Sales Transactions

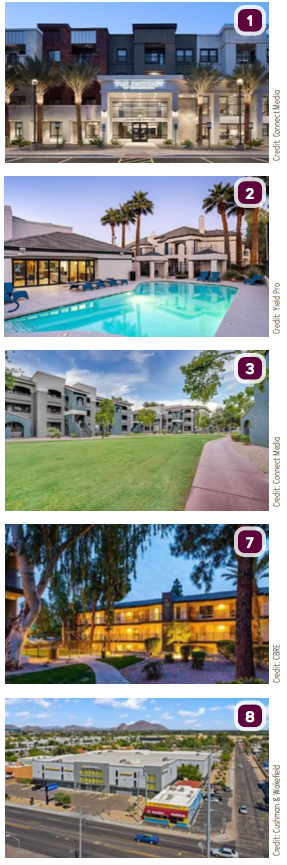

1. PCCP acquired the District at Chandler, a 340-unit, four-story apartment complex at 2222 W. Frye Road, Chandler, for $95M. The seller was an entity tracing to Kaplan Management Company and The Carlyle Group. Great American Insurance Group provided $63.5M in new debt for the deal.

1. PCCP acquired the District at Chandler, a 340-unit, four-story apartment complex at 2222 W. Frye Road, Chandler, for $95M. The seller was an entity tracing to Kaplan Management Company and The Carlyle Group. Great American Insurance Group provided $63.5M in new debt for the deal.

2. NexPoint Real Estate Advisors purchased The Fairways at San Marcos, a 352-unit apartment asset in Chandler, for $84.48M. Steve Gebing and Cliff David, IPA executive managing directors with Institutional Property Advisors, a division of Marcus & Millichap, represented the seller, Virtú Investments and procured the buyer.

3. Tides Equities continues to expand its portfolio in Phoenix with the addition of Tuscany Palms Apartments, a 582-unit apartment complex at 901 S. Country Club Drive, Mesa, for $83M, from Investcorp. The property will be rebranded as The Tides on Country Club. NorthMarq Capital arranged $66.4M in new debt for the deal.

4. An entity affiliated with TPG Real Estate acquired Regents on University, a 225-unit apartment/student housing asset at 1949 E. University Drive, Tempe, from Preferred Apartment Communities. KeyBank delivered $36.243M in new Freddie Mac debt for the deal.

5. S2 Capital acquired Eagle Crest Apartments, a 408-unit, 20-building community at 6451 W. Bell Road, Glendale, for $55M, from an entity affiliated with EPI Property Management. Benefit Street Partners provided $47.22M in new debt for the deal. IPA’s Cliff David, Steve Gebing and Marty Cohan handled the sale transaction.

6. Tides Equities purchased Dunlap Falls, a 288-unit garden-style multifamily property at 3333 W. Dunlap Avenue, Phoenix, for $40.5M. Senior Managing Directors Ric Holway and Mark Forrester and Senior Director Dan Cheyne of Berkadia’s Phoenix office represented the seller, Shefflin Properties.

7. CBRE’s Capital Markets’ Debt & Structured Finance team announced it arranged a $39.7M loan for the purchase of two multifamily properties in Phoenix, The Vicinity, a 125-unit complex at 6131 N. 16th Street, and Ascent 1829, a 180-unit complex at 1829 E. Morten Avenue. Dana Summers, Doug Birrell, Robert Ybarra, Bruce Francis and Shaun Moothart of CBRE arranged the five-year loan with MF1 Capital on behalf of the buyer, a private investor.

8. Barker Pacific Group purchased a 935-unit, 94.5KSF self-storage property at 3325 N. 16th Street, Phoenix, for $14.25M. Devin Beasley, Mike Mele and Luke Elliott of Cushman & Wakefield’s Self-Storage Advisory Group represented the seller, Hawkins Company Commercial Developers.

9. Ripe Assets Management, LLC purchased Arcadia Lofts Apartments, a 63-unit multifamily community located near 40th Street and North of McDowell Road, Phoenix, for $8.5M. NorthMarq’s Phoenix Investment Sales team led by Ryan Boyle, Trevor Koskovich, Jesse Hudson, and Bill Hahn, arranged the sale and represented both buyer and seller, a partnership between Westgrove Partners and The Grupe Company.

10. An individual/personal trust purchased Ocotillo Oasis, a 42-unit apartment property at 6220 West Ocotillo Road, Glendale, for $4.925M. Paul Bay, vice president investments in Marcus & Millichap’s Phoenix office, procured the buyer and had the exclusive listing to market the property on behalf of the seller, who was also an individual/personal trust.

10. An individual/personal trust purchased Ocotillo Oasis, a 42-unit apartment property at 6220 West Ocotillo Road, Glendale, for $4.925M. Paul Bay, vice president investments in Marcus & Millichap’s Phoenix office, procured the buyer and had the exclusive listing to market the property on behalf of the seller, who was also an individual/personal trust.

