By Colliers in Arizona

The Greater Phoenix medical office market posted 6.2 percent rental rate increases over the past 12 months and investment sales were relatively strong in first quarter, despite recording a three-month period of negative net absorption. These statistics are part of the quarterly Medical Office Report released by Colliers in Arizona.

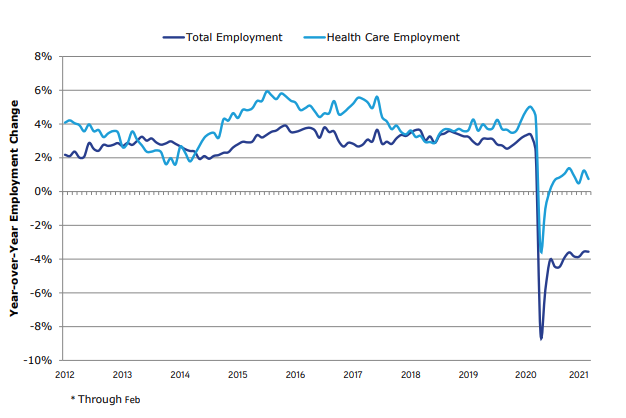

Rental rates for medical office space rose during the past 12 months and are anticipated to continue rising as Phoenix becomes a top tier destination for medical practices to relocate and expand. Phoenix is the top major metropolitan area in the country for population growth, which is driving demand for healthcare services.

Rental rates at the end of first quarter were $22.92/SF, marking a 3.1 percent increase over-the-quarter. Midtown/Phoenix submarket posted the largest year-over-year increase of 10.7 percent to $22.43/SF. This was followed by Chandler and Downtown North submarkets, which increased 9.7 percent to $20.45 and 9.0 percent to $21.58.

Net absorption during first quarter was -12,431SF, which marked the end of a five consecutive quarter run of positive absorption. The Loop 303/Surprise area posted the largest net absorption with 26,599SF, followed by the Piestewa Peak Corridor with 21,742SF of net absorption during first quarter. The rollout of COVID vaccines increased confidence in the market, which led to a 4.1 percent increase during the quarter of new deals. Despite the increase during the quarter, the number of deals was still down 9.5 percent year-over-year.

Medical Office vacancy ended the quarter at 13.2 percent, which was 10 basis points lower than first quarter 2020 but matched the vacancy at year-end 2020. Downtown North, which has more than 1.2MSF of inventory, posted the lowest vacancy at 2.9 percent. The Loop 303/Surprise submarket posted the largest decrease in vacancy year-over-year, dropping 490 basis points to 10.7 percent. Unlike the traditional office market, the medical office market has not been impacted by an increase in sublease space availability.

First quarter 2021 marked the first time in five quarters that no new medical office product was delivered. Approximately 325KSF of new medical office space is under construction, which is an increase from fourth quarter 2020, but marks a decline of 36 percent from the same time last year. Arrowhead submarket leads the market in construction of medical office space.

The transaction volume of investment sales during first quarter was very active with 10 transactions (more than 10KSF and $1M) totaling $86M. This marks an increase of almost 28 percent year-over-year and 48 percent over-the-quarter. The median price paid / SF climbed dramatically to $373, reaching the highest prices ever paid for medical office space in the city. Only three buildings traded below $200/SF. Sales volume was predominantly focused in the Southeast Valley, where more than 50 percent of the volume occurred in four transactions.

As the city’s population grows and we increase the number of healthcare educational options, Greater Phoenix will expand its need for medical office space. Land prices and construction costs are increasing, which will result in even higher rental rates for new medical office space coming online. (Source)