By Roland Murphy for AZBEX

Two standard indicators of construction industry confidence – Associated Builders and Contractors’ Construction Confidence Index and the National Association of Home Builders/Wells Fargo Housing Market Index – both declined in their most recent surveys.

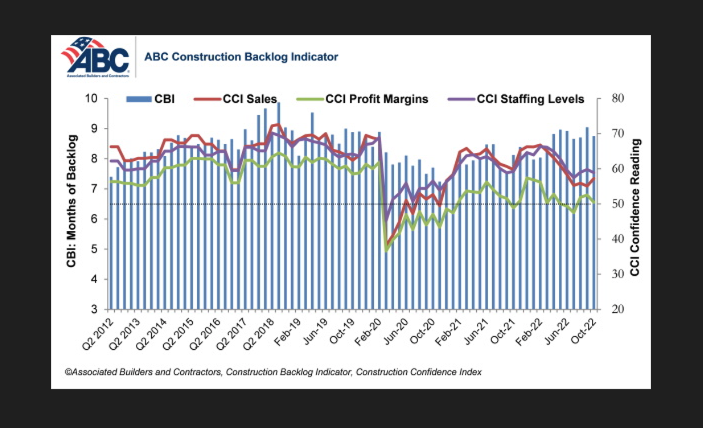

While the October ABC CCI showed confidence in future sales increasing, profit margin and staffing predictions declined. All three indicators remain in positive territory, however, with readings greater than the midpoint of 50.

CCI sales readings for Oct. 2022 came in at 57.2, up from 55.1 in September. Profit margin confidence fell to 50.4 from 52.5 and staffing dropped to 58.9 for the month, down from 59.8. The Oct. 2021 numbers were 59.7, 48.9 and 59.2, respectively.

“October’s survey data hinted at some emerging weakness in the nation’s nonresidential construction sector,” said ABC Chief Economist Anirban Basu. “While the industry continues to gain strength from significant funding for public work, pandemic-induced behavioral shifts – including remote work and online business meetings as well as surging borrowing costs – are translating into meaningful declines in backlog in commercial and institutional segments.”

On the home builder side of the industry, NAHB’s November HMI survey reported its eleventh straight month of decline. HMI surveys builders for their perceptions on current single-family sales and sales expectations for the coming six months. Builders are also queried on traffic from potential buyers.

NAHB’s announcement says, “Scores for each component are then used to calculate a seasonally adjusted index where any number over 50 indicates that more builders view conditions as good than poor.”

All three segments were down for November. Sales conditions estimates dropped six points to 39, expectations for the next six months fell four points to 31, and prospective buyer traffic declined five points, coming in at 20.

Not including the spring of 2020, NAHB reports this is the lowest set of readings since June 2012 and attributes the ongoing declines to a combination of rising interest rates, high materials costs and falling affordability in the housing market.

Concurrent with the CCI, ABC also released its Construction Backlog Indicator results for October. After showing an increase in September, BCI has again fallen back down below pre-pandemic levels. Oct. 2022 surveys showed the current backlog at 8.8 months, down from 9.0 in September, but up from 8.1 a year ago.

“With borrowing costs likely to increase during the coming months and materials prices set to remain elevated, industry momentum could easily downshift further in 2023,” said Basu. “But it is also conceivable that certain economists are overly pessimistic. There is still underlying momentum in the U.S. economy, and some believe that near-term recession is not inevitable. Contractor survey data indicate that while backlog declined in October, it remains reasonably healthy. Moreover, the average contractor continues to expect sales, staffing and margins to grow over the next six months. Time will tell whether this lingering optimism is justified.”