In the last week BEX Research staff has added three new Build-to-Rent projects to our DATABEX database, showing more momentum for the growing pace of development in the racing multifamily subsector.

As the markets where the hot housing trend first took root, Arizona in general and Phoenix in particular had a head start, even though every area of the nation has made great strides adding its own projects to the sector.

Still, with every new addition Arizona adds to its leadership standing, and the three most recent projects contribute nearly 750 units, 704KSF and $129.5M in project construction valuation to the mix.

Bungalows at Norterra

In Phoenix, Cavan Companies is proposing to build Bungalows at Norterra (19th Avenue & Parsons Road), a 170-unit Build-to-Rent community on 17.6 acres north of Happy Valley Road.

With 11 dwelling units/acre, the development will consist of 64 one-bedroom units (or 32 duplexes), 73 two-bedroom and 33 three-bedroom units, according to the project narrative submitted in October.

Planned amenities include private backyards, dog parks, a pool, fire pit and seating areas, and outdoor dining and cooking spaces. The surrounding area includes single-family and townhome communities.

The developer is seeking a rezoning from Maricopa County from rural to residential (R-2). The Planning and Zoning Commission recommended it for approval on January 13th, and the Board of Supervisors is scheduled to hear the request on February 9th. Assuming the rezoning is approved, the project will then move on to the City of Phoenix to annex the land.

Maricopa County planning staff has received several letters and statements of opposition from nearby residents, nearly all of whom cite increased traffic, density and perceived negative impacts on neighborhood character if zoning in the area is changed from its current one unit/acre designation.

Hancock Communities at Casino Royale

In Glendale, a proposal for 293-units on nearly 28 acres at the NEC of Northern Parkway and Sarival Avenue called Hancock Communities at Casino Royale is under consideration.

Along with private backyards maintained by the property manager, the location will feature a main communal area with a fitness center, pool and spa, and a covered ramada along with turf areas. Additional open spaces are planned throughout the development.

The proposed unit mix comprises 50 one-bedroom duplex units, 46 one-bedroom units with garages, 53 two-bedroom, 76 two-bedroom duplex, and 68 two-bedroom with garage units.

Hancock submitted a site plan review request in November. No construction timeline has been announced, but the project narrative accompanying the request says construction is planned to start as soon as possible once the required approvals are in place, depending on market conditions.

Arise Mandarina

Phoenix is not the only Arizona market adding Build-to-Rent projects by any means. In Marana, Family Development (FD Construction) is planning Arise Mandarina, a 283-unit development on 25 acres north of I-10 and Tangerine Road.

Centered around a large public park and featuring a lounge, pool and spa, fitness center, walking paths and paseos, and a dog park, the development will consist of one-, one-and-a-half and two-bedroom units.

The Marana Planning Commission approved a conditional use permit request at its January 26th meeting.

State of the BTR Market

Build-to-Rent has been surging in popularity for the last several years. While it was already gaining ground quickly before the pandemic, the desire for more removed living spaces added demand both in Arizona and nationwide. Combined with short supplies and high demand for both traditional single-family and apartment units, the new niche was quickly accepted by both residents and the investment community.

An August 2021 report from international commercial real estate investor resource AFIRE cites 2020 information from the Harvard Joint Center for Housing Studies showing single-family rental units – both new BTR and existing homes conversions to rentals – increased 18% in the 10 years from 2008 to 2018 for a total of 15.5 million units, roughly one-third of the national rental unit total.

As demand has increased, so have investment and development. A recent report from RentCafé shows 6,740 newly-constructed BTR units were delivered nationwide in 2021. Relying on Yardi Matrix data for units under construction, RentCafé expects 2022 deliveries to be more than double to a total of 13,910.

Arizona is the undisputed national leader in Build-to-Rent volume. The RentCafé report shows metro Phoenix having 6,420 BTR homes, with Columbus a distant second at 4,780.

As we discussed in our recent report on Phoenix multifamily delivery projections (AZBEX, January 21st) relying solely on under construction numbers to predict completions will almost always lead to an over-estimation, given the delays projects of all types are experiencing due to labor and materials shortages and increased costs across the board. Still, even if that prediction is off by as much as 25%, that will still be nearly 3,700 more units delivered in 2022 than 2021.

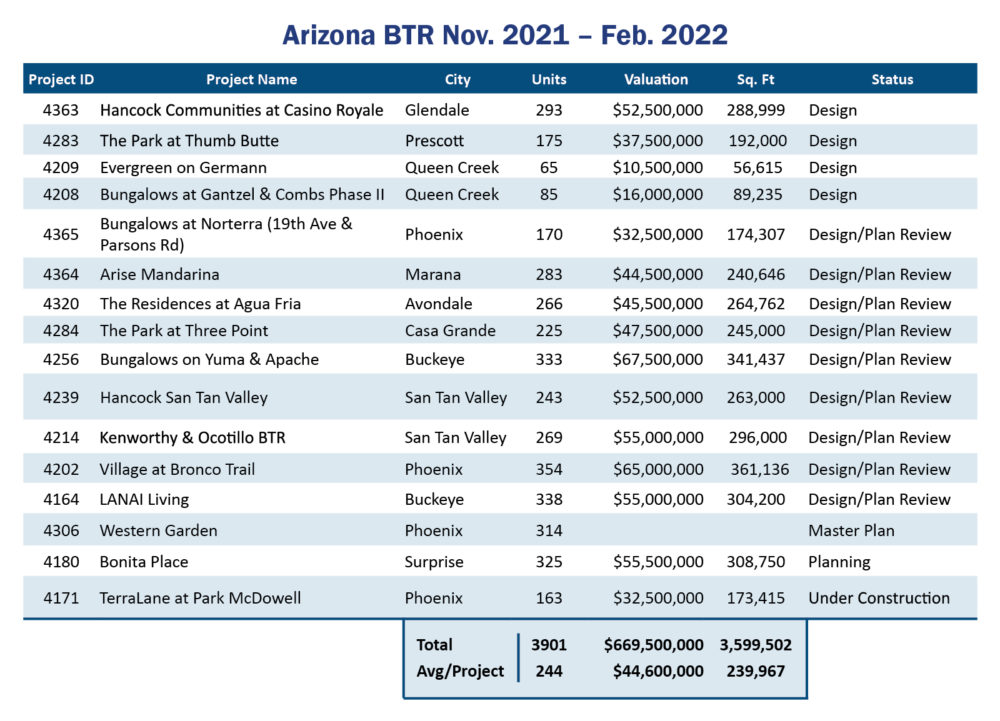

Our own tracking shows the appetite for Build-to-Rent hanging strong in Phoenix and across the state. DATABEX staff has added 19 BTR projects since November 1st. In putting together a total overview for this article, we have eliminated three projects (mostly master plans) that had no unit counts, square footage or construction cost estimates included. One master plan, Western Garden, has only a unit count but was allowed to remain.

Of the 16 projects left after scrubbing the list, Arizona has added a total of 3,901 units, making up nearly 3.6MSF of build area and adding $669.5M to the development pipeline in three months. The 16 projects with unit count estimates average 244/project. The 15 projects with square footage and construction cost estimates average nearly 240KSF of built space and $44.6M/development.

Interestingly, DATABEX contains a total list of 152 BTR projects in various stages of development. Even though we took notice of BTR projects early on, we didn’t officially list them as a distinct subgroup in multifamily until August of last year. Our Research team has since gone back through the listings and updated legacy projects under the new market sector designation.

What is unquestionably certain is, barring a black swan event even more disruptive to building cycles than COVID, the momentum for BTR in Arizona and across the country will remain strong even amid market challenges.