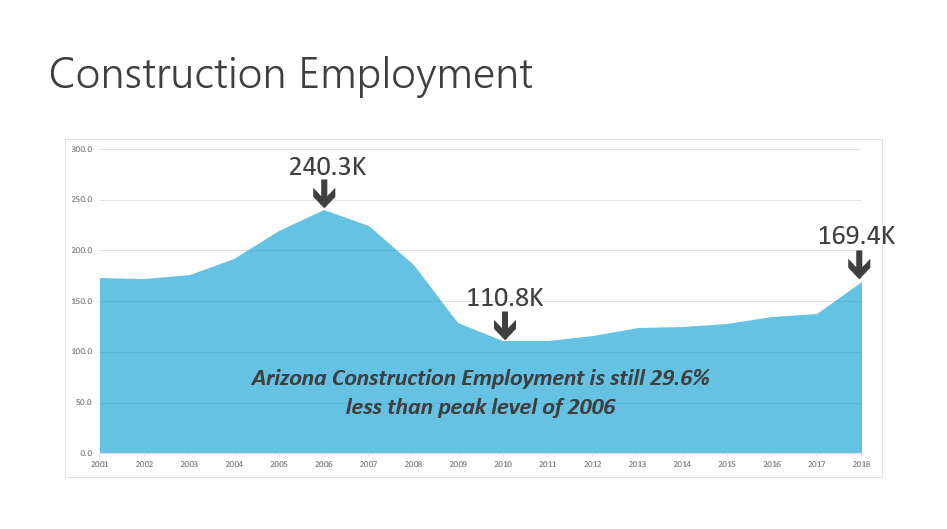

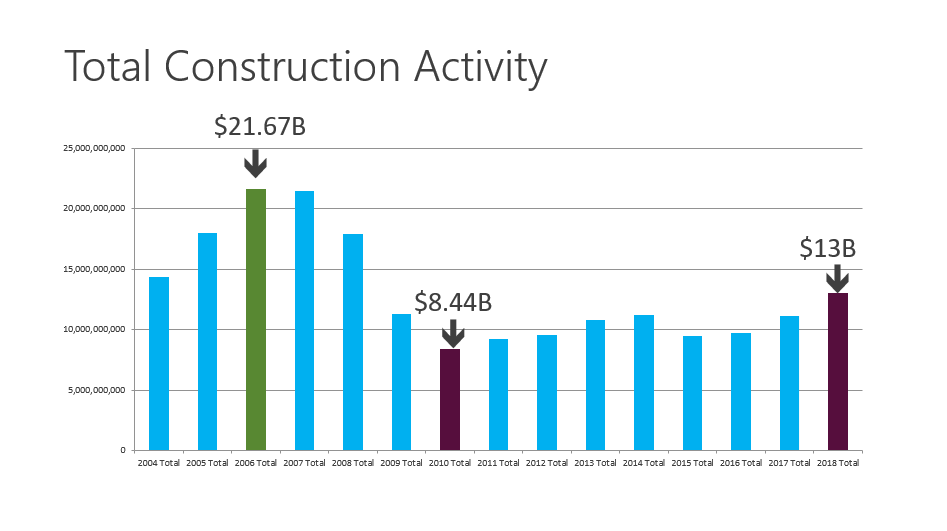

Morris presented data from the Arizona Departments of Revenue and Administration showing the history of both construction activity and employment. Both data sets tracked similarly – peaking in 2005-2006, dropping to a low point in 2009-2019, and having experienced a bumpy recovery since then. Construction activity is still nearly 40 percent off the peak level of volume, while employment is nearly 30 percent lower than the peak level of 2005.

Those indicators tell us that the market as a whole is becoming less efficient; requiring more labor to produce the same level of output.

Input #1 – Materials

A simplistic view of the cost of construction can be thought of as an equation:

Materials + Labor + Overhead/Profit = Contract Bid Price

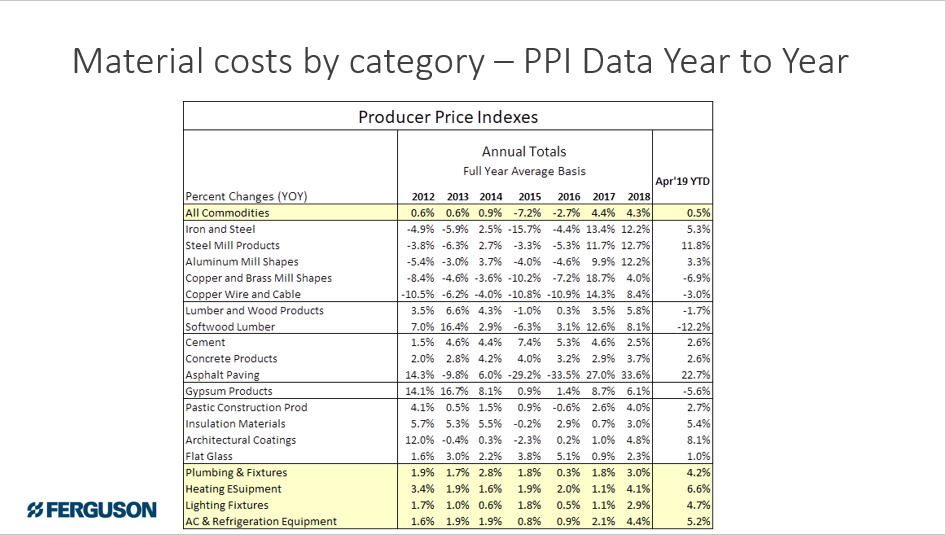

Discussing the cost of materials, Bell Steel, Ferguson and CEMEX described materials cost increases in the range of 15 to 25 percent since the beginning of 2019. While the aggregate and raw materials that make concrete are sourced locally, building products including steel, glass, copper, and mechanical components are more likely to be imported. Building products are rising in cost due to increased demand but also tariffs and increased manufacturing labor costs.

