By Roland Murphy and Rebekah Morris for AZBEX

Arizona’s seasonally adjusted unemployment rate decreased to 5.7% in September, down from 6.2% in August, according to the latest report published by the Arizona Office of Economic Opportunity.

The national rate decreased to 4.8% from 5.2%. In September 2020, the state had a seasonally adjusted rate of 6.9%, and the national was 7.8%.

The state had a net gain of 20,400 non-farm jobs over the month. “Historically (2011-2020), nonfarm employment has recorded a gain of 30,100 jobs in September,” the report states. Government had the largest gain of 14,100, fewer than the historical ten-year average of 21,900. As in August, the report credits most gains in Government to State and Local Government Education.

Private employment increased by 6,300 jobs in September. Data from 2011-2020 show an average gain of 8,200 for the period, usually led by Education & Health Services.

Trade, Transportation & Utilities led September gains this year with 4,200 jobs, followed by Education & Health Services at 3,100. Construction was third at 3,000.

The Information sector neither added nor lost jobs for the month. Professional & Business Services led losing sectors with a drop of 3,900 jobs, followed by Financial Activities falling by 1,000 and Manufacturing down 800.

Nine of the 11 sectors tracked posted year-over-year gains. Leisure & Hospitality led with 50,600 jobs from September 2020 to September 2021. Trade, Transportation & Utilities was second with 33,500. The two other top gaining fields were Professional and Business Services with 26,800 and Education & Health Services with 22,600. Construction reported a 3,900-job gain over the year.

Government and Information were the two sectors reporting YoY job losses from September 2020 to September 2021, falling by 3,200 and 1,100, respectively.

Construction Employment

Statewide construction employment totals 176,800 jobs, which increased by 3,000 from August 2021 and increased by 3,900 from September 2020. August 2021 employment numbers were revised downward since being released last month.

The Arizona Construction sector features three major segments: Buildings, Heavy, and Specialty Trades. There are currently 36,500 jobs in Buildings, which is unchanged from August 2021 and up by 1,000 from September 2020. Heavy Construction increased by 800 over the month for a total of 20,700 and gained 400 over the year. Specialty Trades increased by 2,200 over the month for a total of 119,600, and the segment gained 2,500 over the year.

Construction jobs in the Phoenix Metro Area (Phoenix-Mesa-Scottsdale) gained 3,000 over the month for a total of 138,500. The September 2020 number was 134,000. Metro Tucson construction jobs were unchanged at 18,400 jobs for the month. The September 2020 number was 17,800.

Yuma, Flagstaff, Prescott, Lake Havasu City-Kingman and Sierra Vista-Douglas combine Construction and Natural Resources jobs in reporting their job sector totals. Yuma lost 100, for a total of 3,600, Flagstaff remained at 2,800. Prescott was also unchanged at 7,100, as was Lake Havasu City-Kingman with 4,200. Sierra Vista-Douglas added 100, totaling 3,800 for the month.

Employment Gains Restricted by Supply

Constraints abound in the local construction market. Widespread reports of materials price increases and shortages are impacting the delivery of construction projects and driving prices sky high. Another widespread problem challenging the industry is the lack of skilled workers.

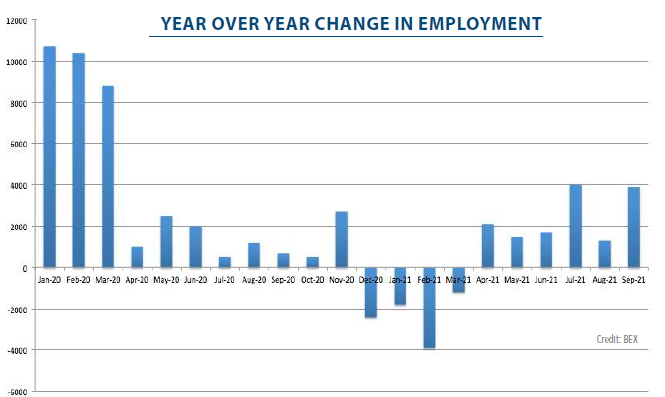

Since early 2020, statewide construction employment has taken some interesting dips and turns. From January through March 2020, YoY gains were significant, consistently notching from 8,000 to more than 10,000 gains each month.

When COVID took hold in March 2020, the industry hit the brakes with a very large monthly loss of 5,800 jobs. Then, from April to November, the gains were small but steady. Only in December 2020 through March 2021 did the statewide industry finally see a YoY loss in construction jobs, with an average YoY decrease of 2,300.

Since April 2021, the average YoY change flipped back to the positive with 2,300 average monthly increases in YoY jobs. Both July and September 2021 saw roughly 4,000 jobs gained YoY.

Demand continues to outpace supply and prices continue to rise. Currently the market appears to be accepting the increased cost of both labor and materials, although changes to traditional ways of doing business – such as incorporating escalation clauses and mobilization cost stipulations – are becoming more common. It will be curious to see when the market starts to correct and decline to move forward with projects because of price, timing, or quality concerns.