By Roland Murphy for AZBEX

BEX Companies’ annual Public Works Conference has become a highlight event for companies working in the space, and this year’s event – the sixth time it has been offered – was no exception.

More than 170 attendees registered to hear project and development leaders from around the state talk about what they’re doing, what’s coming down the road, and how to best to manage their processes and procedures.

Event organizers across industries continue to innovate new approaches to getting people together in the wake of the pandemic, and the 2021 Public Works Conference was no exception. Unlike past events filling a hotel ballroom or convention space, the presentation itself was conducted virtually via Zoom. In a new, hybrid approach, however, the networking component – long a hallmark of this particular event – was held afterward as an in-person meetup at a popular high-capacity Phoenix Midtown gastropub.

As is traditionally the case, BEX Founder and President Rebekah Morris welcomed attendees with brief introductory remarks. After that, the experts were off to the races.

Speakers for this year’s event were given a general set of five topics to address during their presentations:

1: The state of capital funding for the speaker’s department or locale;

- Major new projects added this year;

- Preferred contract types (Design-Build, Design-Bid- Build, CMAR, JOC, etc.)

- Expected funding infusions that could cause the CIP to expand, and

- What the presenter wants and needs from the consulting and contracting community at the moment.

In general, the speakers took the format to heart and even stayed mostly within their assigned time limits.

City of Phoenix – A Little Bit of Everything

City Engineer Eric Froberg kicked things off by discussing the City of Phoenix’s near- and long-term works plan. Sticking closely to the recommended format, Froberg began with a historical chart of Phoenix’s five-year CIPs, noting the COVID-fueled dip knocked the originally planned $8.5B CIP down to $8B. The most recently released five-year plan calls for $8.2B in expenditures.

As Arizona’s largest city, Phoenix’s CIP covers a wide range of capital needs, or, as Froberg put it, “A little bit of everything.”

Froberg started with a variety of projects related to Sky Harbor International Airport, which have taken on newfound importance as travel resumes post-pandemic.

On the public transit side, the City is continuing to invest in light rail, most notably with ongoing work on the South Central extension and the Northwest Phase II extension.

As the population grows, the Parks Department is focusing on enhancing and expanding facilities and recreation offerings, including four new parks planned for the coming year.

All of Arizona is feeling the effects of drought, and Phoenix is investing heavily in water management projects, most notably those associated with the Drought Resiliency Infrastructure Program Master Plan.

On the Streets Department side, pavement maintenance and improvement are top issues, after the department was tasked three years ago by Phoenix City Council to advance $250M of its Transportation 2050 funding allocation to, in Froberg’s words, “Pave the roads like crazy.” As the pavement maintenance program completes, the focus will shift to new roadway construction.

Phoenix has no bond measures planned and has not undertaken a new general obligation bond program since 2006.

ADOT – Going from Fair to Good

The second presenter was Steve O’Brien, the senior division administrator for the Arizona Department of Transportation Project Management Group. After a brief overview of ADOT’s CIP development process, O’Brien launched into a discussion on the condition of Arizona’s roads and bridges.

At present, ADOT estimates its inventory of bridges and roads has an asset value of $23.5B. If those assets needed to be completely replaced, the estimated cost would be roughly $300B. Consequently, ADOT’s five-year plan includes a major commitment to preservation.

Bridges and roads are scored on a three-tiered system of Good, Fair and Poor. Bridges throughout the state have a rating of 59% Good, 40% Fair and 1% Poor. In 2010, 78% of bridges were rated Good.

On the pavement side, roads in the Interstate system are rated 48% Good, 51% Fair and 1% Poor, down from a 72% Good rating in 2010. Roads non in the Interstate system but still part of the National Highway System are rates 32% Good, 65% Fair and 3% Poor. In 2010, 68.1% were Good. Roads not on the National Highway System rate on 19% Good.

The Department’s three categories of highway needs and investment are: Preservation, Modernization and Expansion. O’Brien observed ADOT is spending nearly 2.4% of its planning on programmed pavement preservation, but spending should ideally be in the 5% range to maintain currently quality.

