A new report from Prologis predicts a combination of pent-up Industrial demand and a slowing in new deliveries will bring about vacancy of around 6.5% this year, falling to the mid-5% range in 2025.

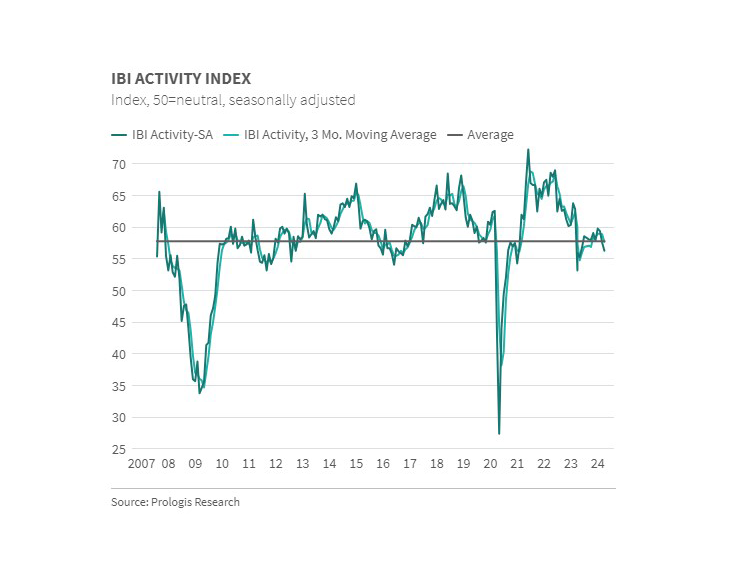

Prologis’ Industrial Business Indicator Activity Index showed that while net absorption lagged in April, market activity was consistent with increasing demand, including data showing businesses restocking inventories and strong consumer activity.

Concurrently, Industrial construction has slowed amid short-term fears of over-delivery. The company predicts this will lead to increased competition for space and an increase in rents.

In April, the Activity Index was 56.3, dipping slightly from its Q1 average of 58. However, March core retail sales were up 1.1% month-over-month and 4.5% year-over-year. The e-commerce channel was up 2.7% month-over-month and 11.3% year-over-year.

March and April both showed facilities utilization at 85%, an increase of 2% over Q4 2023.

The report shows sales outpacing inventory growth, with the inventory-to-sales ratio hitting 1.24, a decrease of 3% from the average in 2019. Given the disparity, Prologis’ analysts see the need to build more inventory, especially for wholesalers.

Accounting for the fact that the net absorption of 26MSF was less than those factors might have warranted, the report notes two temporary factors influencing the study period: Some customers expanded growth capacity in their existing networks, and cost concerns prompted a hesitancy to make decisions.

Prologis predicts customers will run out of usable surplus space in one or two quarters, particularly since sublease space growth has slowed in every market except Southern California and Seattle. (Source)