By Rebekah Morris for AZBEX

As we cross the midpoint of the calendar year, the Arizona construction industry is working harder than ever and constantly adapting to changing market conditions. Here are some of the biggest trends happening in the local market:

Statewide Construction Volume Rises, but at a Slower Pace

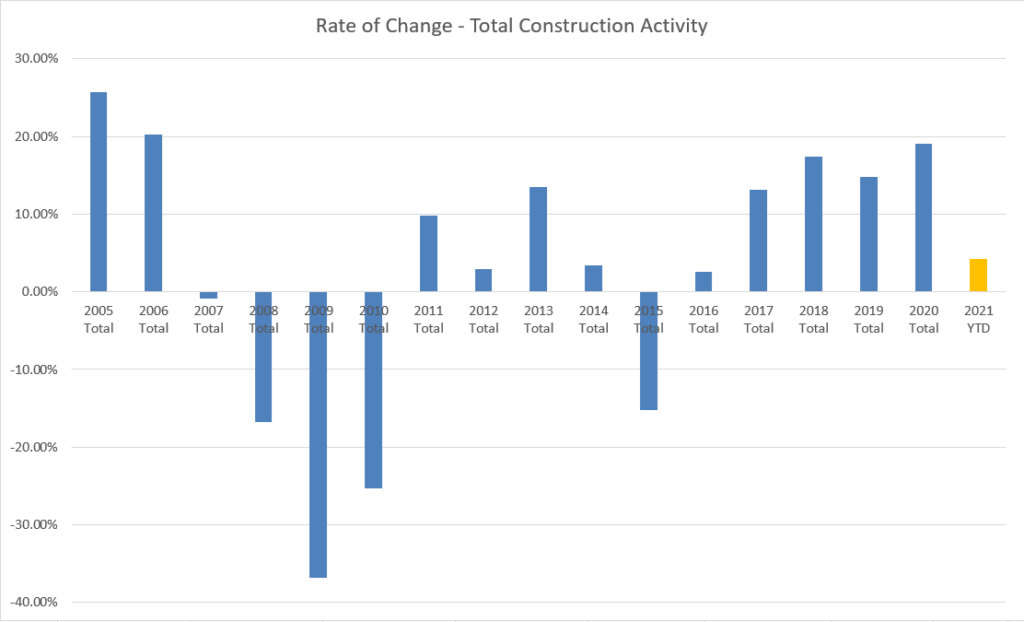

Statewide construction volume continues to increase year-over-year (YOY), but the pace of increases has slowed noticeably. Starting in 2017, statewide construction volume has notched no less than 13 percent YOY gains; however, since the beginning of 2021, the pace of increases has slowed dramatically, with the YTD increase pegged at just 4.24 percent over 2020 data. As always, BEX uses the taxable sales data from the Arizona Department of Revenue to determine construction volume.

Enter the Drama of Materials Pricing & Availability

Starting in Q4 of 2020, construction materials prices started to increase, and anecdotes of delays began. Throughout the first half of 2021, materials prices increased, in the case of lumber quite dramatically, and delays became more commonplace. The fragility of construction materials supply chain has been exposed.

Currently, lumber pricing is starting to retreat from its peak of May 2021, but availability of materials and assemblies is still causing delays. Firms are required to plan further in advance, buying materials ahead and storing them, and navigating a near-constant stream of notices from suppliers and subcontractors. Gone are the days of quotes being valid for six days; in some cases, we are hearing of no more than a seven-day window to secure the stated price.

New Concerns: City Review Times, Labor Availability

One new issue we are starting to hear rumblings of is the impact of municipal review times of projects. Whether in for permit or plan review, many cities are not keeping up with the influx of development projects coming to them. It appears this is especially true of multifamily projects in the East Valley. Whether it is fatigue of city staff or the reluctance to add projects to the agenda due to the possibility of neighborhood resistance, cities are starting to impact development in real ways. Walt Brown, Founder of Diversified Partners at the July LMS event said he has hired a new person specifically to shepherd his development projects through the city processes so they do not slow down unnecessarily.

TSMC and Intel continue to be the largest individual projects occurring in the state. A flurry of activity on the TSMC site is visible from the I-17 in North Phoenix on a daily basis. These mega projects, along with the I-10 Broadway Curve, Nikola and Lucid Motors manufacturing plants in Pinal County are contributing to concerns about available manpower to build all the projects currently in planning or design.

Public Spending Increases Slightly, Private Spending Driven by Industrial and Housing

Public spending is on the rise due to strong tax revenue. Compiling the list of the Top 10 Capital Programs in the state, public spending is projected to rise approximately six percent YOY. The City of Phoenix is planning over $8.24B in capital spending in the next five years, which is just a hair lower than last year’s five-year total but still well ahead of the second largest plan in the state – ADOT. ADOT is planning to spend more than $5.75B in the next five years, a healthy 12.93 percent increase over last year’s total.

On the private side, housing and industrial are the leaders of the pack. Both sectors are recording over $4B in activity per year, far outpacing any other market sectors and together comprising roughly 1/2 of the total construction market activity in Arizona.

Arizona construction is enjoying a five-year run of positive headlines after so many years of depressed activity due to the Great Recession. The industry as a whole is looking ahead to continued growth and a focus on attracting and retaining a skilled workforce that can enable future growth along the way.