Source: RCM LightBox

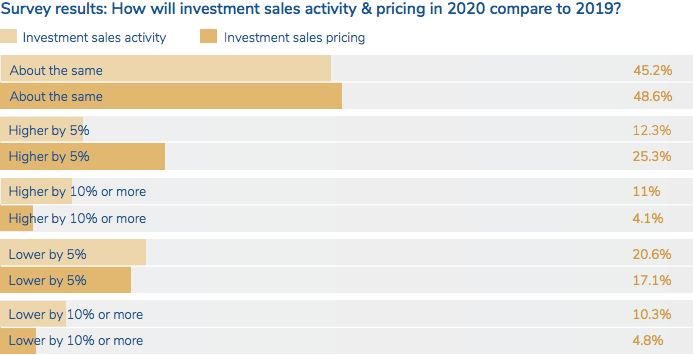

According to a new report, commercial real estate investors, brokers and lenders are expecting a potential surge of activity in Phoenix and other U.S. markets in the first half of 2020, ahead of the U.S. election. Participants in the 2020 RCM LightBox Investor Sentiment Report noted the strong market fundamentals, available investor capital, the potential for a slowing economy, and the impending presidential election as contributing factors in boosting investment levels before the election.

After being particularly hard hit during the Great Recession, Phoenix has emerged as an economic leader, especially within the multifamily and industrial sectors. “Phoenix may be the hottest multifamily market in the country,” says Brian McAuliffe, president, CBRE | Capital Markets. “It is the market that on various levels is outperforming almost any other across the country. Investment and development activity is strong there; rent growth is occurring at a rate of approximately eight percent annually.”

According to CBRE’s Q4 2019 report, Phoenix had the highest year-over-year rent growth (8.0 percent) among major markets, followed by Tucson (6.1 percent), Colorado Springs (5.8 percent) and Las Vegas (5.8 percent).

Origin Investments Cofounder David Scherer notes multifamily assets were trading at 5 percent cap rates two years ago in Phoenix, but have moved to 4 percent cap rates recently. Comparatively, in Austin, cap rates over the last two years have remained at about 4.5 percent, says Scherer. “Because of the strong economic climate in Phoenix, investors who bought multifamily assets there two years ago are seeing strong returns on an unlevered basis,” adds Scherer. “The question on every investor’s mind is where is the next Phoenix?”

In addition to the highlights above, the report includes industry perspectives around shifting strategies for investors in light of market threats and drivers for 2020.

“We’ve reached a point in this current cycle, where optimism and discipline continue to prevail and drive investment activity, but not necessarily for everyone,” says Tina Lichens, COO, RCM LightBox. “Investors expressing a more cautionary tone aren’t completely pulling back but instead are adapting their investment profile and looking at different markets and risk profiles.”

Shifting Strategies in 2020

Throughout this extensive expansion cycle, investors, developers and lenders have been lauded for their discipline. Today that level of discipline is being fine-tuned further, with lending criteria more narrowly focused to take a more defensive approach. Among the changes cited by Sentiment Report participants are:

- Some investors are moving away from value-add opportunities to stabilized assets that produce healthy, predictable cash flow.

- Lenders are being more careful in evaluating LTVs, individual debt exposure by property, tenant and business line and property cash flow.

The top threat to CRE investment, noted by 34.5 percent of Investor Sentiment survey respondents, was a change in economic conditions, such as interest rates, corporate growth or stock market levels. A potential mid-year “wait and see” pause due to the election was noted as the top threat by 33.8 percent.

Aggregated, nearly 78 percent of survey participants say availability of capital and the current fundamentals are the biggest drivers of activity in 2020. While there is considerable optimism about the CRE market, various commercial real estate professionals believe that a “tap on the brakes” is imminent.

“If I had to put a word on the coming year in terms of the economy and the market, the word would be deceleration,” says Hugh F. Kelly, PhD, CRE Special Advisor, Fordham University’s Real Estate Institute. “We’ve enjoyed a very long run of expansion. At the very least we should be focusing on things slowing down in 2020.”