While copper is currently trading at approximately $2.70 according to Rosendin Electric, he sees this commodity as highly likely to increase in cost over the next six to 12 months. Greenawalt described the heyday of 2006-2007 as a time when he pre-purchased copper to avoid the rapid price increases.

All participants agreed that the impact of the delay from engineering estimate/budget to subcontractor bids, through contract buyout to eventual purchase order as a big reason for the sticker shock we’re experiencing now in the market. The total timeframe from preliminary design budget numbers to actual purchase of materials could be over a year. Panelists explained there is no way for anyone to hold pricing for that extended timeline. More often bid prices can be held for 30-60 days.

Input #2 – Labor

Roundtable participants all echoed the same thought on this topic: the market needs more skilled labor, and the shortage is driving the cost of construction higher. Altogether, Arizona is short 100K skilled construction workers.

When asked how many workers each subcontractor would hire today: Rosendin hired 90 union electricians in the last week alone for one major project in Chandler, pulling from other locations through his union connections and plans on hiring another 50-75 people in the next month. Roofing Southwest would hire 15-30, and Bell Steel would hire 15 steel fabrication workers.

Clarke with Roofing Southwest described the current state of construction labor. “Roofing is not easy, it’s not glamorous and we’ve had to raise wages in order to attract people to do the job.”

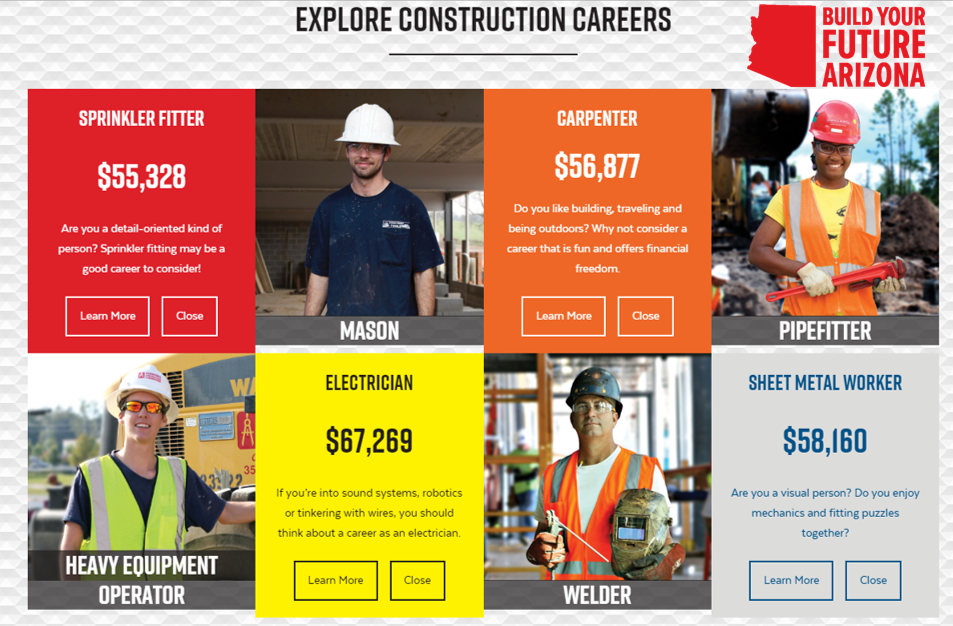

Bontrager with Adolfson & Peterson described Build Your Future, an initiative he is co-chairing through the Greater Phoenix Chamber of Commerce that aims to fill the construction workforce pipeline. All panelists had in-house training or access to workforce development programs, from Ferguson University to safety courses for field crews. Bontrager summed it up well. “Training is available for anyone who wants a career in this field; what we need is to really fill the pipeline with people.”

Greenawalt described one challenge of convincing parents that construction is safe saying, “Parents think we’re going to kill their kids and that’s just not true. Construction as an industry is safer than it has ever been.”

Safety has not come for free, however. Clarke described the safety measures Roofing Southwest has put in place saying, “we have 14 full time safety personnel; this cost just wasn’t there 5-10 years ago.”

Conclusions – Construction Prices will Not be Going Down

All participants agreed their current level of backlog is at or near record levels. They did also seem to agree with the national predictions of maintaining a 5 percent year-over-year escalation as reasonable. While that figure has been woefully low for the last 12-18 months, the panel seemed to agree that the rate of increases should moderate, and the 5 percent should hold for the next six to 12 months at least.

Stay tuned for a more in-depth series on this topic.