Source: Colliers International in Arizona

The Greater Phoenix medical office space market performed well during third quarter, rebounding from a challenging performance during second quarter. Medical job growth hit 3.7 percent during the first three quarters of 2019, outpacing the 2.7 percent overall employment increase.

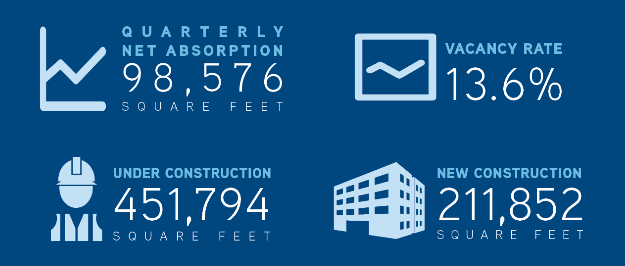

Net absorption of medical office space reached nearly 100KSF during third quarter, outperforming the negative (152.8KSF) of net absorption posted in second quarter.

Developers have completed 211.6KSF of new medical office space this year.

More than $1B of bioscience related projects are currently under construction with more than $2B set to launch of the next couple of years. These projects are expected to create nearly 7,000 new jobs once completed. Projects to watch include ASU/Wexford’s 227KSF medical lab/office space in Downtown Phoenix, Creighton University’s Medical School at Park Central and Mayo Clinic’s $600M North Phoenix campus expansion.

Despite deliveries of new space, vacancy of medical office space fell approximately 30 basis points to 13.6 percent. Third quarter marked the eighth consecutive quarter of medical office space vacancies below 15 percent. The lowest vacancies are found in the Downtown North (2.7 percent) and I-10 West (4.0 percent) submarkets. Vacancy is expected to slightly rise during the last months of 2019 as more developments come online. However, increased absorption rates could counterbalance that new inventory addition.

Asking rental rates rose slightly during the third quarter with a 0.2 percent increase. Thus far in 2019, asking rental rates have risen 3.1 percent to $21.16 per square foot. The West I-10 submarket posted the largest increase over the year, elevating 20.3 percent to $23.06 per square foot. Second was South Tempe/Ahwatukee where rates increased 13.6 percent to $17.69 per square foot. Rental increases are expected to rise throughout the rest of the year at a moderate pace.

Year-to-date Greater Phoenix has posted its highest medical office investment sales volume since 2015. Thus far, volume has reached $238M across 41 transactions. The median sales price has been $158 per square foot with cap rates settling at eight percent. During third quarter, sales volume rose 52 percent from second quarter levels to $111.6M within 18 transactions. The median sales price during third quarter was $247 per square foot and cap rates were at seven percent.

The primary drivers of medical office space demand remain firm. Robust population and job growth are propelling the market in near to medium term.