By Roland Murphy for AZBEX

More than 200 attendees made their way to south Phoenix’s Desert Willow Conference Center Wednesday for the 2024 BEX Private Development Summit.

While Desert Willow was a new venue, event attendees were treated to the same diversity of topics, panelists and data they have come to expect from a BEX industry conference.

Introduction: Arizona Construction by the Numbers

After a brief welcome and introductory remarks from program emcee Michael Martella, senior economic development manager for the Town of Gilbert, BEX President & Founder Rebekah Morris went into her trademark overview of market trends and economic data to warm up the crowd and focus their attention.

While the format of Morris’ presentation is consistent across the dozens of times she’s spoken at both BEX events and outside forums, the data is constantly updated, giving attendees an up-to-the-moment view of happenings in the Arizona construction sector and the greater economy.

Among the key points Morris touched upon is the core position population growth occupies in driving both the general Arizona economy and construction activity. While in the pre-Great Recession boom years of 2004-2006, that growth held at an exceptionally high rate of more than 3%, and plummeted to less than 0.5% after the collapse, population increase has held in the neighborhood of 1.5% since 2016.

Morris noted an interesting and unusual disagreement in population data sources, however. The 1.5% number comes from Arizona state government data. When using federal Census Bureau data, the figure is closer to 0.8%. While Arizona remains a leading population growth market regardless of the source, as evidenced by the state’s ongoing pace of development, the disparity is noteworthy, particularly in how it could impact projecting potential future change scenarios.

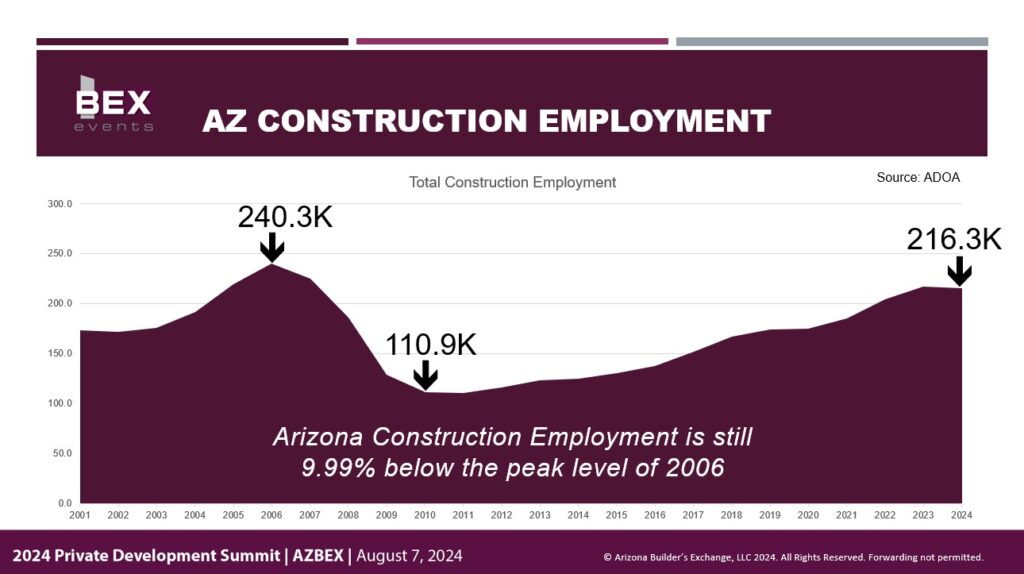

Another key pre-Recession-to-today point is the change in construction employment. According to Arizona Department of Administration data, there were 240,300 construction jobs in the state in 2006, which crashed downward to 110,900 in 2010. While the market has steadily added construction jobs between then and now, Arizona currently has 216,300 positions, which remains 9.9% below the peak.

Even more interestingly, while 2022 year-over-year growth was at 10% and 2023 was at approximately 6%, 2024 year-to-date has turned slightly negative at approximately -1%. While that total is statistically flat, it remains well below the degree and pace Arizona has come to expect this far into a calendar year.

In terms of the sectors fueling construction activity, the old, longstanding “normal” of one-third market share each for public, housing and private development shows no sign of returning. Public now makes up 19% of the construction activity volume, followed by housing at 27% and private development at a colossal 54%.

