Sales Transactions

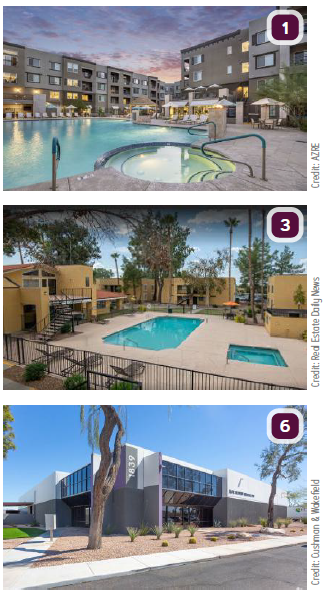

1. Pacific Development Partners purchased Montreux, a 335-unit luxury mid-rise apartment asset at Desert Ridge in Phoenix for $117M. Steve Gebing and Cliff David of Institutional Property Advisors (IPA), a division of Marcus & Millichap, represented the seller, The Statesman Group, and procured the buyer.

1. Pacific Development Partners purchased Montreux, a 335-unit luxury mid-rise apartment asset at Desert Ridge in Phoenix for $117M. Steve Gebing and Cliff David of Institutional Property Advisors (IPA), a division of Marcus & Millichap, represented the seller, The Statesman Group, and procured the buyer.

2. Praxis Capital purchased Tierra Vida Apartments, a 200-unit multifamily complex at 1970 W. Old Magee Trail, Tucson, for $35.75M. Art and Clint Wadlund with Berkadia Tucson represented the out-of-state seller. The buyer was self-represented.

3. Bridge Investment Group purchased Villa Bugambilias Apartments, a 360-unit apartment complex at 7400 E. Golf Links, Tucson, for $34.75M. Art and Clint Wadlund with Berkadia Tucson represented the out-of-state seller. The buyer was self-represented.

4. Bridge Investment Group purchased Agave at 22, a 266-unit apartment complex at 8485 E. 22nd Street, Tucson, for $33.45M. Art and Clint Wadlund with Berkadia Tucson represented the out-of-state seller. The buyer was self-represented.

5. Pulte Homes acquired 351 lots from Metropolitan Land Company for $10.57M and resold 179 of those lots to Meritage Homes for $5.128M. The lots are part of McClellan Ranch Phase II. Ben Heglie, Ryan Semro, and Bret Rinehart of Land Advisors Organization served as the brokers for both deals.

6. Libitzky Property Companies purchased Elliot Park 10, a 95.3KSF multi-tenant industrial asset at 1819–1849 W. Drake Drive, Tempe, for $10.5M, from BKM Capital Partners. Bob Buckley and Tracy Cartledge with Cushman & Wakefield in Phoenix represented both parties.

7. Meritage Homes acquired 25.43 acres of land at the NEC of John Wayne Parkway and Smith Enke Road, Maricopa, for $9.702M, from Harvard Investments. Nate Nathan of Nathan & Associates acted as the broker for both the buyer and the seller. The land is part of the Lakes at Rancho El Dorado development.

8. An undisclosed buyer purchased the 47-room Days Inn & Suites Scottsdale North at 7330 N. Pima Road, for $6M. Zack Mishkin with ORION Investment Real Estate represented the buyer and undisclosed seller.

9. An Arizona-based buyer purchased Brix, a 24-unit, garden-style condominium community in Tempe, for $5.1M. ABI Multifamily‘s Royce Munroe represented the California-based seller.

9. An Arizona-based buyer purchased Brix, a 24-unit, garden-style condominium community in Tempe, for $5.1M. ABI Multifamily‘s Royce Munroe represented the California-based seller.

Lease Transactions

10. UACJ Automotive Whitehall Industries, a leading supplier of precision aluminum components for use in vehicle manufacturing will take over a portion of the former Walgreens distribution center in Flagstaff and plans to invest as much as $60M with their new expansion. The company expects to begin operations toward the end of April.

11. Robinhood, the app that allows users to invest in stocks and exchange traded funds online, leased 34KSF of space – the entire 12th floor – in the Watermark in Tempe. The building owner is Fenix Development.