The first three years of the CIP spend a significant portion on expansion projects, but the 2025 and 2026 plans include significant increases in preservation funding. In greater Arizona, not including Maricopa or Pima county-specific projects, funds allocation for FY 2022-2026 consists of 64% preservation, 24% expansion and 12% modernization.

For FY 2022, major expansion projects total $159M and consist of SR 69, Prescott Lakes Pkwy to Frontier Village, US 93: “The Gap” Tegner Street to Wickenburg Ranch Way, and I-17: Anthem Way TI – Cordes Junction (I-17 Flex Lanes).

The big FY 2023 project is the I-10 Gila River Bridge Project, and FY 2024’s major expansion will be the I-40/US-93 West Kingman Traffic Interchange.

No expansion projects are planned for FY 2025-2026.

Mesa – Building for Growth

Given the explosive growth her city is seeing, it was probably a kindness Mesa City Engineer Beth Huning kept her presentation more general in scope rather than providing a line-by-line detail of all the upcoming projects.

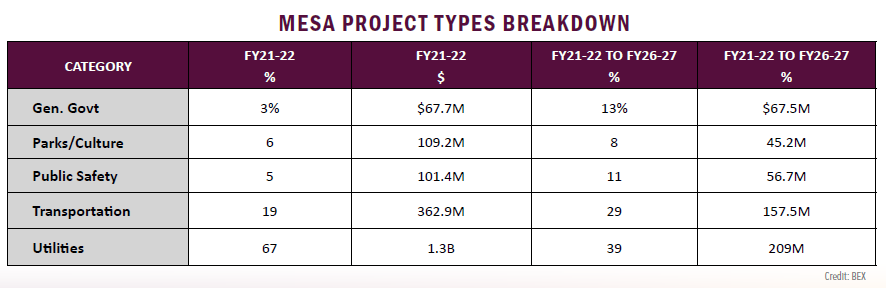

Following an overview of the 11 types of projects Mesa uses for categorization, Huning identified the six major sources of funding and then provided project type breakdowns for FY 2021-2022 and for the five-year CIP.

Utilities like water are a key component fueling the city’s growth, and the heavy outlay now is viewed as essential to providing the livability infrastructure to enable the development taking place in the east and southeast sections of the city.

Gilbert – A Poster Child for Managed Growth

Gilbert Town Manager Patrick Banger wasted no time highlighting his municipality’s multi-award-winning approach to growth and hitting the highlights of its current and 10-year plans.

Currently Gilbert has 172 projects in process, 32 of which are new. Thirty of the projects are in pre-design, 59 are in design, 39 are under construction, and six are warranty projects.

Banger pointed out the town is seeing an increase in its average total number of projects. Key considerations in Gilbert’s planning for the future are a focus on transportation capacity and efficiency, a focus on so-called “active transportation,” and advancing public safety initiatives.

For FY 2022, the Town has 172 projects valued at $425.5M. Maintaining the trend seen elsewhere, Water is a leading project segment, with 47 projects valued at a total of $180.4M. Wastewater is second with 24 projects totaling $83.2M, and Streets rounds out the Top Three with 31 projects at $76.5M.

Under the 10-year plan, Water continues to hold the leading position, with $977.4M planned in 61 projects. Streets shifts to the Number Two spot at $758.4M and 76 projects, and Parks & Recreation comes in third at $650.1M in 48 projects.

The Town has a major bond measure on the ballot currently before votes, which would deliver a total of $515M for Streets, Transportation and Infrastructure-related projects.

Valley Metro – Adding Rail, Expanding Services

Valley Metro Director of Capital Development Henry Ikwut-Ukwa focused almost entirely on the light rail program, which currently has 28 miles of service line in place.

By 2025, when the Proposition 400 transportation tax is set to expire, two additional projects will be added to the program. Currently, the Northwest Phase II and South Central extensions are being built, creating a two-line system, with a Green Line (North/South Line) running from downtown to MetroCenter and a Red Line (East/West Line) running from Gilbert Road in Mesa to downtown Phoenix.

