By Roland Murphy for AZBEX

As you might expect, we have an incredible volume of market reports and news articles coming in every week talking about how wonderfully or terribly (depending on the source and the issue) a given sector is performing at the moment.

This has, apparently, been the week for Multifamily. Knowing that many of our readers are on many of the same lists that we are, we decided to take this space to save you the trouble of reading them all and provide a quick summary of what everyone else is saying and to cap it off with a brief snapshot of what our own data shows.

Inflection Point?

The big to-do this week was Cushman & Wakefield in their U.S. National Q2 Multifamily Report daring to voice the term, “inflection,” even if it was posed as a question. Leading off the “Key Takeaways” intro to the report, C&W said, “Inflection or head fake? U.S. multifamily vacancies declined by 10 basis points (bps) in the second quarter as absorption topped 138,000 units. With more than 500,000 jobs added in the second quarter, the resilient labor market remains supportive of new household formation, as real wage growth remains positive. Year-to-date absorption has nearly surpassed the total demand from last year and is up 75% over the first half of 2023.”

While the entire industry is eager for a shift and a sea-change improvement, speculating as to whether a 0.1% shift in one metric over a single quarter might be the start of the shift is the epitome of wishful thinking and headline grabbing. At least one respected industry news outlet rose to the bait, with GlobeSt running the headline, “Multifamily Nears Inflection Point,” even though its first paragraph said, “could be nearing.”

Still, hype and hyperbole aside, Q2 saw net move-ins hit 138,000, making it the best quarter for absorption since Q3 2021 and the fourth best since 2000. C&W’s data shows total absorption year-to-date is at 230,000 units, which is impressive when compared to 2023’s total absorption of 253,000 units.

Phoenix saw a net absorption of 3,987 for Q2, compared to 1,539 for the same time last year.

Supply and Demand Leveling Out

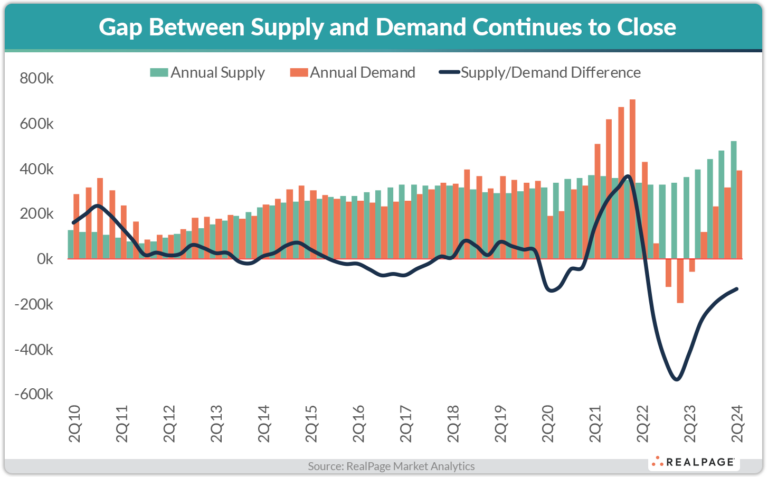

Early last month, RealPage Analytics also touted the impressive pace of absorption, with even higher numbers. According to their analysis, absorption through the first two quarters was at 257,000. Over the past 12 months, the national market has absorbed 390,000.

That’s a good thing because, as RealPage points out, “While the gap is closing, record supply continues to moderately outpace demand. More than half a million new market-rate apartment units delivered in the past 12 months. This not only represents a 45% increase from the same time horizon in the previous 12-month period, but it is remarkably the highest total number of apartment units delivered since 1986. Considering an additional 629,000 market-rate apartment units are expected to deliver in the next 12 months, headlines will most likely continue to focus on supply-side fundamentals.”

Investors and owners, of course, still yearn for the double-digit rent growth of just a few years ago. They have, in some cases grudgingly, come to accept that the explosion in rent growth also brought incredible problems to the overall economy and that it will not be returning anytime soon.

Still, the exceptional pace of deliveries and depth of demand reaching some degree of balance has given them some things to be happy about. RealPage shows rents up 0.2% for the 12 months ending in June. While there is not much likelihood of appreciable growth acceleration for the rest of 2024, the report says, “…stabilization of rental rates considering the background of a two-generation supply wave supports the idea of incredible demand capacity in the market today.”

