By Roland Murphy for ABI Multifamily

As a reporter and an analyst, you are always on the lookout for things like riots, fires and mudslides because they’re riveting to report and write about.

As someone who actually cares about the areas you cover, you want things to be slow, incremental and even placid.

Q3 gave a fair amount of both and, unusually, did it in all the markets we cover. Following is a quick look at many of the happenings we’ve been following.

National Rents

In major markets across the U.S., rent growth has slowed or retreated slightly. While we tend to make a point of trying to ignore analysts who look at nine weeks of data and pretend that’s a broad enough set to predict a trend, it does merit discussion.

While certainly not saturating, Class A vacancies have begun to inch up over the last two years in major markets like New York, LA, Washington (D.C.) and Seattle. An interesting quote in the “Emerging Trends in Real Estate® 2020” report noted, “It has largely to do with the finite limits of that more price-elastic group that can tolerate pass-along costs in their monthly rents, versus a far-larger and much faster-growing universe of people whose household incomes set lower rent tolerance levels.”

More people are moving out of their parents’ basements and moving into their own place, but even people who can afford it are looking at other-than-top-tier properties. As we have noted here repeatedly, that’s putting more pressure on availability in Class B and even Class C properties.

In still hot markets like Arizona in general and Phoenix in particular, that’s going to have continuing impacts on affordability and continue fueling the drive toward value-add renovations, particularly in the face of labor shortages and land costs in highly desirable submarkets, compared to completing and pressing new unit deliveries into the markets.

What’s Up with California?

California is exceptionally fortunate that it has an economy larger than most developed nations to absorb the scope and breadth of its policy practices, even though it’s anyone’s guess how long that will remain the case if it continues its business-hostile ways from the past three-plus decades.

Most recently, the state has passed and scheduled a rent control process that has investors worried about what to do next. Short version: Rent growth is capped at five percent per year for properties older than 15 years. That’s likely going to gut the renovation and value-add market.

Combined with a slew of 18 new laws intended to create tax exemptions during construction, ease permitting, simplify zoning and remove other barriers to creating new and affordable housing, rent control could, potentially, fuel new development, particularly given the rent control statute’s exemption for properties newer than 15 years.

However, no amount of legislation is going to overcome the three harshest realities slowing development in California and around the country: 30 years of shunning trade skill training across the U.S. has created a horrifying lack of workers to execute projects; land prices are continuing to increase, and everything from concrete to rebar to drywall to nails is getting more expensive.

On the California upside, however, a 9/27 GlobeSt discussion with David Harrington of Matthews Real Estate Investment Services noted an interesting possibility as a result of the new state regulation: California properties, even those that haven’t traditionally raised rents on a year-over-year basis, could now start implementing 5 percent bumps every year like clockwork. For properties with secure and stable debt, that’s not the worst potential ROI outcome.

Oregon and New York also passed rent control measures this year, and many experts are concerned this could be the beginning of a national trend that could hamper the industry across the board.

The field of Democratic Party 2020 presidential candidates is still huge, and candidates are reaching far and wide to issue proposals that will get them noticed. Toward that end, a couple of the more prominent aspirants have floated the trial balloon of federal level rent control. Details have been scant, but the idea could be appealing to younger voters starting their careers and having trouble affording the $1,189 national average for a two-bedroom.

Industry opinions on the idea have ranged from denial and dismissal to amusement to abject terror.

Phoenix Market Metrics: By the Numbers

While rent growth is slowing nationwide, Phoenix has remained largely immune, and as a result the transaction appetite is still heavy.

For 10-99-unit properties, Q3 saw a transaction volume of more than $197M, which represented a 0.7 percent Year-over-Year decrease from Q3 2018. In the 100+ unit category, Q3 brought in $1.93B, up 12.5 percent over 2018.

Average Price-Per-Unit amounts were up in the 10-99 segment, rising 21.3 percent Y-o-Y to $119,664, and up 19.9 percent to $174,583 for 100+. These translated to an Average Price/SF of $154.04 in 10-99 (up 17.7 percent) and $205.13 (up 20.9 percent) in 100+.