The system expansion beyond 2025 revolves around two major projects: The Capitol Extension and the I-10 West Extension. The Capitol Extension will bring light rail from downtown Phoenix to the State Capitol campus. The I-10 West Extension will then create a major corridor that will expand service all the way out to 79th Avenue.

Under Valley Metro’s new regional plan, which is dependent on a renewal of the Prop 400-based funding, a West Phoenix Extension is intended to create a transit corridor between Camelback and McDowell Roads to 91st Avenue.

The currently in development Tempe Streetcar project will also experience a major expansion, known for planning purposes as the Rio East/Dobson Streetcar Extension, adding service that will extend it out to Dobson Road and then down Main Street where it will connect with the light rail system.

That will then be extended in the Fiesta Streetcar project to Southern Avenue and the Fiesta Corridor. According to Ikwut-Ukwa, a study was completed earlier this year to officially begin exploring the project details.

Valley Metro also plans to expand light rail service to the ASU West Campus with a four-mile corridor extension from MetroCenter.

In addition to the major projects, the earliest installations of light rail track are now nearing 20 years old, so a key focus is going to be maintaining the system, optimizing service and system and assisting in the implementation of transit-supportive development across the service area.

Tempe – Managing Growth and Shifting Use Plans

Wendy Springborn, engineering services manager for the City of Tempe, brought attendees up to speed on the current, FY 2021-2022, plan and discussed the City’s future vision and needs.

Under the plan the breakdown is as follows:

- Enterprise (Water, Wastewater, Solid Waste, etc.): $9M, a 2% increase over the previous year;

- Special Purpose (Arts & Culture and Transit): $48.9M, up 34%;

- General Purpose (General Governmental uses): $139.4, up 130%, and

- Transportation: $51M, a 17% increase.

Tempe only funds Year One of its five-year plan. Key elements that will play into future bond proposals for the City is a master plan for the Downtown Complex. The City has several properties around its “upside down pyramid” city hall facility. As use plans evolve to include more consistent telecommuting, Tempe is working with a consultant to determine best uses for those properties moving forward.

Other major items under consideration and development are the location of a Fire Station #8 and the Arizona Coyotes arena mixed-use development.

Scottsdale – Voter Support Fuels Project Momentum

Scottsdale Public Works Director Dan Worth wasted no time jumping into the City’s projects, challenges and opportunities.

Scottsdale’s adopted Capital Improvement Plan for FY 2021-2022 totals $821.2M, with allocation broken down as:

- Water Management: 39.8%, $326.9M;

- Transportation: 31.5%, $258.6M;

- Community Facilities: 12.7%, $104.8M;

- Service Facilities: 4.9%, $40.1M;

- Preservation: 5.2%, $42.5M;

- Public Safety: 3/5%, $28.9M, and

- Drainage: 2.4%, $19.4M.

In 2018, Scottsdale voters approved a 0.1% increase to enable the City to meet its match obligation for Maricopa Association of Government transportation projects. Worth said, “We had been kicking our projects down the road. (These were) projects that were identified and programmed and MAG-supported, and we didn’t have the local match to meet them. We started to get afraid Prop 400 would run out before we got our projects done. We took an issue to the voters, they voted yes, and that’s been a huge benefit for us as we try to get these projects moved back up and completed.”

The voter-approved funding was spread across three questions covering Parks, Recreation and Senior Services; Community Spaces & Infrastructure, and Public Safety & Technology.

Upcoming projects fell largely under the street development and parks and recreation umbrellas.

Maricopa County – Overhauling, Upgrading and Expanding

Charles “CJ” Jones, the Maricopa County Facilities Management Director, took attendees through a change of pace, as Facilities Management deals largely with vertical-only projects.

The Department currently has five projects under construction and 10 in design, along with several major maintenance and user/department-funded projects.

Major upcoming projects include the Downtown Fuel Station and the Durango Jail Demolition.

Major projects currently in design that will be going to bid for construction in the near future include the Maricopa County Sheriff’s Office SWAT/Major Crimes Facility and the MCSO Warehouse at the Durango Campus.