11. KB Home closed on 92 lots (40’X120′) in the eastern half of Block 27 of Gladden Farms, a 1,350-acre master planned community in northern Marana, for $4.6M. The lots were purchased from Gladden Phase II, LLC. Will White and John Carroll of Land Advisors Organization in Tucson handled the transaction.

12. Bondar Holdings, LLC purchased a 9.6-acre site at 5824 S. 38th Street, Phoenix for $4.15M, and plans to construct a 135KSF office/showroom/warehouse building on the site. NAI Horizon Senior Vice President Rick Foss represented the seller, Thomas and Olivia DuVall Trust of Phoenix, and Ton Bagneschi of Insight Land and Investment represented the buyer.

13. 3065 43rd Avenue LLC (Hanson Capital) purchased a single-story, 61KSF industrial warehouse building at 3065 S. 43rd Avenue, Phoenix, for $3.719M. Pete Batschelet, SIOR and Allen Lowe, SIOR with Lee & Associates represented the buyer and seller, Lippert Components Inc.

14. A private capital investor from Southern California purchased a 7.7KSF, single-tenant industrial property at 1410 W. Harvard Avenue, Gilbert, for $3.2M. Mike Parker of CBRE in Phoenix represented both the buyer and the seller, a Canadian investment group.

15. Marcus & Millichap announced that a limited liability company purchased Beverly IV, a 24-unit apartment property at 6740 W. Montebello Avenue, Glendale, for $3M, from a private investor.

16. Stephen Burke, a 1031-exchange buyer, purchased Fry’s Shops at Ellsworth, a four-unit, 5.8KSF, multi-tenant retail center at 439 S. Ellsworth Road, Mesa, for $2.4M. Newmark’s Senior Managing Directors Steve Julius and Jesse Goldsmith and Associate Chase Dorsett represented the developer and seller, Evergreen-Broadway & Ellsworth, LLC, an affiliated entity of Evergreen Devco, Inc. the buyer was represented by Cushman & Wakefield.

17. Equity Land Group announced it has closed on its first two properties in Arizona for a combined purchase price of $2M. The first two properties that Equity Land Group secured are a 20-acre parcel in Buckeye, off of Miller Road and the Interstate 10 and a 19-acre property in Casa Grande, located off of Interstate 10 and Florence Boulevard.

Lease Transactions

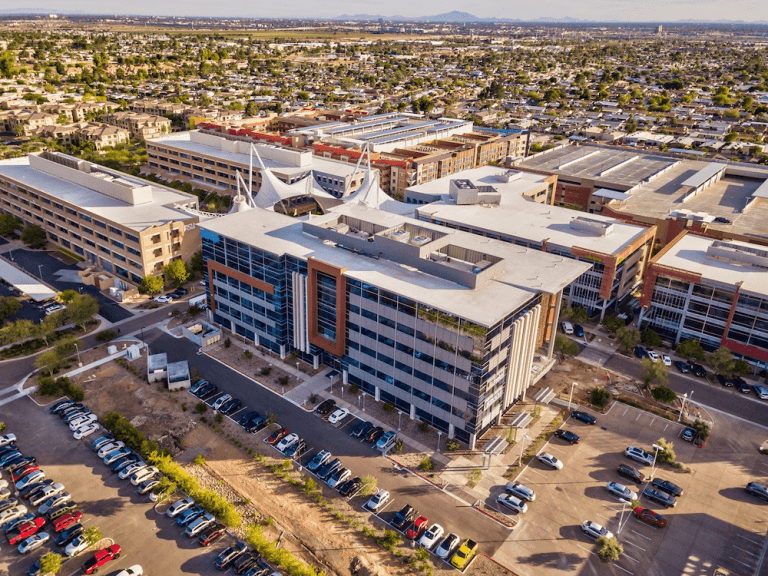

18. T.Y. Lin International has agreed to a long-term lease on a 10.1KSF space in SkySong 1, with occupancy beginning on July 1st, 2021. They are relocating to SkySong from their existing offices on Tempe Town Lake. The Coppola Cheney Group of Lee & Associates, SkySong’s leasing broker represented the property ownership group. Chris Nord, Greg Fogg and Justin Grilli of Cushman and Wakefield represented T.Y. Lin International.

NEWS TICKER

- [September 5, 2025] - Major General Plan Amendments Requested for 1,800-acre Florence Area

- [September 5, 2025] - Mesa Approves 29-Unit Townhome Plan

- [September 5, 2025] - VanTrust Announces 1.1MSF Industrial Plan in Glendale

- [September 5, 2025] - Construction Job Openings Up 77,000 YoY

- [September 5, 2025] - Arizona Projects 09-05-25

- [September 3, 2025] - TSMC Building Water Reclamation Plant

- [September 3, 2025] - Pinal Airpark Gets OK, Funding for Air Traffic Tower

- [September 2, 2025] - 336 Apartments Coming to Casa Grande Commons