By Roland Murphy for AZBEX

Arizona’s construction employment sector is projected to grow 0.7% in 2023, according to newly released data from the Arizona Office of Economic Opportunity.

Statewide employment growth across all sectors is expected to grow 1.4% for the year, with 10 of the 11 sectors tracked predicted to post gains. Only Financial Activities is expected to report job losses in 2023, with OEO expecting a decrease of 0.6%

Construction reported 194,733 jobs as of Q2 2022, an annual percent change of 5.4%. The Q4 2020 number was 179,026 jobs. The Office projects Q2 2024 to hit 197,613 jobs.

Total statewide employment for Q2 2022 was 3,241,387 jobs, a 5.9% annual percent change. As of Q2 2020, the total was 3,109,385. The projection for Q2 2024 is 3,332,012.

A number of assumptions go into building the projections model. According to the list provided by OEO, these include:

- No major economic or political disruptions will occur during the projected period;

- COVID-19 is not likely to cause additional major economic disruptions;

- Government agencies will operate within their budgets;

- The distribution of Arizona’s population will not differ significantly from the distribution in the base year;

- The U.S. economic framework will not differ significantly from the framework in the base year, and

- Arizona’s population growth will continue to be among the fastest (top five) in the nation.

The Overall Economic Picture

A host of challenges are poised to impact the overall economy and employment sector, however. Because of the rampant and lingering difficulties with inflation—spurred, in part, by high levels of federal spending meant to spur the economy during and after the pandemic, as well as to advance the current administration’s social and infrastructure development program priorities—the Federal Reserve has undertaken an aggressive series of interest rate increases, which many economists predict may tilt the overall economy into actual recession.

While inflation has abated and stabilized somewhat—settling at 6.4% for the 12 months that ended in January—it is still appreciably higher than the Fed’s 2.0% target rate and has not responded to rate increases to the expected degree. A key factor in that response pace is the consistently hot job market, which has not slowed to nearly the extent Fed officials or market analysts would have expected based on historical performance and prevailing theory.

At the end of January, economic data showed employers had hired 500,000 people for the month, nearly three times the amount expected. For inflation to continue slowing, hiring has to slow, and it should have by nearly every traditional model. The extent to which the current economy is in uncharted territory, and the lack of diversity in the central bank’s figurative tool chest, has many analysts, including some at the Fed, itself, wary about the near-term economic future.

Mortgage Bankers Association Chief Economist and Senior VP of Research Mike Fratantoni recently announced his expectation that the national economy will enter a recession in the first half of 2023. Fed watchdog group Accountable.us raised its own concerns last week, predicting that—despite a slowing in the amount of increase per individual adjustment—the Fed’s consistent and persistent rate hikes since March 2022 “could cost millions of Americans their jobs.”

In reporting its projections on interest rate hikes and the upcoming 10-year budget and economic outlook, the Congressional Budget Office stated: “In response to the sharp increase in interest rates that occurred in 2022, the growth of real GDP (that is, GDP adjusted to remove the effects of inflation) comes to a halt in our projections in 2023. As the Federal Reserve reduces the target range for the federal funds rate, real GDP growth rebounds, led by the interest-sensitive sectors of the economy. It averages 2.4% from 2024 to 2027 and 1.8% from 2028 to 2033.

“The unemployment rate rises through early 2024, reflecting the slowdown in economic growth. That rate falls thereafter, as output returns to its historical relationship with potential output (that is, the maximum sustainable output of the economy).”

Concurrent with all the maneuvering at both the top and street levels concerning Fed policies, Construction as a national sector continues to deal with an unprecedented, decade-plus labor shortage. In 2006, at the peak of the previous boom’s upswing, Arizona had 240,300 Construction jobs. As noted above, the state’s Q2 2022 Construction sector employment was 194,733 jobs.

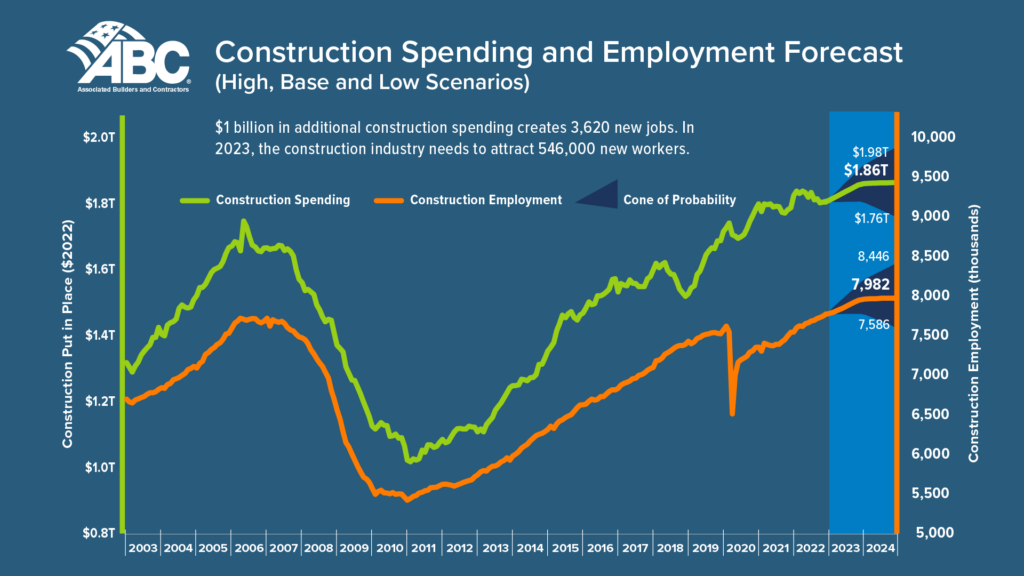

Arizona’s Construction sector employment shortfall aligns with the national trend. Earlier this month, Associated Builders and Contractors reported its proprietary model’s projections on the state of the U.S. Construction employment shortfall, saying, “The construction industry will need to attract an estimated 546,000 additional workers on top of the normal pace of hiring in 2023 to meet the demand for labor.”

The ongoing need for both skilled workers and laborers in general across all components of the workforce, combined with the ongoing refusal of the current reality to align with traditional and historical models and fundamentals of Keynesian economic theory, promise to be an issue set throughout 2023 and, possibly, beyond.