By CJ Jorgensen and Roland Murphy for AZBEX

The United States has seen a steady improvement in its nationwide infrastructure throughout the past four years. Despite this, plenty of areas are still in dire need.

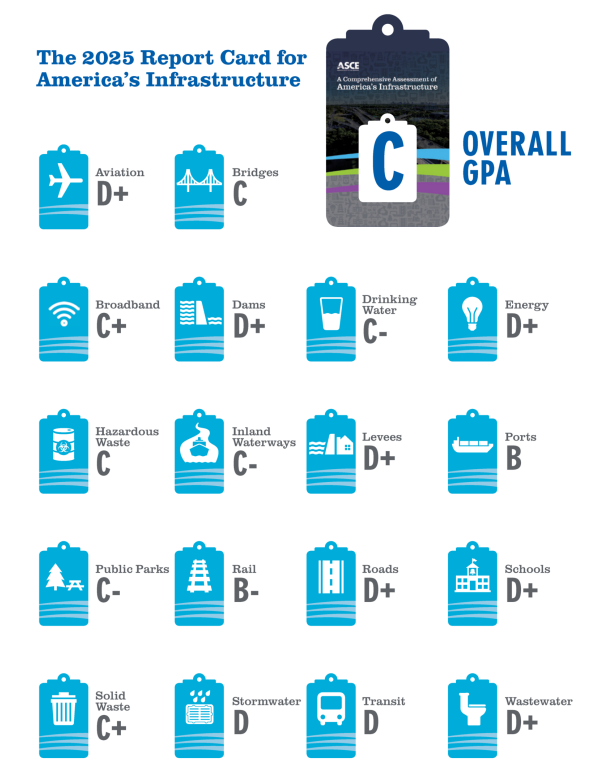

The American Society of Civil Engineers recently released its 2025 Comprehensive Assessment of America’s Infrastructure report, giving the United States an overall grade of C.

Arizona has benefitted from significant infrastructure funding over the last five years. A thorough breakdown of Arizona’s section ratings and a review of some of the infrastructure investments in the state follows below.

The National Details

ASCE has been releasing report cards grading U.S. infrastructure since 1988. ASCE noted its “unflattering grades” were to criticize federal, state and local governments, alongside private entities that have allowed much of the country-wide infrastructure fall into disrepair. The report assesses 18 different categories nationwide.

ASCE stated improving the infrastructure investment gap is one of the most important steps in maintaining competitiveness on a global scale, while also preserving local businesses and keeping families connected. The most recent previous report card was released in the early portion of 2021.

The latter half of 2021 saw the introduction of the Infrastructure Investment and Jobs Act, which was a substantial improvement in federal investments in infrastructure throughout the country. The legislation provided funding for water infrastructure, transportation and other areas.

IIJA investments resulted in improvements in transportation, water, energy and waste systems. This yielded higher grades in nearly half of the categories in the most recent report. The federal government was not alone in improvements, as state/local governments and the private sector also made steps toward improving infrastructure.

The improvements have not solved the rapidly degrading infrastructure crisis in the nation, however, as many systems are continuing to age and demand increases. The report also noted renovations and replacements should prioritize resilience to withstanding extreme weather. Not only will this be safer for citizens, but it will also save money by preventing disaster-related damage.

The ASCE also argued proper funding should be maintained to incentivize resilient designs and continue to improve the situation throughout the nation. This is the second consecutive report that has seen an improvement in grades. Remarkably, this is the first report that did not rate a single category as D-.

The report estimated $9.1T should be invested to reach a proper state of repair across all 18 categories. Currently, there is $5.4T forecasted to be invested throughout the next 10 years. This reflects a $3.7T gap in retaining proper infrastructure within the next decade, according to ASCE’s projections.

If Congress reverts to previous spending levels, the gap could more than double. If this occurs, ASCE projects $5T will be lost in gross economic output over the course of 20 years. The society also predicts 344,000 jobs will be lost in 2033. Moreover, predictions indicate disposable income for American families will lose $1.9T throughout the next two decades. IIJA funding is set to expire in 2026.

National Grades

Aviation was given an overall grade of D+. Air travel has completely recovered from the pandemic and is continuing to grow. Passenger traffic is estimated to grow by 58% by 2040. IIJA funding provided the subsector with $25B over the course of five years. The next 10 years have a projected funding gap of $114B. The previous report gave Aviation a D+ as well.

Bridges received an overall grade of C. Only 6.8% of bridges are labeled as being in poor condition. Over time, many bridges previously reported in good condition have fallen to a fair ranking. The IIJA had two different bridge programs that totaled $40B in funding. Bridge rehabilitation currently has a need of $191B. Bridges also received a C grade in the 2021 report.

Broadband received a C+ grade. Broadband is one of the fastest growing infrastructure subsectors, as only 1% of adults in the United States had broadband access at home in 2000. Currently, 80% of adults throughout the nation have access to broadband. Private entities have invested heavily in the subsector. The IIJA provided $65B toward Broadband. The subsector was ungraded in 2021.

Dams received a grade of D+. Currently, more than 92,000 dams throughout the nation generate electricity, provide drinking water and protect communities/infrastructure. Of the 92,000, almost 17,000 have a high hazard designation. The designation means if the dam were to fail, it has a high likelihood of causing immense damage. The IIJA dedicated $3B to dams, but Congress later shifted $364M in funding toward other areas. Despite this, Dams’ overall grade improved, as it last received a flat D.

Drinking Water maintained its C- from the 2021 report. Much of the water infrastructure is aging and poses health concerns, such as water systems featuring lead service lines. The IIJA invested more than $30B in this subsector. The Environmental Protection Agency stated the subsector needs $625B over the course of 20 years.

