By AZBEX Staff for Arizona Builder’s Exchange

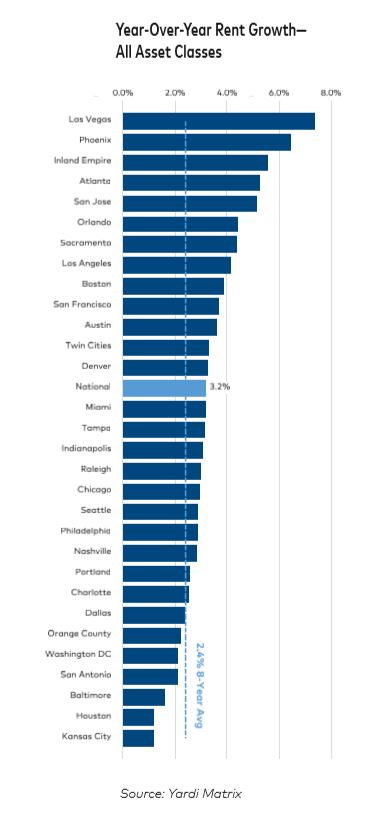

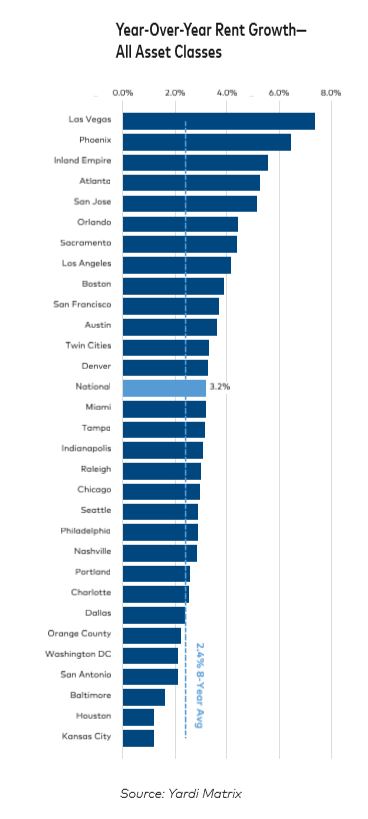

Despite U.S. Multifamily rent growth remaining flat at 3.2 percent in December from November, 2018 proved to be a solid year for multifamily.

According to the December 2018 Multifamily National Report from Yardi Matrix, “3.2 percent rent growth slightly exceeded going-in expectations. Despite the recent volatility in the financial markets, we foresee more of the same in 2019, with strong demand producing rent growth just shy of 3 percent nationally.”

Phoenix’s market strength in 2018 is evidenced by its rent growth across market segments. With a growth rate of 6.5 percent, the city ranked second overall when measured across all asset classes. Growth in lifestyle rentals showed Phoenix at just over 6 percent – second nationally – and the city rated second overall in the renter-by necessity class, also with growth of more than 6 percent.

With Phoenix ranked as one of the top three metros in 2018, below Las Vegas (7.3 percent) and above the Inland Empire (5.5 percent), “Rent growth in 2019 will again be led by metros in the Southwest, West and South regions,” according to the report.

While there’s worry this upward swing in the market is overextended, the overall view for rent growth for 2019 and beyond remains positive due to job and population growth driving demand.

According to the report, the market is “benefiting from migration out of high-cost and tax-prohibitive areas in California and the Midwest. Job growth in tech and finance have attracted educated Millennials, and warm weather and a lower cost of living continue to bring retiring Baby Boomers.”

Another worry for continued rent growth remains that supply will not be able to meet growing demand.

“The biggest obstacle to rent growth remains the supply pipeline, as the market approaches another year of about 300,000 deliveries. Submarkets in the urban cores of secondary markets including Dallas, Denver and Nashville, are likely to see growth stymied in the short term,” the report states.

Despite these concerns, the outlook for Phoenix and the national multifamily market remains optimistic.