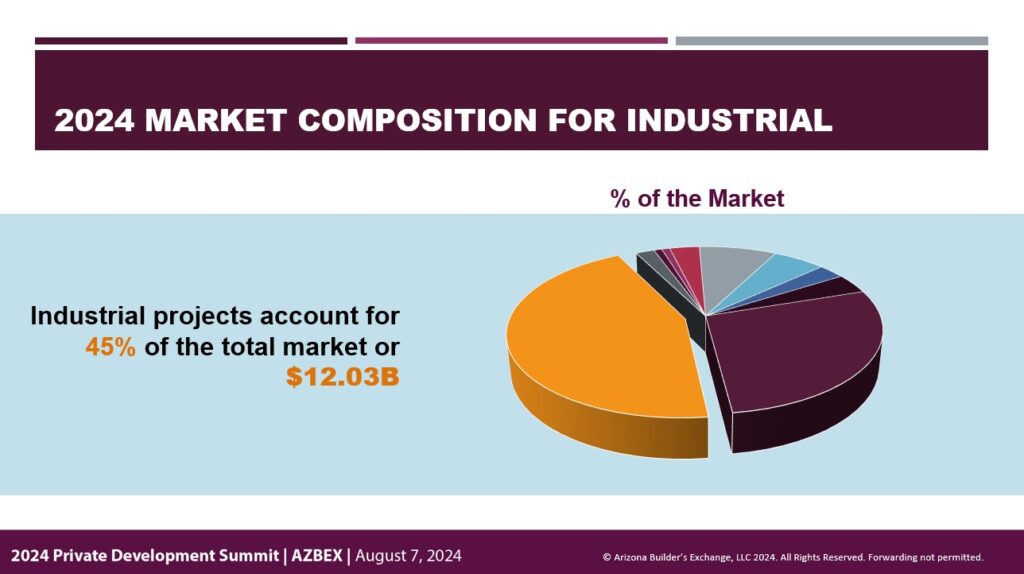

For dollar volume, the “500- and 800-pound gorillas in the room,” according to Morris, are Multifamily at $7.3B and Industrial at $12B in a market that closed out 2023 with a total of $25.8B.

Looking at Multifamily, Morris offered several key takeaways. With ongoing challenges in the overall economy and the hefty pace of new deliveries in recent years, development has slowed and supply and demand have come into a closer state of balance. The challenges are demonstrated, in part, by the fact that there were 80 Multifamily projects in the state identified in the DATABEX project database as “On Hold” at the end of 2023 but 124 as of May 2024.

Projects with the right funding and attractiveness are still moving forward, however. December 2023 data showed 303 listed as “Under Construction,” while May 2024 increased to 334. Still, Morris said BEX is revising its 2024 and 2025 projections downward in the face of difficulties with getting projects to both the start and the finish lines.

In terms of Industrial developments, which make up 45% of the current total market, the pace of supply is slowing to meet demand levels after an incredible volume of recent deliveries. Q1 2024, for example, saw deliveries of 9.1MSF and starts of just 3.9MSF. Vacancy currently stands at 10.1%, an increase of 1.2% from Q1.

Of particular interest in the Industrial segment is the ongoing rise in data center development. Mesa has become a breakout area for data center construction and currently has a pipeline of $8.03B.

Key factors to consider in the Industrial sector include the ripple effects generated by TSMC and other mega-projects, the ongoing rise in data centers—which are projected to become fully half of the Industrial development market by 2026—and the resulting power needs of data center and manufacturing enterprises, which was considered important enough to have its own panel later in the afternoon’s agenda.

Industrial Campus (Re)Development

After Morris’ introduction, the rest of the afternoon centered around expert panels addressing core topics of interest. The first panel: Industrial Campus (Re)Development was comprised of:

- Andrea Piering, President, Sun State Builders – Moderator;

- Matt Jensen, Partner, The Boyer Company;

- Daniel J. Slack, President & COO, Baker Development Corporation, and

- James Smith, Director of Economic & Workforce Development, Pinal County.

After letting the panelists introduce themselves and summarize their organizations and current activities, Piering began the question and answer portion by asking what trends the panelists were seeing in the market. Slack said a key item at the moment is tenants taking a long time to come to decisions and take action. He chalked that up to uncertainty in the capital markets leading Corporate America to slow its decision pace and focus on capital conservation.

Jensen agreed, saying it takes longer for tenants to arrive at decisions and that the longer timelines introduce more complications in the overall process. Smith said over the last 18 months there had been more slowdowns in how projects were pacing and more delays, specifically making reference to LG Energy Solution’s decision to put part of its Queen Creek development on hold while still continuing with its core battery plant construction.

Speaking of TSMC, LGES and other “mega projects,” Piering asked about their impacts on the markets and if there was “a new normal.” Jensen said the mega projects have not significantly disrupted the historical average for leasing, but that more tech companies are now taking space, a trend he expects to continue.