Energy is the first subsector on the list to decrease its rating. It received a C- in 2021, but it is now rated D+. Data centers and electric vehicles are heavy energy consumers, resulting in a subsector that needs to grow quickly to keep up with its demand. Both the IIJA and the Inflation Reduction Act have put funding toward improving energy systems and transmission lines.

Hazardous Waste improved in the past four years, going from a D+ to a C. The infrastructure currently manages around 36 million tons of waste. The IIJA invested a total of $5B in the subsector through multiple programs. As new and additional materials are deemed hazardous, the infrastructure will need to accommodate an increased amount of stress.

Inland Waterways increased from a D+ to a C-. Inland waterways are located throughout the country and heavily serve the industrial and agricultural sectors. The system covers 12,000 miles of inland navigation and an additional 11,000 miles in intracoastal channels. The subsector moves $158B of goods annually.

Levees also saw an improvement, going from a D to a D+. Levees protect areas from floods, servicing more than $2T worth of property, from buildings to farmland. Federal funding has provided minimal support to the subsector over the past few years, but improvements have been made, such as the introduction of the National Levee Safety Guidelines and continued work on the National Levee Database.

Continuing the trend of improvements, Public Parks improved from a D+ to a C-. Parks can increase property value, provide jobs and improve the health of local residents. Despite heavy federal investments from IIJA, the American Rescue Plan Act and the Great American Outdoors Act, many park systems have numerous deferred maintenance projects.

Ports remained one of the U.S.’ strongest subsectors, having its grade raised from a B- to a B. Ports aid in $2.89T in GDP and support more than 21.8 million jobs. Federal investments are close to doubling the amount of annual funding for programs like the Port Infrastructure Development Program, which now sees $450M/year.

Rail, despite being one of the strongest subsectors, saw a decrease from B to B-. The network encompasses 140,000 miles that serve both passenger and freight lines. Freight lines support moving 1.5B tons of goods on a yearly basis. Ridership is continuing to grow as time moves on. IIJA allotted $66B for rail projects from 2022 to 2026.

Roads received a D+ in the most recent report. The subsector plays a massive role in the U.S. economy. Around 39% of major roads in the country are listed in poor or mediocre condition. In 2020, 43% of roads were mediocre at best. The IIJA invested more than $591B toward the subsector, but there is still a $684B 10-year gap. Roads were previously given a D grade.

Schools remained one of the U.S.’s largest struggles, again receiving a D+ grade. The U.S. contains more than 98,000 public K-12 schools for its 49.4 million students. The average age of schools throughout the nation is 49 years. Many schools are in desperate need of improvements but receive limited funding.

Solid Waste also remained consistent among the two most recent reports, receiving a C+ in both instances. This subsector is funded by both public and private entities. Recycling rates and demand have plateaued in recent years.

Stormwater maintained its D rating from the most recent report. ASCE estimates more than 60% of stormwater utilities are aging and need upgrades. The EPA estimated $115.3B in funding is needed to repair the necessary infrastructure in its 20-year estimate. The IIJA and IRA added $46B in funding from 2022-2026.

Transit, another one of America’s struggles, improved from a D- to a D. In 2023, it was estimated that 34 million trips were taken daily. Transit has struggled more than most sectors in bouncing back to its pre-pandemic levels. The IIJA provided the subsector with $108B. Despite the funding, the subsector still has a funding gap of $152B in the next decade. The gap is spearheaded by deferred maintenance.

Wastewater maintained its D+ in 2025. Within the past decade, capital projects focusing on the subsector decreased from 3% to 2%, while infrastructure continues to age. Approximately 30% of the subsector’s needs are being met. If funding continues at this pace, the gap is expected to surpass $690B by 2044.

Arizona

NOTE TO JACOB: PUT TABLE IN IMAGES HERE. HEAD IT Grades for Arizona vs U.S.

Arizona’s most recent infrastructure report card and overview was issued in 2020. We have emailed the state ASCE chapter to ask when or if it expects a new report but had not heard back by press time.

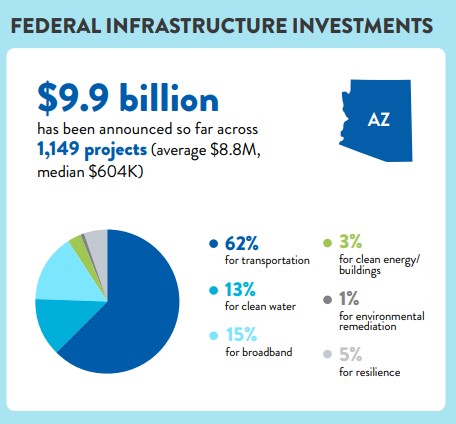

Still, however, there are reasons for both optimism and concern about the state of infrastructure in Arizona, as it has been a leading investment recipient since the 2020 report was issued.

By far, the most significant source of infrastructure investment in Arizona has come via the IIJA. According to a May 2024 CNBC report, Arizona ranked seventh in total IIJA allocations as of last year, with a total of $15.4B. The full impact of that investment, however, given the scale of total stated need claimed by ASCE, combined with inflation across the general economy and in construction costs specifically, may be less than the raw dollar figure might imply.

As the table on this page shows, Arizona’s infrastructure in 2020 was generally on par with, and occasionally even exceeded, the national grades in 2025.

The new report lists an individual major detail for most of Arizona’s sectors over the intervening years since the 2020 report:

- Aviation received a total of $94.5M in 2024 improvement grants distributed across 11 airports;

- 1.2% of Arizona’s 8,573 bridges were structurally deficient in 2024;

- Arizona’s drinking water infrastructure need totals $12.1B;

- The state has 15 hazardous waste Superfund sites;

- In 2023, transit volume totaled 59 million trips across 42 systems, and

- Arizona has a total wastewater investment needs of $4B.