Inventory age remained relatively consistent Year-over-Year, with Average Year Built for 10-99 being 1971, versus 1970 for the same quarter last year. Average Year Built in 100+ was 1994, compared to 1991 in 2018.

The market’s occupancy rate remained high. Q3 occupancy for 10+ units was 95.3 percent, an increase of 0.1 percent Y-o-Y. Average rent was $1,176 up 7.2 percent ($79) from Q3 2018.

Phoenix MSA demographics continued their solid trends. The Census estimate of total population was 4,737,270. The unemployment rate finished the quarter at 3.8 percent, according to Bureau of Labor Statistics numbers.

Median Household Income was $57,935, and Per Capita Income came in at $29,542.

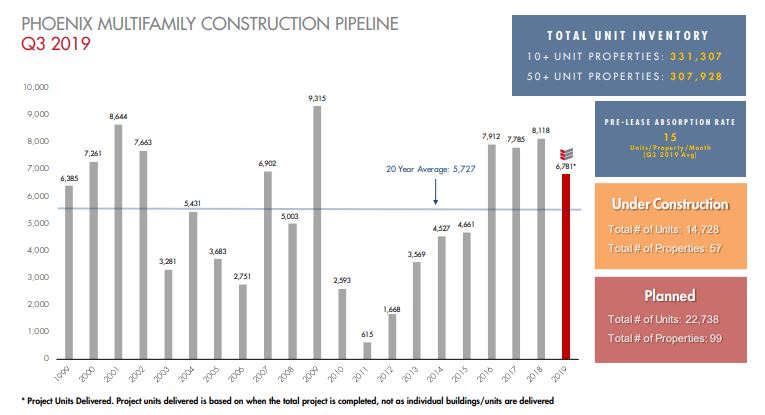

In the realm of new construction for 50+ unit properties, only 1,895 units were delivered across 10 projects, bringing the year-to-date count to 6,781 units at 30 properties, and making the odds of exceeding our start of the year projection of 8,500 deliveries appear highly unlikely.

An estimated 22,738 units are in the Planning stages across 99 properties. A total of 14,728 units were listed as Under Construction in 57 properties.

Pre-lease absorption rates are still high across the region at a rate of 15 units/property/month.

Total Unit Inventory for 10+ properties was 331,307, and 50+ came in at 307,928.

Across the MSA, 50+ unit inventories by city were:

- Phoenix: 137,415

- Mesa: 37,774

- Tempe: 34,235

- Scottsdale: 27,583

- Glendale: 24,492

What’s in Store for Arizona?

Most experts at a recent conference in Los Angeles said they aren’t particularly worried about California’s five percent cap. However, if that turns out to be the beginning of the more sweeping changes some experts anticipate, and they have the effect of driving down transaction volume, it will likely turn up the heat for investment in Arizona as more investors look for new outlets.

In addition to sitting at or near the top for demographic appeal, owners and developers looking to invest in Arizona are also benefitting from the current environment of falling interest rates. Coupled with a relative abundance of capital, the area’s investment and development boom should continue and likely accelerate even as cap rates continue to compress.

While Arizona enjoys a favorable climate in terms of both weather and opportunity, and despite an attractively balanced mix of eager investors across the private, institutional and foreign sectors, accessing that abundance of capital continues to be a challenge for new development.

At Bisnow’s Phoenix State of the Market event in September, several panelists lamented what they called, “An East Coast stranglehold,” on development capital. They explained an ongoing challenge in getting projects funded, particularly in office but also in multifamily, is that major lenders rely on national actuarial formulations and don’t fully take into account the currently exceptional deviations from the norm Arizona brings to the table.

“If rent growth slows from 3 percent down to, say, 1.5 percent nationally, that’s all the money guys are going to look at,” said one panel member. “It’s frustrating when we’re seeing rent growth at 7 percent and occupancy over 95 percent. Come on, guys, we’re filling every unit we build, and we can fill a lot more if you just look at us realistically and realize we’re in a perfect environment to build and absorb more and faster than nearly anywhere else.”