By Colliers International

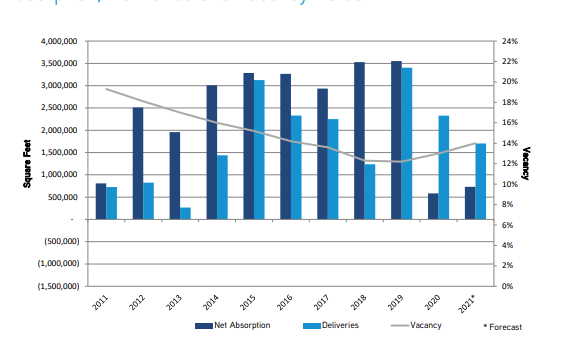

Impact of the COVID-19 pandemic has clearly arrived in Phoenix office market statistics for fourth quarter 2020. The city had its first quarter of negative net absorption in more than eight years. Yet, the outlook is optimistic for a swift recovery in 2021 and 2022 as companies can safely bring employees back to work for much-needed interaction and career development.

The Greater Phoenix marketplace posted 143.4KSF of negative net absorption during the final three months of 2020. This followed an astonishing run of 34 consecutive quarters of positive net absorption. This negative net absorption is directly attributed to companies exploring the idea of entirely working from home, subleasing a portion or all of their space.

Despite these unprecedented actions in the market, Greater Phoenix posted positive net absorption for 2020 of 582KSF. Sublease availability decreased slightly at the end of the year, following a peak in third quarter. However, year-over-year sublease space is up 91 percent.

Seven of the city’s 10 largest leases this year took place in the first and fourth quarters. These transactions occurred pre-pandemic and after the vaccine was approved. This bodes well as we move into 2021 with vaccinations being broadly distributed in the first six months.

Direct vacancy rates increased in fourth quarter 2020 to 13 percent, a 30-basis-point increase during the quarter and 80-basis-point elevation over the year. Office vacancy had been steadily trending down until 2020 and is now on an upward trajectory.

Vacancy hit an all-time low in fourth quarter 2019 at 12.2 percent and has increased each quarter of 2020. The availability of sublease space has increased significantly in the Class-A sector, rising 4.1 percent during fourth quarter and 125 percent throughout 2020. Sublease space now represents 1.17 percent of the total office inventory. During fourth quarter, sizable move outs by American Express and McKesson placed more than 200KSF of vacant space back on the market.

Construction activity remained steady during fourth quarter with projects that were started earlier in the year. Three new projects were delivered this quarter, totaling 360.5KSF, which brings total deliveries for 2020 to 2.3MSF. No new projects were started during fourth quarter.

Phoenix is moving up to be a top tier market on the national stage. In addition to those existing Greater Phoenix tenants executing new leases, we are now attracting more new-to-market requirements than ever before. Out-of-state companies seeking space are coming from a wide range of states, primarily California, but also from the east coast. (Source)

NEWS TICKER

- [September 5, 2025] - Major General Plan Amendments Requested for 1,800-acre Florence Area

- [September 5, 2025] - Mesa Approves 29-Unit Townhome Plan

- [September 5, 2025] - VanTrust Announces 1.1MSF Industrial Plan in Glendale

- [September 5, 2025] - Construction Job Openings Up 77,000 YoY

- [September 5, 2025] - Arizona Projects 09-05-25

- [September 3, 2025] - TSMC Building Water Reclamation Plant

- [September 3, 2025] - Pinal Airpark Gets OK, Funding for Air Traffic Tower

- [September 2, 2025] - 336 Apartments Coming to Casa Grande Commons