By Rebekah Morris for AZBEX

Materials shortages and delays in permitting may be finally having an impact on the total market as two of the last three months are showing Year-over-Year declines in construction activity statewide.

According to the University of Arizona Eller College of Business website, azeconomy.org, taxable sales for construction reached $1.623B in June of 2021, a 0.87% decline YoY, and $1.416B in July 2021, a 9.5% YoY decline. This results in three of the seven months for which data is available in 2021 showing a decline in YoY volume. Construction activity had been on a solid growth pattern up until this point, with 29 months straight of YoY increases.

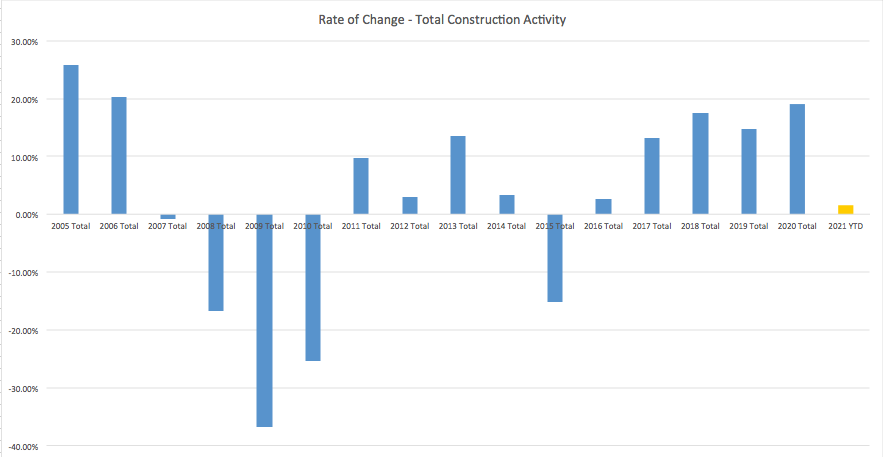

BEX research on total market activity has borne out some impressive and sometimes shocking increases. Since 2017, YoY increases in market activity have topped 10% easily, with 2020 volume topping 2019 volume by a whopping 19.06%.

Already in 2021, the rate of growth had been coming back down to earth. For the first five months of the year, a 4% YoY rate of growth was achieved. Taking into account these latest figures, the YoY growth rate is now sitting at 1.56% YTD.

Housing and Industrial Dominate

The 2020s are roaring, due primarily to housing and industrial projects. Permit volume for single-family and multifamily is up more than 28% YoY. Build-to-Rent projects have hit the mainstream and many new faces are dipping their toes into this type of development. According to Yardi and Colliers International, more than 1,800 BTR units have hit the market in 2021 so far, with another 1,850 units set to deliver by the end of the year.

Industrial and manufacturing projects are so big and so frequently announced it is hard to keep them all straight. The most recent report from CBRE, which covers data through Q2 2021, indicates a whopping 20.885MSF under construction, and demand remains high with the vacancy rate dropping to 4.7%. Space under construction is surging, increasing 83% in just one quarter, at least some of which can be attributed to the TSMC project in North Phoenix.

Materials and Permitting Delays may be Impacting Volume

The market has been facing significant challenges in obtaining materials for projects, and a relatively new problem of permitting delays is slowing down project starts and pushing out timeframes for deliveries. Skilled labor shortages continue to percolate under the surface, but these have largely been overshadowed by more pressing permitting and materials delays.

Construction prices have been rising fast, especially since the fourth quarter of 2020. It appears that rising rent and consistent demand factors are allowing developers and owners to keep projects moving forward. For example, anecdotally the BEX research team is reporting that a multifamily project that would have been estimated at $3M in 2019 is now roughly $5M in 2021.

Taken together, the market may finally be showing signs of leveling off, but underlying demand factors of population growth and employment are strong and bode well for future demand for the built environment.