Sales Transactions

1. Rise48 Equity has bought the 288-unit apartment community The Waterfront in Phoenix for $75.3M. The seller was represented by a team from Northmarq headed by Trevor Koskovich. The Northmarq Debt & Equity team financed part of the acquisition with a loan of $61M.

2. Cushman & Wakefield announced the firm has advised Tanbic Edgehill Centerra Apartments, LLC in the $74.75M sale of Centerra, a renovated 202-unit apartment community in Scottsdale. The buyer was an entity formed by Cortland. David Fogler and Steven Nicoluzakis with C&W’s Multifamily Advisory Group in Phoenix represented the seller.

3. TruAmerica has acquired the 164-unit Rise on Peoria apartment development for $45.4M. The company will renovate 130 units and rebrand the development as Verve. Both TruAmerica and the undisclosed seller were represented by Brad Goff, Brett Polachek and Chris Canter with Newmark.

4. Villas Las Mandarinas DE, LLC has purchased Cordova Village, a 324-unit multifamily investment property in Tucson from Equilibrium Cordova Village, LLC for $34M. Allan Mendelsberg and Conrad Joey Martinez with Cushman & Wakefield | PICOR, represented both parties.

5. Tower 16 Capital Partners has sold the 180-unit Loramont on Thomas Apartments in Phoenix for $32.1M. They were advised by Ric Holway and Dan Cheyne of Berkadia Phoenix.

6. Larry Kush of ORION Investment Real Estate represented the seller in the recent disposition of 140.39 acres of land with mixed-use, industrial and multifamily zoning along Loop 202 between Dobbins and Elliot roads.

7. Cushman & Wakefield announced the firm has brokered the sale of Missouri Professional Plaza, a two-story medical office building totaling 24.8KSF. 1277 Investment Alliance, LLC acquired the asset from Helix Properties for $9.05M. Eric Wichterman, Mike Coover, and Alexandra Loye with Cushman & Wakefield’s Capital Markets & Private Capital teams in Phoenix represented the seller.

8. ABI Multifamily announced the $4.75M sale of “Apache & McClintock Development Opportunity,” a land deal located at 1734 E. Apache Blvd., Tempe. The site currently consists of a convenience store and gas station, a self-service car wash and a small strip mall on 1.92 acres. ABI’s John Klocek and Patrick Burch represented the seller.

9. Land Advisors Organization announced it recently completed the sale of an 18.1-acre parcel at 1441 S. 27th Avenue on behalf of the Murphy Elementary School District for $4.33M to Merit Partners. LAO broker Michele Pino, in partnership with CBRE’s Jackie Orcutt, represented both parties.

10. SAAVI Services for the Blind has purchased a 16.5KSF building at 2920 N. 7th Street in Phoenix for $1.92M and a headquarters building at 3350 N. Grant Road in Tucson for $2M. The Phoenix seller was Fourth Burroughs, LLC, and the Tucson seller was TRT Grant/Rita Associates. The buyer was represented in both transactions by Greg Hopley and Dillon Hopley with Colliers in Arizona.

11. Menlo Group Commercial Real Estate announced the $3.06M sale of the 22KSF Dobson Professional Plaza in Mesa. Steve Berghoff of Menlo Group, represented the seller, 1845 South Dobson, LLC. The buyer, Vignes Investment Partners, LLC, was represented by Jamie Swirtz of CBRE.

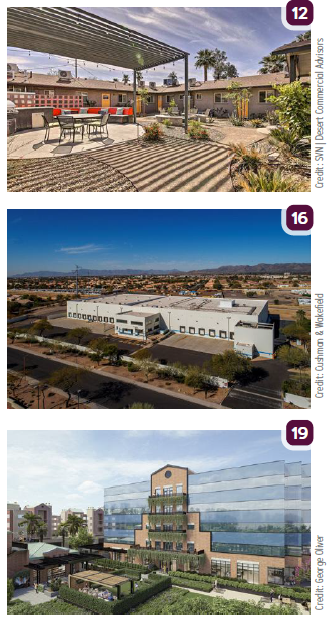

12. SVN | Desert Commercial Advisors announced the $2.95M sale of Palm Lane Apartments, a 12-unit complex in Phoenix. Buyer The Arizona Opera will use the property to house musicians. The transaction was brokered by SVN’s Carrick Sears and Royden Hudnall.

13. WG Group has bought the 110.4KSF Foothills Corporate Centre I in Phoenix from SDC Foothills, Inc. for an undisclosed amount. Newmark’s CJ Osbrink, Scott Scharlach and Kevin Shannon represented both parties.

Lease Transactions

14. Lucid Group Inc. has leased 116KSF of industrial space at 525 W. 21st Street in Tempe. Landlord TA Realty was represented by Cushman & Wakefield‘s Phil Haenel, Mike Haenel and Andy Markham. Lucid was represented by John Asher of AT Real Estate Services.

15. Thyssenkrupp Supply Chain Services NA, Inc. leased 115KSF of industrial space from Greenbean Investments LLC, located at 6760 S. Lisa Frank Avenue in Tucson. Robert C. Glaser and Paul Hooker with Cushman & Wakefield | PICOR, represented the landlord. Paul Sieczkowski of Colliers International AZ represented the tenant.

16. Cushman & Wakefield announced that KOAM has fully leased a freestanding 90.5KSF industrial/last mile facility in Tempe. Phil Haenel, Mike Haenel and Andy Markham with Cushman & Wakefield represented the landlord Stonelake Capital Partners, and the firm’s Joshua Wyss and Christian Coraggio represented the tenant.

17. AeroCheck MRO has entered a 15-year lease for 48KSF office and hanger space in Phoenix-Mesa Gateway Airport. Clint and Blake Hardison of Ike Commercial Real Estate represented the landlord Southwest Jet Center.

18. And Go Concepts, LLC leased 39KSF of retail space at Riverside Crossing Retail Center in Tucson from LCC LA CHOLLA/RIVER, LLC. Dave Hammack with Cushman & Wakefield | PICOR represented both parties.

19. Developer George Oliver announced major pre-lease interest in its redevelopment of the historic Hayden Station in Tempe into a modern mixed-use property called “Arbor.” Preleases signed so far include 18.6KSF by Worldwide Express, 9KSF by Trainual and 4.6KSF by Radius AI.

20. Herc Rentals, Inc. recently leased 16KSF on South 7th Street in Phoenix from 7th and Elwood, LLC. Jake Ertle and Nic Chavira of Rein & Grossoehme Commercial Real Estate represented the tenant. The landlord was represented by Jim Wilson and Garrett Wilson of Cushman & Wakefield.