Sales Transactions

1. An entity tracing to Raymond Kao purchased Escape at Arrowhead, a 324-unit multifamily property at 7951 W. Beardsley Road, Peoria, for $103.75M, from an entity tracing to Embrey Development.

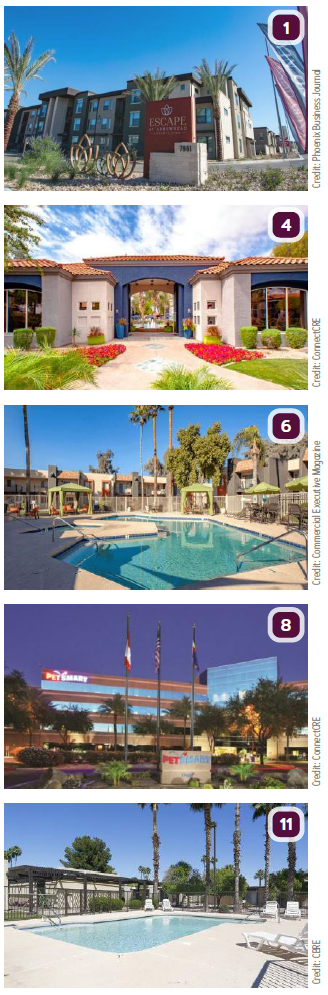

1. An entity tracing to Raymond Kao purchased Escape at Arrowhead, a 324-unit multifamily property at 7951 W. Beardsley Road, Peoria, for $103.75M, from an entity tracing to Embrey Development.

2. An entity tracing to Investcorp purchased Carleton Club Apartments, a 436-unit multifamily property at 17425 N. 19th Avenue, Phoenix, for $86.5M, from an entity tracing to Tides Equities.

3. An entity tracing to Investcorp purchased The Edge Apartments, a 380-unit multifamily property at 15202 N. 40th St.., Phoenix, for $83M, from an entity tracing to Tides Equities.

4. MG Properties Group purchased The Retreat Apartments, a 480-unit garden-style community in Phoenix, for an undisclosed amount. The undisclosed seller was represented by Steve Gebing and Cliff David of Institutional Property Advisors.

5. An entity tracing to Revantage purchased Encore Tessera, a 240-unit multifamily property at 4713 E. Van Buren Street, Phoenix, for $70M, from an entity tracing to Encore Enterprises.

6. Western Wealth Capital purchased Villetta Apartment Homes, a 352-unit multifamily apartment community in Phoenix for an undisclosed amount. The acquisition was brokered by Steve Gebing and Cliff David with Institutional Property Advisors.

7. Element Property Group purchased NorthPointe Student Housing, a 300-unit student housing complex at 850 E. Wetmore, Tucson, for $44M, from CPP Tucson LLC, an affiliate of Columbus Pacific Properties.

8. BPM Real Estate Group purchased the PetSmart headquarters, a 365KSF class A office campus at 19601 N. 27th Avenue, Phoenix, for an undisclosed amount. A $68M senior first-mortgage loan was arranged by Ramsey Daya and Stephen Scarpulla of Newmark.

9. Richmond American Homes bought 73.91-acres of land at 21843 E. Queen Creek Road, Queen Creek, for $25.418M, from Communities Southwest. Nathan & Associates represented both the buyer and the seller.

10. Mattamy Homes purchased 85-acres in San Tan Valley in the coveted San Tan Heights master-planned community, for $20.56M. The land is final platted for 324 home sites. Mattamy’s new community will be known as Pinnacle at San Tan Heights.

11. A private partnership completing a 1031-exchange purchased The Flats at Granite Reef, a 135-unit multifamily property at 980 N. Granite Reef Road, Scottsdale, for $17.5M. Brian Smuckler, Jeff Seaman, Derek Smigiel and Bryson Fricke of CBRE represented the California-based seller, and the buyer.

12. Skymaster, LLC purchased Revival on 7th Apartments, a 67-unit mid-century modern apartment complex at 6060 N. 7th Street, Phoenix, for $9.6M. NorthMarq’s Phoenix investment sales team of Trevor Koskovich, Bill Hahn, Jesse Hudson, and Ryan Boyle brokered the sale.

13. 2222 Piedmont LLC purchased Dover Shores Office Park, a +/- 96.4KSF, 11-building, multi-tenant office park at 2222 & 2266 S. Dobson Road, Mesa, for $8.65M. Tyson Breinholt, Partner/Associate Broker, and Shane McCormick, Vice President – Sales & Leasing for Commercial Properties, Inc., represented the sellers, Meckelborg Financial Group LTD.

14. Arizona Land Consulting recently assisted an undisclosed 1031-exchange buyer to acquire a 36-acre parcel of land at Miller and Broadway Roads, Buckeye, for $7.1M. The buyer plans to use the front 16-acres as commercial use and has already received an offer for a gas station user on the corner.

15. An Arizona-based buyer purchased Mountain View 2, a 16-unit multifamily apartment property in Flagstaff, for $3.2M. ABI Multifamily‘s John Klocek and Patrick Burch represented the buyer. Dennis Kelly of Kelly & Call Commercial represented the Arizona-based seller.

15. An Arizona-based buyer purchased Mountain View 2, a 16-unit multifamily apartment property in Flagstaff, for $3.2M. ABI Multifamily‘s John Klocek and Patrick Burch represented the buyer. Dennis Kelly of Kelly & Call Commercial represented the Arizona-based seller.

16. MAG Capital Partners, LLC purchased a 38.3KSF fully occupied cold storage warehouse property at 2721 W. Willetta Street, Phoenix, for an undisclosed amount. Mary Garnett and Jim Tuesley of Barnes & Thornburg LLP represented MAG Capital Partners in the sale-leaseback transaction. Oscar Lopez and Steve Lowe with Matthews Real Estate represented the seller, Lin’s Distribution Corp.

17. A limited liability company purchased Dutch Bros Coffee Ground Lease, a 1.14-acre property at 4433 N. 7th Street, Phoenix, for $2.759M. Chris Lind and Mark Ruble, investment specialists in Marcus & Millichap’s Phoenix office, procured the buyer and had the exclusive listing to market the property on behalf of the seller, a limited liability company.

18. LGP Enterprises, Inc purchased a 12.5-acre development site at the west and northwest corner of Avondale Boulevard and McDowell Road in Avondale for $2.651M. The seller, SCM-POG, LLLP, was represented in the transaction by Kidder Mathews commercial real estate broker Brian Rosella.

19. HOH PV, LLC purchased a 12.6KSF church building at 3539 E. Stanford Drive, Paradise Valley, for $2.41M. NAI Horizon’s Thomas A. Smith represented the seller, Gloria Dei Evangelical Lutheran Church. The buyer was represented by Waseem Hamadeh with Venture REI.

20. Olive Pearl, LLC purchased a 12.4KSF retail building at 2430 W. Apache Trail, Apache Junction, for $2.341M. NAI Horizon’s Lane Neville and Logan Crum represented the seller, JAM Apache Trail, LLC. Steve Ghirado with Ghirado Real Estate Group represented the buyer.

Lease Transactions

21. NAI Horizon’s Thomas A. Smith represented the landlord, HOH PV, LLC in a 24-month church lease for 12.6KSF at 3539 E. Stanford Drive, Paradise Valley. The tenant, Blessings Community Church was represented by Lorence Zimbaum with Paramount Ventures.