By Florentina Sarac for RentCafé

Following an almost decade-long period of vigorous expansion, the growth of the U.S. renter population has reached a plateau in 2016. Construction had continued to break records – until this year, when Yardi Matrix market data suggests that the total number of new completions is going to remain far below the 300K mark.

Compared to 2017 when the number of new deliveries reached an all-time high mark in the last 20 years, 2018 will see about 34,900 less deliveries ready to hit the market. The amount of new construction has followed a fast-ascending trend in the past 6 years, but the trend is estimated to change course this year. 2017 deliveries represented a new post-recession high, although actual apartment deliveries last year came short of initial estimates in many metros, due to increased construction costs and qualified labor shortage. As the market is approaching a saturation point, 2018 may mark the start of a construction cooldown for the next few years.

On the other hand, carrying out a large-scale apartment project from the initial phases of planning to delivery rarely fits into a one-year timeframe. If we look at the combined delivery figures of 3-year periods, however, the past three years still top the output seen in three decades. Apartment construction has last peaked at 933K deliveries between 1983-1985 and is forecasted to reach an astonishing number of 910K deliveries by the end of 2018, the closest it’s come to that record-breaking performance ever since. Although the pace of construction has helped tremendously with supply, it’s still going to be a challenge for developers to keep up with the demand, taking into consideration the fact that the number of renters is on the rise.

The Average Rent is Still Increasing

Rent growth has followed a path of ups and downs since the recession, but prices have not decreased since 2010 at a national level. It seems that 2017 brought a touch of relief with rent prices starting to slightly hit the brakes.

However, the national average rent has already seen a 2.3 percent increase during the first six months of this year, and whether or not it will outpace 2017’s 3.5 percent uptick by the end of the year is up to the market’s reaction time, as the slightly narrower pipeline has the potential to blow even that little wind out of the sails of renters. One thing’s for certain: the number of renters has been on the increase in the past years, and it’s unlikely to start decreasing as long as home prices are shooting up faster than rents.

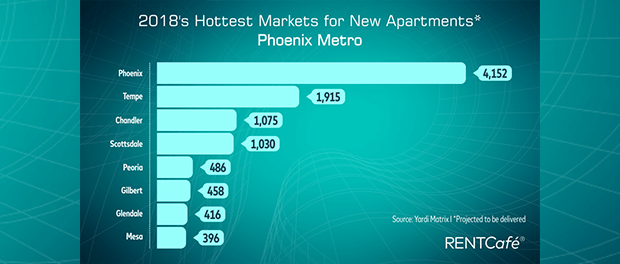

Phoenix, Tempe and Chandler are the Top Three Hottest Markets for Apartment Construction

Besides affordable rent prices, those living in Phoenix metro have another reason to rejoice as developers are planning to build over 10,000 new apartments this year, 55 percent more than they did last year. The metro saw its population soar by 2 percent in the last year while job growth was also strong at 2.8 percent.

Home to employers like JP Morgan Chase, UPS or Santander Consumer USA, Phoenix is seeing a boost both in its job market, as well as in its apartment construction. The city is planning on adding 4,152 new units by the end of the year, an increase from last year when it only delivered 2,316 new apartments.

Construction volumes will reach 1,915 new apartments in Tempe, 1,075 in Chandler and 1,030 in Scottsdale. Peoria, Gilbert, Glendale, and Mesa are expected to add only around 400-500 new apartments each.

Both Jacksonville metro and Phoenix metro are building over 50 percent more apartments this year compared to 2017. The metros are also among the top 10 with the highest population growth, therefore the increase in construction comes as good news for renters hoping to see prices cooling off.

As for what lies ahead at a national level, Doug Ressler, senior analyst at Yardi Matrix, believes that since “the residential development pipeline has slowed, there won’t be as many new properties coming online. Vacancy is also increasing slightly because of the new apartment buildings coming online, particularly in the Sunbelt and the Southwest.”

Read more at RentCafé.