By PB Bell

Momentum has shifted in the Phoenix apartment market as the area transitions from being one of the hottest multifamily metros in the country during the pandemic, to facing substantial challenges today.

Starting in late 2021, the surge in multifamily demand that drove unprecedented performance in the prior 18 months began to evaporate as potential renter households buckled under the weight of high inflation and economic uncertainty. The slowdown in rental demand came just as new supply was ramping up, an imbalance that sent vacancy rates soaring and rent growth negative.

Moving forward, Phoenix has yet to feel the full impact of the current pipeline, and the market is expected to see further dislocation over the near term as new supply is digested.

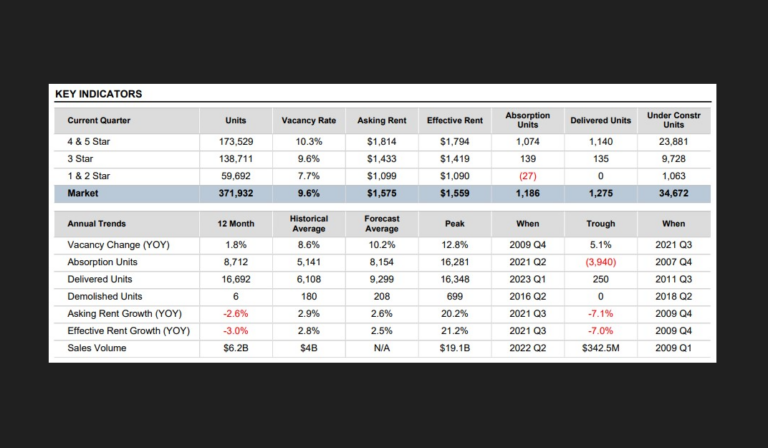

Though first-quarter demand was unexpectedly strong, just 8,700 units of net absorption took place over the past 12 months, coming up well short of the 17,000 new units delivered. This supply and demand disconnect caused vacancy to climb from an all-time low of 5.1% in mid-2021 to 9.6% today, the highest level in a decade.

Additionally, Phoenix’s annual rent growth has sharply decelerated and turned negative, at -2.6%, a far cry from the more than 20% gains seen during its peak.

The supply waves will continue as about 35,000 units are currently underway, the majority of which are for luxury products. The focus by developers to build high-end properties is disproportionately impacting fundamentals in the 4 & 5 Star segment, especially in supply-heavy areas like Downtown Phoenix and Tempe.

Indications from local property managers are that concessions of about six to eight weeks of free rent have become the norm at newly delivered complexes as competition at the top of the renter pool intensifies.

Although the current landscape is quite dour compared to where the market was just a few years ago, there are some signs of optimism heading into the back half of the year. Net absorption posted its strongest quarter in the past 18 months in Q1, and CoStar‘s daily asking rent series suggests that the decline in rental rates has bottomed out.

Additionally, the long-term drivers that supported the outstanding apartment performance during the post-COVID boom are still in place. Phoenix’s healthy job market and robust demographics will continue to strengthen underlying rental demand over the long term. The existing shortage of housing coupled with the unaffordability of the for-sale housing market will also play a role, as high prices and elevated mortgage rates force some would-be homeowners into the renter pool. To fill this niche, developers have increased the construction of single-family Build-to-Rent products, an emerging trend worth monitoring.

Elevated interest rates and softening property performance have had a noticeable impact on sales volume. About $653M worth of Phoenix apartments traded hands in the opening three months of 2023, one of the weakest quarters in the past five years.

Buyers are contending with materially higher debt costs and are underwriting to lower rent growth assumptions, which is making it difficult for deals to pencil. Sellers, meanwhile, have not shown a great deal of urgency to voluntarily dispose of assets if they cannot achieve outsize pricing.

As a result, the current investment climate is in a holding pattern, which may not be resolved until greater clarity emerges on the future of monetary policy or loans on existing properties come due. Additionally, apartment values, which were climbing rapidly in 2020-21, have begun to decline and cap rates have risen 100 to 150 basis points. (Source)