Sales Transactions

1. MDH Partners has closed a $1.26B sale of the Sunbelt Logistics Portfolio. The 58 properties total 9.7MSF. Seven properties are located in Arizona. Eastdil Secured marketed the portfolio for MDH Partners, which will retain a stake and operate the warehouses on the new owner’s behalf.

2. Institutional Property Advisors, a division of Marcus and Millichap, announced the sale of the 826-unit Hilands apartment community in Tucson for a record $178M price. IPA’s Clint Wadlund, Hamid Panahi, Art Wadlund, Steve Gebing and Cliff David represented seller Northland Investment Corporation and procured buyer Bridge Investment Group.

3. Aukum Group/Management has purchased the 440-unit Canyon Creek Village apartment community on 9th Street in Phoenix for $142.25M. Security Properties was the seller.

4. Draper and Kramer, Inc. has purchased the 240-unit Senita on Cave Creek apartment development in Phoenix for $109.5M. Mission Rock will manage the property.

5. Harrison Street Capital has bought the 600-bed student housing property The Vertex in Tempe from KKR and Partners for $108.5M as part of a $725M portfolio sale.

6. CBRE announced the sale of Terra Verde I and Tower at Scottsdale Landing in Scottsdale to Edgewood Real Estate Investment Trust for $85M. Sellers Wentworth Property Company and Northwood Investors were represented by CBRE’s Barry Gabel and Chris Marchildon. The two office properties total 269KSF.

7. U.S. Merchants has purchased the 637KSF Building D in The Cubes at Glendale from Clayco for $62M.

8. CBRE Investment Management has purchased the 230KSF Freeway Logistics Center for $60M. Seller Cohen Asset Management was represented by Will Strong, Greer Oliver and Connor Nebeker-Hay of Cushman & Wakefield.

9. Sundance Bay has purchased the 252-unit apartment community Port Royale in Sierra Vista for $46.5M. Seller Element Property Company was represented by Hamid Panahi, Clint Wadlund and Cliff David of Institutional Property Advisors, a division of Marcus & Millichap.

10. NextGen Apartments has paid $45M for the 104-unit multifamily development Craft @ Gilbert & Baseline in Mesa. The company was represented by Steve Gebing and Cliff David of Institutional Property Advisors, a division of Marcus & Millichap

11. BKM Capital Partners has bought the 153KSF, seven building Mesa Ridge Business Park near Falcon Field in Mesa for slightly more than $38M. The seller was an entity of Randall Investment Group, and the deal was brokered by Cushman & Wakefield.

12. An entity of McBride Cohen Management Group sold 3.32 vacant acres of land on the south side of Tempe Town Lake to a different entity of the same company for $33.75M for development of the estimated $1.8B South Pier at Tempe Town Lake project.

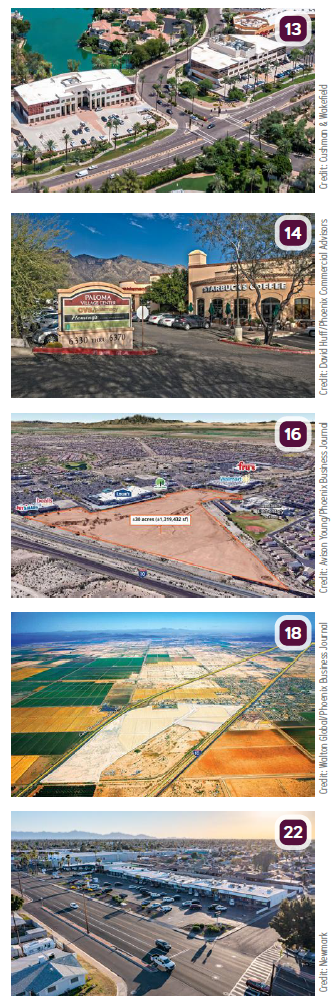

13. Cushman & Wakefield announced the firm has advised Alturas Gainey Ranch, LLC in the $33M acquisition of office buildings Gainey Ranch Town Center I & II, totaling 126.5KSF. The seller was Gainey Ranch Town Properties, Inc. Eric Wichterman, Mike Coover, Steve Lindley and Alexandra Loye with Cushman & Wakefield represented the buyer. Ben Geelan, Will Mast and Lynn Lachapelle of JLL represented the seller. Cushman & Wakefield’s Scott Boardman and Kristina Cutillo have been retained by the new owner for project leasing.

14. Chad Tiedeman and Danny Gardiner of Phoenix Commercial Advisors represented the seller in the $18.4M disposition of Paloma Village, a 33.5KSF shopping center in the Catalina Foothills area of Tucson.