Slack said the pace of development became much more frenetic than the market was prepared for around three years ago, but things now appear to be reverting to a more normal rate of activity. He said the market is stronger for the recent experiences it has undergone, but that it could not have maintained that heavy pace for much longer.

Moving onto other broad trend influences, Piering asked about the influence of politics on development. Smith replied that the influx of funding to advance politically popular programs, such as reshoring semiconductor manufacturing and electric vehicle development has had a significant positive influence.

He also commented on the fickle nature of political favor among various administrations, noting that alternative technologies and EVs are currently popular and well-funded, but that activities like mining, though essential, are facing protracted delays in gaining approvals. He added these conditions could flip depending on the outcomes of various elections.

Slack said he believed capitalization in terms of funding advanced technology and reshoring are a significant positive. “We sold our souls down the river 30-plus years ago with this whole notion of offshoring, and the fact that we’re bringing jobs back here in manufacturing is a really good and important thing.” He added, “The fact that we allowed countries that see us as an existential threat to produce things that we need, not just from a living standpoint but from a national security standpoint, I’m glad that we’re starting to see a focus on bringing back those jobs and that manufacturing. It’s sorely needed.”

Turning to the subject of ongoing economic development, Piering asked the panelists to give their thoughts on how to best support those efforts. Jensen said the best path was to work with economic development groups directly, to provide financial and advisory support and help with networking.

Smith said a key contribution could be getting involved with efforts at the project level. Given the degree of opposition so many projects encounter, he said it is vital that supporters of economic development in general and specific projects, in particular, write letters in support to show officials evaluating proposals that the NIMBY voices are not the only ones to be heard.

Supply of Power to New Real Estate Development

Until quite recently, the availability of power for new developments was something users could reasonably well take for granted. With the sheer scale of new development in Arizona—particularly in data centers, advanced manufacturing and related operations—that all shifted permanently in 2023.

Given the comparative newness and far-reaching urgency of the issue, the second panel focused on power delivery. Moderated by environmental, natural resources and energy attorney Michelle De Blasi, the panel consisted of Salt River Project Economic Development Manager Karla Moran and Arizona Public Service Economic Development Manager Kelly Patton.

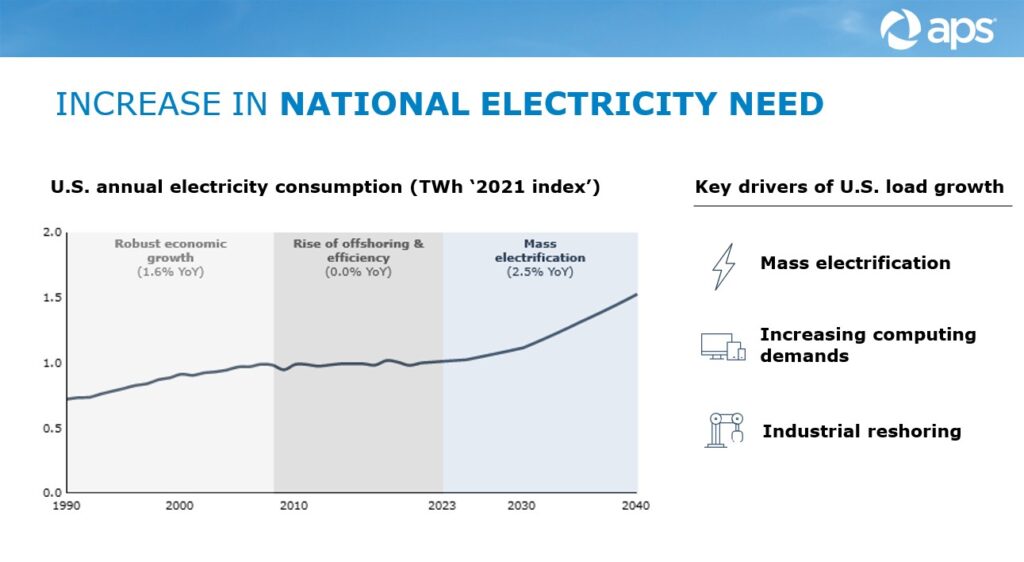

Both panelists discussed the startling rise in electric power generation needs coupled with the demands for increased clean energy output. In her introduction, Patton said the robust economic growth from 1990-2010 saw fairly consistent year-over-year growth of around 1.6% in terms of annual electricity consumption. From 2010-2023, consumption growth was relatively flat because of the rise in usage efficiencies and offshoring of several high-energy operations. In 2023, however, a period of mass electrification began, with consumption starting a hockey-stick trajectory that is expected to continue at 2.5% year-over-year into 2040.

In terms of real numbers, she said APS currently has 12 kMW of total capacity and another 11 kMW of power requests pending on its books. The provider expects to see a 40% increase over the next eight years.