Yardi Matrix, in its July 2024 National Multifamily Report, concurred, saying, “Although year-over-year rent numbers are weak by historical standards, July produced encouraging signs, including a rebound in growth in some Sun Belt metros that have struggled over the past year due to the heavy delivery pipeline.”

Evictions

Of course, all that rent growth and the previously mentioned overall economic problems have had real-world effects. Eviction Lab was launched in March 2020 to track housing impacts under COVID-19 and the policies and actions associated with the pandemic.

The site tracks eviction filings in 10 states and 34 cities. Over the past 12 months, data show slightly more than 1 million evictions filed, with 77,840 filings taking place in the last month.

The data for Phoenix shows 86,582 eviction cases filed over the last year and a filing rate (the number of evictions filed/100 renter households) of 15%. This marks a 35% increase relative to the pre-pandemic average and is indicative of the market’s status as one of the most hard-hit metros for post-pandemic rent inflation. According to data from Elliot D. Pollack & Company, average rent in Phoenix went up 32% between 2021 and 2023, leaving many households with no way to cover the increase.

2024 New Arizona Multifamily Construction Activity

While the national and localized multifamily trend data is useful, we wanted to see what that has meant at a ground level for construction activity in the sector for 2024 so far.

As of July 31, according to multifamily market consultant Thomas Brophy, metro Phoenix has seen construction start on 956 units and delivery of 5,188.

With those bookends addressed, we decided to look at the middle: What’s the activity level on newly planned projects?

Since Jan. 1, the DATABEX research team has added 74 multifamily projects to the database. These include freestanding developments across our various categories (Apartments/Condos, Build-to-Rent, Senior Housing, Student Housing) and those that are part of a mixed-use or master-planned proposal.

For the purposes of this column, we’ve cut 21 entries. These consisted primarily of municipal redevelopment solicitations and private master plans that will have multifamily components but that currently lack specific details like unit counts, etc.

Readers should also understand this is not a complete reporting of all the projects that have been submitted to various jurisdictions for review. As diligent and efficient as the DATABEX team is, projects still have to be input one-by-one, and there will always be a backlog of items waiting for inclusion.

With all those caveats about methodology and process restrictions out of the way, the data still shows some interesting activity.

The 53 projects examined for this report will, if built as planned, deliver 11,616 new units across the state. Of the projects listed in DATABEX since the beginning of the year, four are already under construction, with expected unit counts totaling 738.

Even though market conditions locally and nationwide have contributed to developer caution in bringing forward new projects over the last 18 months, the activity still taking place is impressive. Five of the 53 projects in this list do not have cost valuations attached, but four of those five are master plans for which unit counts are included.

Unfortunately, two of the projects submitted so far this year have already been canceled, taking 475 off the total count.

Still, of the entries for which we have construction cost estimates, the valuation total for projects added to the database so far this year and still moving forward exceeds $3B.

Thirty-three of the developments are located in Maricopa County, providing a functional equivalency for the Metro Phoenix core. These 33 projects total 7,256 units with a construction valuation of $2.45B.

Expanding the sphere of influence to include Pinal County adds another eight projects and 2,557 units. Two of the projects without available valuations are in Pinal, but even with only six entries available, the estimated construction valuations total $360.5M.

There is always a desire to wrap up a column like this in a neat little bow, but that’s rarely possible or advised. Here’s what we can say with certainty:

- Even though national and local multifamily data show heavy delivery volumes, those are—to a surprising extent—offset by the deeply established demand caused by years of underbuilding and other market and cultural forces.

- The current economic situation is exceptionally complex, and some factors will help multifamily development while others act as a drag. The odds are the Federal Reserve will implement one rate cut this year. Then again, the odds on Jan. 1 were that there would be three, possibly even four.

- We can look at all the standard and eccentric data points we want, but pretending a prediction is anything more than a best guess sometimes overly fueled by optimism is exactly that: pretending.

What we can say without fear of contradiction is it is an invigorating time to be involved in multifamily construction, and that is unlikely to change anytime soon.