City still faces extensive housing deficit

By Roland Murphy for AZBEX

Property owner Vintage Partners and developer LIV Communities are proposing a 214-unit multifamily development in the Timber Sky area of Flagstaff on 13 acres at the SWC of US Route 66 and Woody Mountain Road.

The plan serves as the final extension of the Timber Sky master-planned community, according to the submitted narrative. The site is vacant and undeveloped. Surrounding uses include the Timber Sky community to the west, the Sky Cottages at Timber Sky Build-to-Rent development to the south, The Flagstaff Public Works Yard to the north and a residential community and a campground to the east.

The development plan calls for residential buildings split between two-story carriage houses adjacent to the west property line and three-story buildings distributed across the rest of the site. The planned unit mix calls for 48 one-bedroom, 118 two-bedroom and 48 three-bedroom units. The total planned building area, including the residences, clubhouse, fitness center and detached garages comes out to 298,306SF.

Planned amenities include “a clubhouse and fitness center, spa, barbeque area and ramadas, fire pit and seating area, pickleball/sports court, game lawn, tot lot/play area, dog park, and other active and possible open space areas,” according to the narrative.

The plan also includes off-site roadway improvements to add a “south-half street of US Route 66 along the Property’s northern frontage and the west-half street of Woody Mountain Road along the Property’s eastern frontage.” Associated with the half-street improvements are sidewalk extension from Timber Sky along Route 66 and other pedestrian accessibility improvements.

The project will be developed in a single phase as determined by market conditions.

To proceed with the project, the developers requested a rezoning and the annexation of 1.82 acres that sat in unincorporated Coconino County. The Flagstaff Planning and Zoning Commission recommended both requests for approval in its Aug. 9 meeting. They will now proceed to City Council for a hearing and vote.

Vintage Partners is the property owner and LIV Communities LLC is the developer. The design firm is Todd & Associates Architecture. Civil engineering is by Shephard-Wesnitzer, Inc. (SWI) an Ardurra Company, and the project is represented by Gammage & Burnham, PLC.

A Housing Emergency in a Challenging Market

Despite the fact that the Flagstaff City Council declared a housing emergency in Dec. 2020 and issued a 10-year housing plan in Jan. 2022, multifamily developments have faced challenges moving from proposal to approval to construction.

City administration has tended to side with opposition groups concerned with a variety of issues, including potential environmental impacts, infringement on accessible (though not necessarily public) open space, preferences for affordable versus market-rate housing, opposition to personal motor vehicle use versus public transit and other, similar concerns.

The 10-year housing plan puts an extensive focus on affordable and subsidized housing while also acknowledging a market deficiency across all housing types. Using 2019 data, the housing plan found 10,916 extremely-low-to-low-income households and 1,156 low-to-moderate income households in need of an affordable housing subsidy or unit. The analysis also found 47% of the city’s population falls into the low-income bracket earning 0-80% of the Area’s Median Income.

Flagstaff currently owns and manages 265 public housing units and has 41.3 acres of City-owned land dedicated to additional housing development. Over the 10-year plan cycle, the goal is to construct 254 additional affordable housing units, with an overall goal of impacting at least 6,000 low-to-moderate income residents through creating units or providing subsidies and creating or preserving a total of 7,976 market-rate housing units by 2031, with a minimum of 10% of units designated affordable.

On the market-rate side, Flagstaff has been plagued by both underproduction and non-standard uses for existing units. The study found that, like most parts of Arizona, Flagstaff’s population has grown at a faster rate than its existing housing supply and development cycles can support.

Cutting into the market rate unit supply, the study found 22% of all Flagstaff parcels are occupied by second homes, which often sit vacant for much of the year. The City is also a popular short-term rental market, with 535 non-owner-occupied and 259 owner-occupied STRs noted at the time the study was published.

A final contributor to the housing supply difficulty is Northern Arizona University’s student population, which is highly transitory and makes up 26% of residents. With a 2020 on-campus enrollment of 20,433 students, 11,480 lived off campus.

The State of Multifamily Development

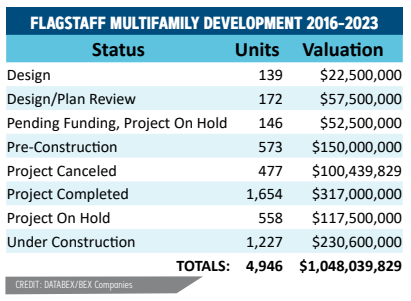

Despite the demand and the explosion of post-pandemic multifamily development in Arizona, a review of the DATABEX project database shows only 30 multifamily developments of any type have been proposed since 2016. It should be noted that DATABEX only tracks projects with estimated construction valuations greater than $5M. Had all been approved and entered into the construction pipeline, the total unit count would have been 4,946 and held an estimated construction valuation of slightly more than $1B.

Those totals, however, do not paint a complete picture. Of the 30 projects listed, seven are student housing and account for 1,688 planned units with an estimated valuation of $350M. Another three projects are dedicated to senior housing and a total of 430 units valued at $109.5M.

Of the total 4,946 units and $1.048B proposed, only 2,828 were standard residential planned in 20 projects that included either market rate or affordable units. Total standard residential unit valuation estimates total $588.5M of the total market, or 56%.

Of course, no market ever approaches a 100% proposal to development rate, and Flagstaff is no exception. Of the 30 projects proposed for standard residential, student and senior housing since 2016, 1,654 have been delivered across seven projects. Only four of those projects, totaling 637 units, were standard residential.

Four projects totaling 477 units have been canceled, three of which were standard and comprised 281 units. Another three projects totaling 704 units, none of which are standard, are currently listed as On Hold.

Three projects, all standard and making up 884 units, are in some stage of design or pre-construction.

There are 11 projects totaling 1,227 units listed as Under Construction, and all except one project with 201 units are standard.

It is also worth noting that despite the proliferation of Build-to-Rent development in the rest of the state, only two of the 30 projects on the Flagstaff list are exclusively noted as fitting the type. One is under construction with 202 units, and the other has been completed, providing 132 units.

The concerning thing for market watchers is the near total dearth of projects in the development pipeline. Not including the 214 units currently proposed at LIV Timber Sky, there is one project (139 units) in Design, one (172 units) in Design/Plan Review and one (573 units –the largest on the list) in Pre-construction.

When we add LIV Timber Sky into the mix, that shows a potential development pipeline of just 1,098 units, assuming all are approved, permitted and built as proposed. If we take those units and charitably include all the DATABEX-tracked projects completed since 2016, the total potential unit count is only 2,752, which is a far cry from the 7,976 target for market-rate unit creation or preservation in the 10-year plan. Even if we add in the planned City-owned units at the market-rate, the total only rises to 3,006.

Granted, it is virtually impossible to accurately predict the “preservation” tally, as that is a somewhat nebulous term, and the numbers shown above do not include any traditional single-family houses. Still, a deficit of 4,970 units shows the City of Flagstaff still faces an extensive set of challenges and still has a great deal of work to do to meet its housing goals.