By Roland Murphy for AZBEX

Since BEX Companies/AZBEX/DATABEX is a small company that covers every commercial development in the state with a valuation of more than $5M, it stands to reason we are a pretty tight crew that communicates efficiently and well.

That said, it’s kind of uncommon for something to happen that so grabs someone’s interest they share it out of sheer surprise. Still, as I was putting together last Friday’s issue on Thursday morning, I got a text from the DATABEX Manager: “Check out Mesa on the leads list!”

The leads list, by the way, is where projects briefly hang out while waiting for inclusion in the database. It’s also a treasure trove for me to find projects that have not yet been reported.

It turns out last week was a particularly busy one for Mesa’s Planning and Zoning and Development Review boards, as six new industrial developments totaling almost 4.8MSF in 21 buildings were added to the queue, with a combined construction valuation of $637.5M.

That prompted a “forest for the trees” moment for me. Yes, the COVID-related boom in warehouse and logistics development nationwide has gotten a ridiculous amount of press, to the point we sometimes don’t bother to pick up trends stories on it because they’re often just more of the same. Yes, Mesa and Glendale are hotspots for this sector, and AZBEX and every other news outlet that covers development have covered individual projects in detail as they wind their way through the approval and construction process.

To be fair, Glendale and the West Valley have gotten the lion’s share of coverage because several once-sleepy areas are now waking up fully caffeinated and ready to run because of freeway development and job and population growth. There is also the fact that many Glendale projects have an annexation component. Mesa, for the most part, though, has only gotten per-project coverage; so I decided to take a closer look.

In the spirit of apples to apples, I culled data centers and multi-sector mixed-use and master plans from the results. Data centers are too huge and too specialized. They also have gotten what is, for purposes of this high-level look, disproportionate coverage. The mixed-use master plans are too vague and under-segmented. They throw off the square footage and valuation projections.

With those caveats in mind, let’s take a look at warehouse/manufacturing and miscellaneous industrial development over the last 22 months.

2020

I’ll throw out one more data concession and stipulate that anything from 2020 comes with a giant asterisk attached. Still, the DATABEX report is interesting.

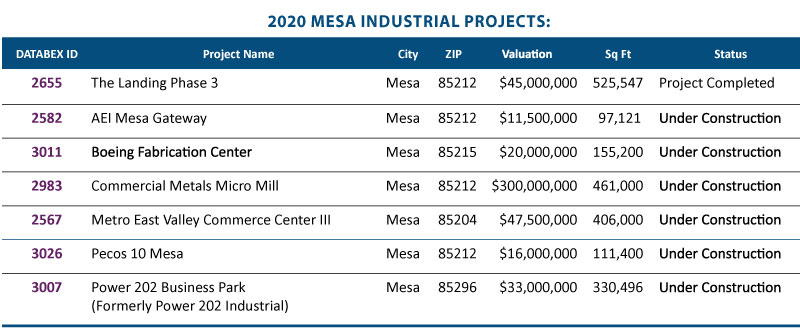

Between January 1st and December 31st of last year, seven industrial projects in Mesa were added to our database. These totaled nearly 2.1MSF and carried construction valuations of $473M.

Of the seven, one – The Landing Phase 3 by Marwest Enterprises – completed construction around the middle of this year. The remaining six are all listed as Under Construction.

2021

Any caution, fear, trepidation or other restraining emotions developers may have experienced in 2020 went out the window this year.

So far in 2021, DATABEX has added 24 Industrial developments. Of these, only five are listed as Under Construction. The remaining 19 are in various stages of Design or Design/Plan Review.

Obviously, the space and dollar totals for such an extensive array of projects is impressive. Taken all together, the 24 listed projects make up a total building square footage of 18.6MSF (427 acres or 0.66 square miles) and have a combined construction valuation of nearly $2.25B.

The Transformation

From the 1970s through the early 2000s, Mesa developed a stigma. It was a city that had withered, with a once-vibrant downtown giving way to encroaching decay and fading development dreams. Despite multiple development and revitalization efforts over the years, it became known as a jurisdiction where grand visions went to die. Time and again, projects would be announced with much fanfare, only to fade into oblivion.

There were many contributors to that problem. While other East Valley cities embraced change, Mesa – perhaps because it was once a destination – kept at least one foot anchored in the past. Development and portions of City government had an “Old Boys Network” in place that made it harder for fresh blood and new processes to gain a foothold.

Those mindsets and practices remained in place for years, decades even, until the announcement of Mesa’s inclusion in the light rail project. Even before track was laid, some city leaders and private stakeholders embraced the potential for development and regrowth.

While the light rail has not brought quite the same astounding volume of growth to Mesa as it has to Phoenix and Tempe, it certainly served as a catalyst. The landing of Arizona State University’s ASU @ Mesa City Center (Creative Futures Lab), the associated Plaza at Mesa City Center and Studios at Mesa City Center finally helped break the cycle of grand announcements leading to nothing.

The Church of Jesus Christ of Latter-day Saints has always been a key cultural influencer in Mesa. The 2017 announcements of a major renovation of the Mesa Temple and The Grove on Main mixed-use development seemed to fuel a perceptual turning point that, perhaps, Mesa really was moving forward.

But what does this have to do with Industrial? It’s relatively straightforward. To get its downtown situation straightened out, Mesa had to embrace new attitudes and new processes, including better plan review and greater openness – both in the business it conducted and how it conducted it. That was combined with serious and focused economic development efforts to show Mesa was a solid option for growth investment.

When those changes and modernizations started bearing fruit, they became more entrenched, and new and different types of development – including industrial warehouse and manufacturing facilities that could take advantage of Mesa’s vast available land – became a resource to the City and its boosters could, and did, rally behind.

The Prime Spot

Most of that land lies within the 85212 ZIP Code, which is loosely bounded by Meridian/Ironwood roads in the east, Power/Recker roads in the west, Germann Road in the south and Guadalupe Road in the north. The Loop 202 runs through the northwest portion of 85212, and US 60 is only two miles from the general northern edge. Most importantly, Phoenix-Mesa Gateway Airport occupies a huge portion of the area’s southwest quadrant.

The combination of available land and ease of transportation makes the area an industrial developer’s dream, as evidence by the number of projects under development there. Of the 30 projects introduced for review since the beginning of 2020, 25 are in 85212. Not only is that an impressive volume for one ZIP Code with a 2019 population of just 37,000, it is also nearly $2.6B and 19.3MSF of Mesa’s overall totals.

Economic development leaders and project developers and investors can thank their lucky stars for the way those stars aligned to make southeast Mesa a haven for logistics, warehousing and manufacturing. They can also pat themselves on the back for seeing an opportunity for growth and change and grabbing it with both hands.