By Rebekah Morris for Arizona Builder’s Exchange, LLC

By many business measures, 2018 was a great year. The Arizona construction market certainly saw shimmering doodads and shiny whatchamacallits at every turn. While we’ll go into much greater depth — with targeted data and detailed analysis — at our Construction Activity Forecast event next Thursday, January 10th, here are some of the highlights and our thoughts on the coming year.

2018 Looks Good on you!

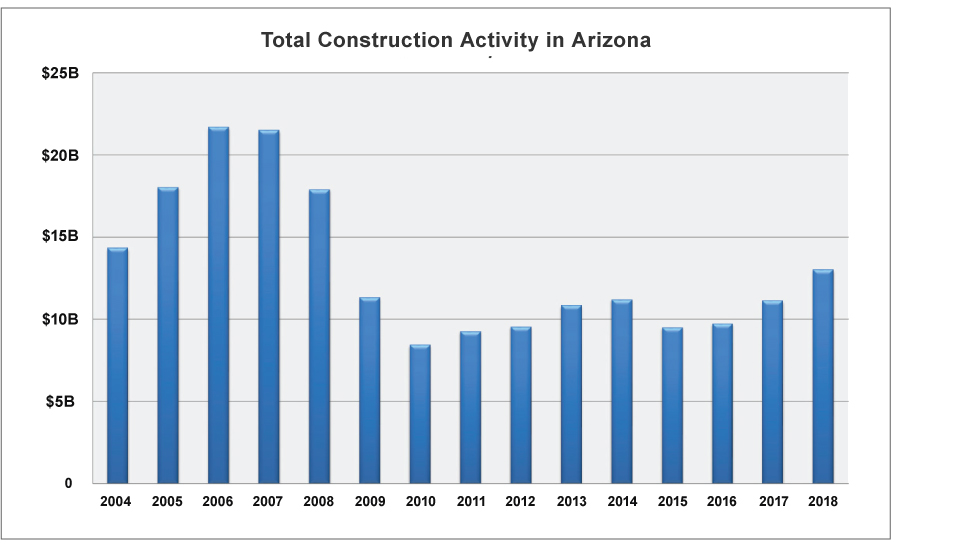

Last year, AZBEX research staff expected total market activity to rise from 2017’s estimated $10.1B annual statewide level to nearly $13B, a spike of nearly 30 percent year over year. Reality was not too far off: 2017 actual construction activity was revised upward, coming in higher than we had estimated, at a little more than $11B, and when the dust settles on 2018 reports, actual activity is expected to come in at a healthy $13B, growing at a rate of more than 17 percent year over year. The data we find most objective and useful for this metric is from the Department of Revenue, the taxable sales for Contracting is the truest measure of total construction activity in the state we can find.

Two related measures of the health of the industry that similarly bode well are construction employment and single-family residential permits. Both are hitting new high levels for this cycle. The conclusion from these three data sets: 2018 was great for Arizona construction companies.

2019 Guesstimations for Residential of all Flavors

While we never pretend to be crystal-ball readers (ok, maybe a little), we can make some highly educated inferences of the future of the market, especially given the data and research we do all day every day to create the wonderful AZBEX Digital Magazine and online searchable database.

The biggest changes in the market come from the residential sector: We expect a dip in single-family residential activity and a leveling off of all multifamily. Multifamily has enjoyed a spectacular run for the last seven years, really starting to take off in 2012 and 2013. We expect 2018 was the peak year for construction activity for this sector. Financing new construction projects is becoming a bit tougher as lenders look at a likely vacancy creep to 6 percent from the current 5 percent level. Workforce housing is becoming a more desperate need, but the market hasn’t yet figured out how to justify significant investment in this space when returns are higher in higher-end spaces. Government at all levels has the ability to step in with tax incentives to encourage development in this space, but so far is not moving the needle in an appreciable way.

Single-family residential gives us the most cause for concern of everything we study right now. Sales of new units are slowing while interest rates and construction costs are rising. That very real decline in demand while the cost of producing the unit is increasing does not bode well for increased activity in 2019.

An October U.S. market report one reader forwarded us from the Housing Research Center was particularly dire, stating in part, “…we are seeing gross sales falling sharply and at the same time cancellations are going up every day, resulting in a low sales pace and creating the perfect storm for builders. On the other hand builders are facing a lot of supply cost pressures coming from a persistent labor shortage, a shortage of buildable lots due to very little land development since the last housing crash began, and escalating cost pressures coming from land development which threaten to crush builder earnings in the future.”