15. Walton Global has acquired the five-acre Smoke Tree Resort property in Paradise Valley for $14M from Geneva Holdings (including GenTree LLC). Multiple attempts by Geneva to redevelop the property fell through, prompting the sale. Walton plans to build a new boutique hotel on the site.

16. Modus Development has purchased 30 acres in Buckeye as part of a plan to develop 400 apartment and Build-to-Rent units. The seller was Western Properties, Inc., represented by Avison Young’s James DeCremer, Matt Milinovich and Alec Miller. Modus was represented by Will French of Cushman & Wakefield.

17. S Wilson UpTown Inc. has bought two medical buildings on River Road in Tucson – occupied by Pima Heart and Vascular – for $9.26M. The buyer was represented by Jim Ashcraft of Ashcraft Investment Services. Seller MED Properties, LLC was represented by Alan Laulainen of Ascension Advisory.

18. Walton Global has sold 92.8 acres of land in the 277-acre Sunshine Industrial master plan area in Eloy to Daren O. Zumberge. Sunshine Industrial is federally approved as a Foreign Trade Zone site.

19. With a purchase price of $8M, The Ensign Group has acquired both the real estate and operations 65-bed nursing facility Villa Maria Post Acute and Rehabilitation, 35-bed assisted living facility Villa Maria Wellness Living, and 30-bed behavioral health facility Tucson Recovery at Villa Maria, all in Tucson.

20. To enable future expansions, Hospice of the Valley has purchased an 11.25-acre site adjacent to its Lund House facility in Gilbert for $7.23M. They were represented by Chris Nord of Cushman & Wakefield. Seller Canyon Oaks Estates LLC was represented by Ryan Willis of Willis Property Company.

21. Cushman & Wakefield announced the firm has brokered the sale of a freestanding 40.8KSF industrial/distribution building in Phoenix. Refrigeration Supplies Distributor acquired the property at 3935 W. Adams Street for $7.2M. The seller was BECMED, LLC. Michael Kitlica and Jason Ward of Cushman & Wakefield represented the buyer.

22. Newmark announced it has arranged the sale of Goldcrest Plaza, 7106-7146 N. 35th Avenue in Phoenix. The property sold for $6.075M. Newmark’s Jesse Goldsmith, Steve Julius and Chase Dorsett represented the buyer, Quach’s Hayward, LLC and the seller, SMHA, LLC. The property is comprised of 28.9KSF.

23. Larsen Baker announced the sale of the recently renovated 7.4KSF north building at SkyCam on the NWC of Campbell and Skyline. The buyer is 6405 North Campbell IC/FH JV, LLC. The property sold for $4.4M. Seller Skyline Encantada Investors, LLC, an affiliate of Larsen Baker, was represented by Isaac Figueroa of Larsen Baker.

24. A 15KSF Walgreens store on South Crismon Road in Mesa has sold for $3.27M. The buyer was LSSBA LLC. Walgreens, which opened in the store in 2001, still has more than four years on its lease. Chris Lind and Mark Ruble of Marcus & Millichap represented the seller.

25. NAI Horizon’s John Filli represented seller Talon Mountain, LLC in the $2.53M disposition of 211.5 acres at the SEC of the intersection of Montgomery Road and Selma Highway in Casa Grande. Lisa Hauger with Sun Commercial Real Estate Inc. provided the listing referral to Filli. Kavitha Pindi with DHS Realty Texas was the procuring agent. The buyer was Magnum Estates LLC.

26. A private equity fund has purchased 40th Street Medical Plaza, 16601 N. 40th Street, Phoenix. Mindy Korth of Colliers in Arizona represented the seller 16601 N 40th Street, LLC.

Lease Transactions

27. Athletic footwear and apparel company Puma has signed a 15-year lease at 303 Crossroads in Glendale. The 1MSF+ building will serve as a regional distribution center for the company. Puma was represented by Fred Regnery and Rob Martensen of Colliers International. Pat Feeney and Daniel Callahan of CBRE Group Inc. represented the landlord.

28. Salad & Go leased 30KSF of retail space at Speedway and Pantano Square in Tucson from Speedway Pantano Square, LLC. Dave Hammack with Cushman & Wakefield | PICOR represented the tenant. Isaac Figueroa and Melissa Lal with Larsen Baker represented the landlord.

29. University of Arizona, Steward Observatory is expanding the Engineering and Technical Services research, testing and demonstration operations at the UA Tech Park off Rita Road and Interstate-10. The observatory will increase its footprint to approximately 25KSF for offices and lab space in Building 9040 to complement the 5KSF of testing and evaluation space in Building 9026.