When it comes to planning growth, Moran said the previous approach was to plan a variety of scenarios from lowest-to-highest need. In the current environment, she said, only the highest volume projections need to be considered, and SRP is exploring partnerships with users and other parties to best plan the path forward.

She said the customers contributing to the problem of load increases are also contributing to the solutions, and that the entire process takes specialized teams and a creative mindset toward problem solving.

Patton called the current state of affairs an “all hands on deck” moment. She said the situation often evokes an emotional response to scarcity, which she likened to the toilet paper hoarding and supply crunch during the pandemic. She said customers are worried there will not be enough power to meet future needs, so they are designing projects that demand more power capacity up front than they could ever actually need. The challenge, she said, lies in shoring up what the real numbers are and working to address the actual need rather than the panicked worries.

Like every other development sector, supply chain constraints hit power generation and delivery hard during and after the pandemic. Unlike many other areas, lead times and availability remain extensively drawn out. Patton said part of the problem is that every project largely needs the same equipment, and with the explosion in new development, particularly in industrial projects lead, times for several vital components and materials have increased from a month or two a few years ago to multi-year timelines today.

She added that while private companies can overpay or offer premiums for necessary components and equipment, utilities cannot.

Discussing other difficulties in the development and delivery process, both panelists said local opposition was an ongoing issue. Moran made the point that even though they need new transmission lines, transformers and generating stations to keep the lights on, no one wants them anywhere near their neighborhoods. Both panelists urged supporters of new installations to write letters and make statements of support to counter the NIMBY voices or, as Patton referred to them, the BANANAs who foster the attitude of Build Absolutely Nothing Anywhere Near Anything.

Positioning of Office & Retail Properties

Amazon was supposed to kill off Retail, and the post-pandemic cultural shift to remote work was supposed to kill Office. The second-to-last panel of the day put those ideas to rest and showed rumors of the death of either sector have been grossly exaggerated.

Moderated by City of Phoenix Community & Economic Director Christine Mackay, the Office and Retail panel was comprised of Colter Kilgour, director of development at George Oliver, and Jeff Moloznik, RED Development senior VP of development.

Mackay started the conversation by asking how the Arizona market was contradicting the “Death of Office” and the national narrative. Moloznik answered by talking about “trophies and trauma” as a descriptor for the move to quality that is taking place both nationally and in Arizona, particularly in metro Phoenix. He said companies are focused on acquiring top-tier, highly amenitized workspaces for their employees, and that even if their overall footprints are getting smaller, the cost/SF is high.

Kilgour agreed, pointing out the high demand George Oliver is experiencing for office spaces it has modernized and made more luxurious and appealing in recent years. He referred to the trend as, “A new way to Office,” and said demand will always be there for good product.

One factor Kilgour noted in driving demand in George Oliver’s redeveloped spaces is common amenities shared by a development’s various users. Having high-demand amenities like fitness centers, podcast studios, private event spaces and other add-ons that are not borne as an individual tenant’s space but as part of the communal environment allows employers to provide a more appealing work environment without taking on all the costs directly.

RED Development has focused on incorporating Office into live/work/play developments, which is a comparatively new concept in the Arizona market. By providing a retail allocation of 200KSF, for example, along with a large number of residential units and luxury office space, its developments are highly attractive to both workers and employers. The high cost and long development times for such projects can be made up for by the protracted degrees of engagement by users in their retail-led mixed-use developments, he said, adding that the retail offerings have to be diverse and appeal to as many different user needs as possible.

Addressing the fact that Phoenix is one of the youngest major cities in the world, all the participants talked about the challenge of maintaining perspective when compared against older, longer-established markets and the opportunities for innovation that exist in having a comparatively clean slate.

“It’s completely different, and that’s what makes it so fun,” Moloznik said. “We’re actually creating the fifth largest city in the country right now, with today’s technology, which is a completely different scenario than what you’re left with in an older market where you sometimes don’t have choices with what you can do with what you have because it’s tearing it down or nothing else. Whereas here, there are so many opportunities and the canvas is so much cleaner.”