We do expect to see more focus on entry level homes in good locations, however, the better the location, the more likely the property will be developed into condos, apartments, or higher end single-family residential.

Office, Industrial, and Retail, Oh My!

Big corporate locates continuously nab headlines throughout the year, and quarterly vacancy reports tell us plenty about the market overall. While we love to read and publish those feel good stories, we also want to be cognizant of what they’re not saying. Potential corporate locates are demanding available spaces ready to move into within 6-12 months, but developers have shied away from speculative development. Build to suit timeframes are more likely to require a 12-18 month process, depending on many factors. This was a common headache heard throughout the year from developers on various panels we covered or hosted.

Industrial development has become the darling of the traditional CRE marketplace, with vacancy rates consistently marching lower and lower. The late 2019 opening of the Loop 202 South Mountain extension will drive new development opportunities across the 22-mile stretch, and the Loop 303 has opened up new potential development sites in the far west valley.

Retail reinvention is the top trend lately, taking many forms including repurposing into office or medical office spaces, higher education, creating destination spaces with a focus on experience or going ultra-luxe. Many of these projects — such as the Metrocenter Mall and Fiesta Mall — experienced declining revenue and occupancy while employment hubs and City Centers moved farther away. Even given the trumpeting by economic development and owners’ planning staffs, these projects have moved more slowly toward execution and fulfillment than anyone would have hoped when they were initially announced.

On the upside, even retail destinations that are experiencing stellar successes are not sitting idle: from Scottsdale Fashion Square to Dana Park in East Mesa, we will continue to see massive reinvestment and reinvention to include dense housing options, office and other uses.

Medical Reawakened by Massive Healthcare Projects

Healthcare would have been considered a bit sleepy in early 2018, but it completely reawakened in the later half of the year courtesy of MIHS blazing ahead with its Roosevelt campus redevelopment, Mayo Clinic’s expansion announcement, Banner’s plans for a 40-year expansion in the Phoenix Metro, and the Dignity Health projects at both Chandler Regional Medical Center and Mercy Gilbert Medical Center. A rather steady flow of medical office space will continue to be developed, especially on existing hospital campuses.

Public Spaces Not to be Outperformed

Not to be outdone by the private development sectors, public works looks to be on the uptick. The key metric here is rising tax revenue. From retail to property tax, public entities are benefiting from a good economy. Agencies are typically able to raise tax rates and pass bonds when they present a compelling case to voters.

New Challenges Popping Up

Fresh issues are starting to appear, namely, the accelerating pace of construction costs and organized resistance to both public works projects and private development.

Long-standing skilled worker shortages are not going anywhere, rather the market has been forced to work around them through such means as prefabricated and modular building components which move production from the jobsite to a more controlled manufacturing environment inside large warehouses. Additionally, firms are responding to the worker shortage by reaching out earlier in the education system, developing talent pools, and focusing on changing the narrative that has long touted the ‘You have to go to college to get a good-paying job’ mantra.

The cost of construction has been accelerating fast in the second half of 2018, materials prices alone have fluctuated between 5-8% above 2017. Beyond just escalation, opportunistic price increases due to the threat and impact of tariffs, competition for construction labor, and the capacity of the overall market are all forces driving prices up. We see individual projects canceled or put on hold due to a higher total cost of construction which drives the project into the ‘no’ zone.

Also threatening to capital programs and individual commercial development is a new sense of empowerment by residents and constituents. Even if a project meets existing zoning, is well designed and makes a lot of sense for the community’s needs, nearby residents feel empowered to speak out if they don’t like it, regardless of whether they purchased the home after the parcel in question went through the approval process (AZCentral 10/31). Voters approved a plan and a measure to fund light rail years ago but are facing increasingly more vocal, determined and organized opposition in recent months.

In conclusion, 2019 will have plenty of news stories to keep us writing and speaking on new and interesting topics. There is never a shortage of opportunity in the market, and those who can nimbly position themselves for shifts in perception and in market condition will continue to reap the rewards of a construction market that is as hot as the Arizona desert itself. Just like the desert, however, there will be occasional clouds on the horizon, but good advance planning and a realistic and real-time monitoring of conditions should allow nearly everyone to weather the storms.