Tucson – Paving the Way for a Smoother Future

Technical difficulties and time constraints bumping into another obligation prevented Tucson City Engineer Fred Felix from delivering his presentation in real time. Felix was kind enough, however, to provide a copy for attendees and to deliver a subsequent overview for attendees to review at their leisure.

Streets and transportation projects have been a key focus for Tucson. The City is working largely through two funding sources, known as Proposition 101 and Proposition 407. Prop 101 provides $100M over five years for resurfacing, rehabilitation and reconstruction efforts, while Prop 407 focuses on parks and connections, providing $225M over five years.

Buckeye – Growing into the Big Leagues

As the fastest growing city in the country, Buckeye has had to step up its planning and processes significantly in the past several years. Supervisor & Construction Manager Kevin Hitchcock guided attendees through an overview of the City’s FY 2021-2022 project along with a peek into what’s to come.

Buckeye’s FY 2021-2022 program breaks down as:

Water Resources: $53M;

Public Works – Civil Infrastructure: $32M;

Parks & Community Services: $24M;

Wastewater: $20M;

Public Safety; $10M;

Airport Development: $8M, and

Public Works – Facilities: $5M.

Over the next six years, Hitchcock said to expect more of the same in terms of the types of projects and division of resources in Buckeye as the City works to satisfy the needs of a population that is expected to continue growing rapidly and requiring the entire scope of services to address their fundamental needs.

Future Funding – Prop 400 Renewal Essential for Many Plans

Many, if not most, Arizona entities received some level of project funding under the Coronavirus Aid, Relief, and Economic Security Act stimulus package, as well as its successor program the American Rescue Plan Act, which infused money for infrastructure projects as a financial boost intended to reverse the effects of the pandemic-spawned economic downturn.

Infrastructure bills currently tied up in Congress, including the Biden Administration’s “Build Back Better” proposal, could provide even more federal funding. Actual dollar amounts, however, will depend on the outcome of negotiations to advance the bill and their eventual passage and implementation.

As mentioned under the Valley Metro recap, Proposition 400 has been a key funding source for transportation projects around the Valley. The voter-approved measure instituted a half-cent sales tax for transportation funding.

Led by the Maricopa Association of Governments, Prop 400 has been responsible for much of the area’s transportation investment since its approval by voters in 2004. With the measure set to expire in 2025, capital projects leaders around the Valley are already lobbying hard for the program’s 2022 renewal campaign, as many of the planned transportation and roadway expansions by Valley Metro and area cities are dependent of the funding if they are to be put in place.

Alternative Project Delivery Methods

All the presenters who addressed the question were generally in favor of APDM. As one would expect, the majority of projects awarded go to Job Order Contracts for those agencies that use them.

In terms of project percentages, Design-Bid-Build or “Low Bid” generally get the next largest number, with CMAR taking third, followed by a small number of Design-Build projects. CMARs, however, tend to get the largest share of the four in terms of dollar amounts, given that the projects requiring CMAR bids tend to be much larger and more complex than others.

What Do Public Organizations Need from Construction and Consulting?

This was a key question provided to the speakers, and everyone who chose to answer it was fairly consistent in the responses given.

Quality was a key touchpoint, both in the final work performed by firms selected for design and construction and in the quality of materials submitted in response to solicitations. Beth Huning of Mesa noted she has seen a significant and disappointing downturn in the quality of firms’ submittals recently, making the firms less competitive for the work and increasing the difficulty in finding the right providers for a given job.

Responsiveness and quality of customer service were also key points, and several presenters noted they want to work with providers who understand their cities’ specific cultures and needs.

Perhaps the most commonly shared point of desire was the need for consultants, designers and builders to be innovative. As the presenters’ partner “on the street” A/E/C vendors more and more frequently need to be the ones offering creative solutions to market problems like supply chain disruptions, delivery delays, labor shortage issues and other points that can negatively impact project schedules and budgets.

Those firms that can provide innovative and creative ways around the problems and deliver quality work on time and on budget have the potential to lock in greater opportunities over time, since leaders are more inclined to remember and circle back to the providers who helped them pull out wins in trying circumstances.