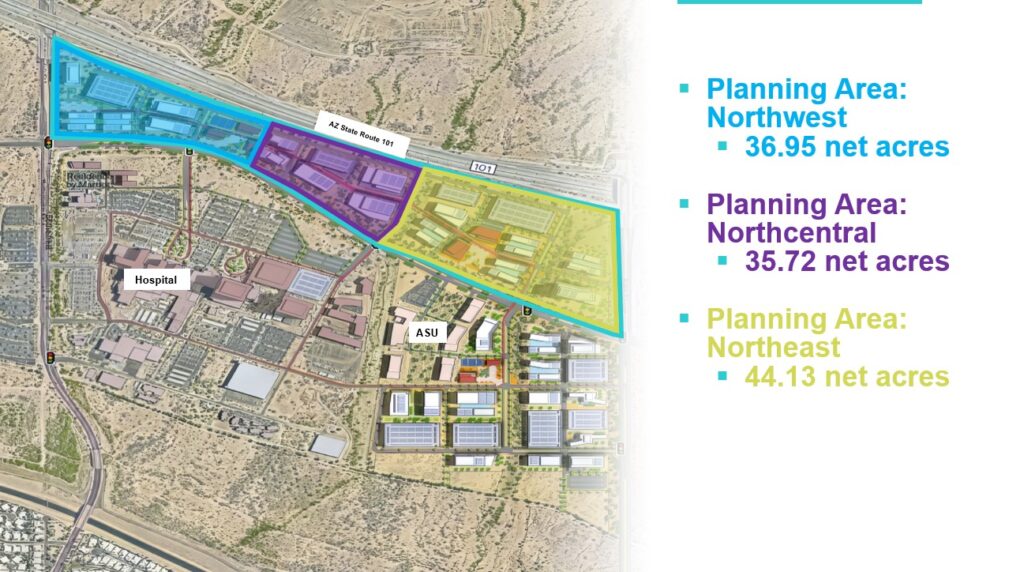

Healthcare and the Mayo Discovery Oasis Campus Update

Even though Healthcare, Biotech and Life Sciences have been eclipsed in terms of market attention, they remain hugely important to the regional economy and a high-prestige cultural cachet component of the regional identity.

The last panel of the day focused on major trends in these areas and gave the attendees insights on where Arizona is headed as it continues to evolve its leadership position in the sector.

The panel was moderated by Alexandra Loye, Cushman & Wakefield’s executive managing director for capital markets and life sciences, and was comprised of:

- Jason Morris, partner and land use attorney at Withey Morris Baugh;

- Aaron Zeligman, Banner Health senior project executive, and

- Aric H. Bopp, Mayo Clinic Discovery Oasis executive director.

Morris led off the discussion by highlighting the economic impacts of healthcare development, reminding attendees that a single hospital can ripple into as many as 17 cross-functioning land use cases for new development in the area, including retail, multifamily, single-family, office and commercial uses of all sizes.

Zeligman explained hospital and associated development is a balancing act between population growth and timing. He said Banner works to be not too far out in front of population growth but also to not trail behind it. The company is always looking for that “Goldilocks situation” when it comes to land banking and planning, he said.

Loye asked the panel about the difficulties they experience with different cities and different processes when trying to get healthcare and bioscience projects approved.

“It’s not for the faint of heart,” Morris said. He explained cities’ leaders and staff often do not have the experience to fully understand the benefits or the issues associated with large-scale healthcare development. He said cities understand retail brings in sales tax revenue on an immediate basis, and they understand the resources and infrastructure needed for single-family development. The deferred payoff and diverse and extensive resources required for hospitals, however, are not part of the regular municipal planning experience. “Complexity breeds delay,” he said.

Loye said another factor, and one many people find surprising, is the extent of NIMBYism sometimes associated with healthcare development.

Morris said there are two aspects to opposition. First is the “organic” opposition, in which area residents are opposed to the potential for increased traffic, noise from sirens, helipads, etc.

Then, he said, there is “inorganic” opposition, which occurs when outside forces, such as an existing hospital, work to squelch the possibility of competition or disruption to their current model by drumming up resistance that might not exist natively. Morris said the challenge lies in uncovering the sources of opposition and countering it with organic support.

Healthcare is a particularly costly field in which to develop. Loye asked the panel about budget considerations, and Zeligman described the challenges in detail. For one thing, hospitals operate on very thin margins, which makes cost challenges even more pronounced. He stressed the importance of collaborating with the design and construction teams on a project, uncovering early what items are going to be scarce and scheduling incremental and concurrent components for time and cost savings.

Turning the discussion to focus on causes for optimism, none of the panelists were at a loss for good things to discuss. Morris said his firm is busy with healthcare-related land use needs, with six facilities as part of his current caseload.

Bopp said healthcare and bioscience development continues as a rapidly emerging market in Arizona and that there are already more jobs there than in semiconductors, despite the hype surrounding that industry’s growth at the moment.

He also added that Phoenix is developing a true sense of place and a “grown up” city mentality, which is bolstered by governmental and economic development support to help projects succeed and industries that are conducting deep and serious research at the forefront of the field.